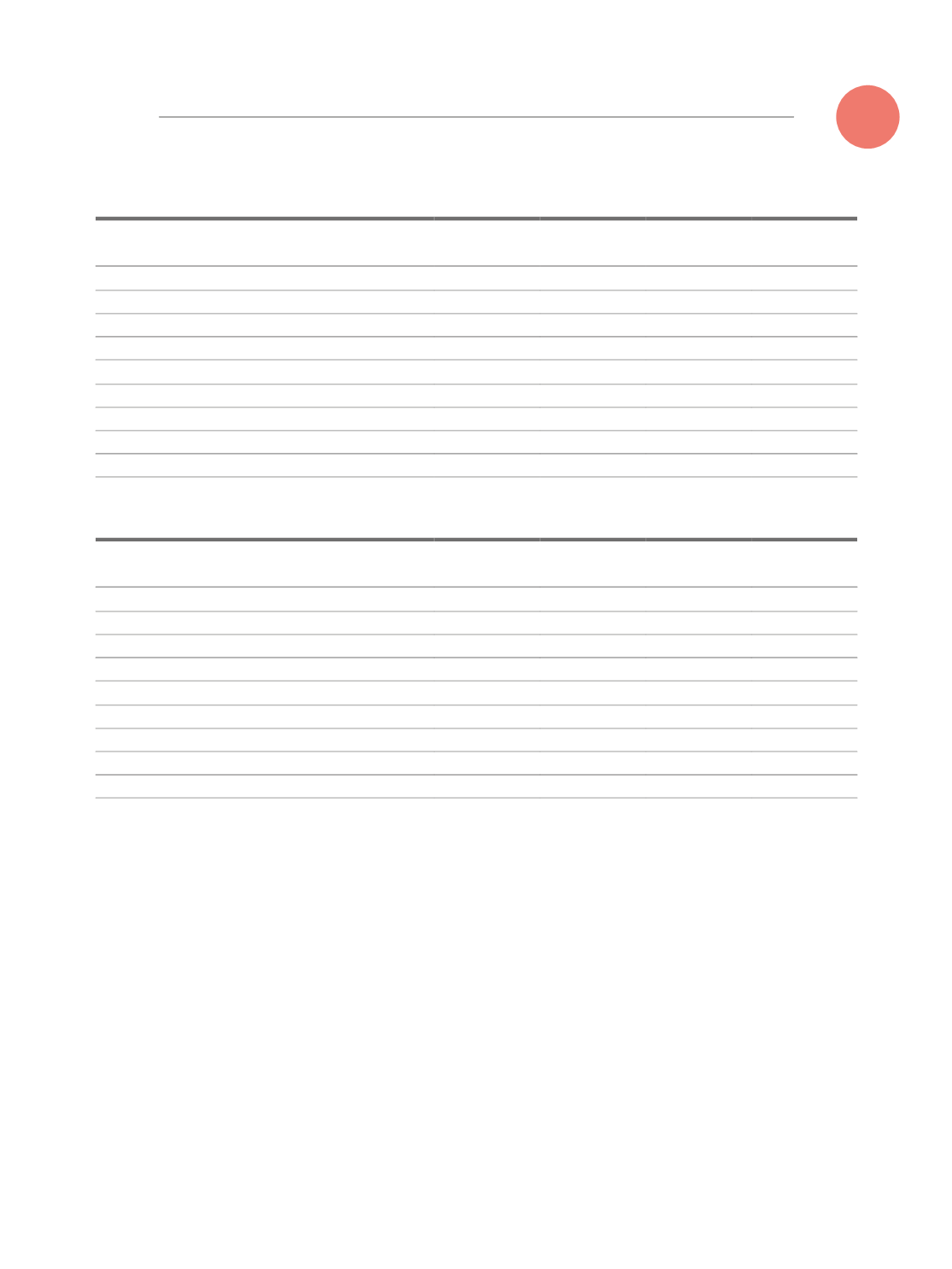

Annual Report and Consolidated Accounts 2015

Year 2015

Kwanzas Equivalent

EUR

USD Equivalent

EUR

Financial Assets

Cash and Bank deposits

203.488.292

1.376.395

6.754

6.212

Others

1.086.467.739

7.348.868

400

368

1.289.956.031

8.725.263

7.154

6.580

Financial Liabilites

