Consolidated Financial Statements

(c) Financial statements

Financial statements assets and liabilities of

foreign entities are converted to euro using the

exchange rates at the balance sheet date, profit

and loss as well as the cash flows statements

are translated into euro using the average ex-

change rate recorded during the period. The re-

sulting exchange difference is recorded in equity

under the heading of exchange rate differences.

“Goodwill” and fair value adjustments aris-

ing from the acquisition of foreign entities are

treated as assets and liabilities of that entity and

translated into euro according to the exchange

rate at the balance sheet date.

When a foreign entity is disposed, the accumu-

lated exchange rate difference is recognised in

the income statement as a gain or loss on dis-

posal.

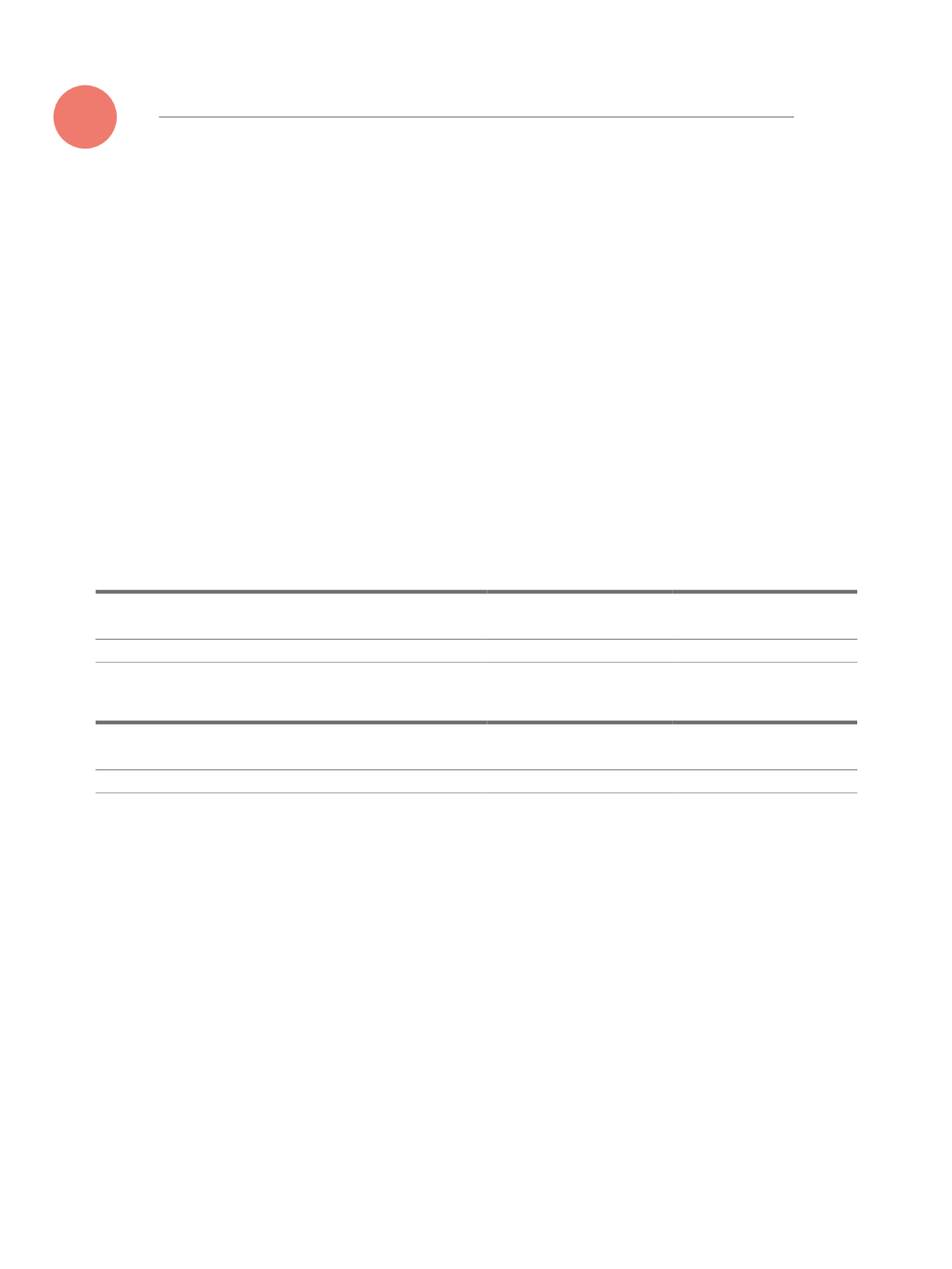

Currency exchange rate used for conversion

of transactions and balances denominated in

Kwanzas in 31 December, 2015 and 2014 were

respectively:

Dec. 2015

Euro exchange rates

(x foreign currency per 1 Euro)

Rate on

December, 31 2015

Average interest

rate year 2015

Kwanza de Angola (AOA)

147,842

134,409

Dec. 2014

Euro exchange rates

(x foreign currency per 1 Euro)

Rate on

December, 31 2014

Average interest

rate year 2014

Kwanza de Angola (AOA)

124,984

131,044

2.5 TANGIBLE FIXED ASSETS

Buildings and other structures include own prop-

erties assigned to the restaurant activities and

expenses on works at third-party properties, in

particular those required for setting up restau-

rant shops.

Tangible fixed assets are shown at the acquisi-

tion cost, net of the respective amortisation and

accumulated impairment losses.

The historic cost includes all expenses attribut-

able directly to the acquisition of goods.

214