Loans

1.747.708.332

11.821.499 2.000.000 1.839.646

Suppliers

431.519.912

2.918.801

2.019.561

1.857.638

Others

33.405.550

225.955

109.006

100.266

2.212.633.793

14.966.255

4.128.567

3.797.550

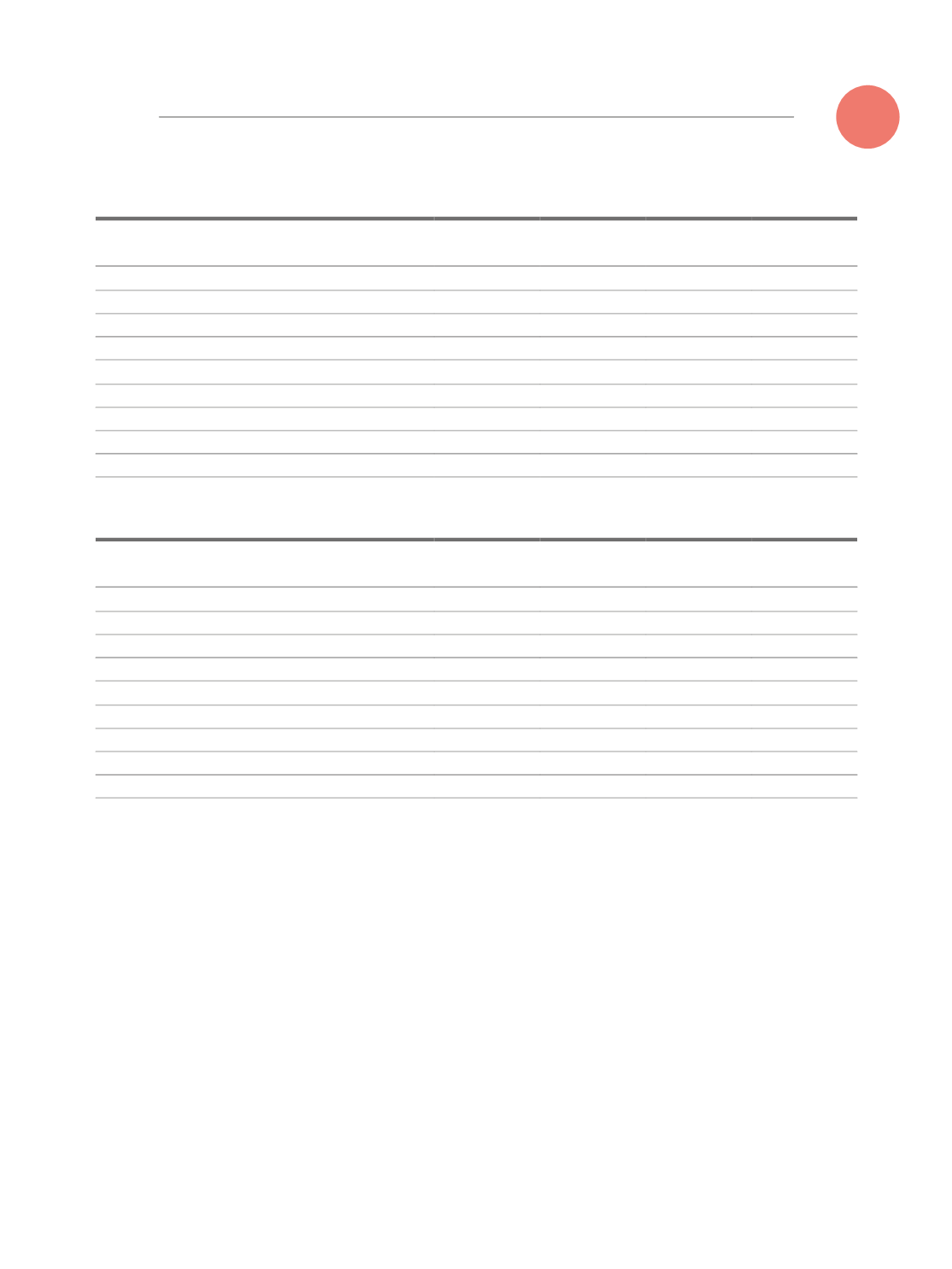

Year 2014

Kwanzas Equivalent

EUR

USD Equivalent

EUR

Financial Assets

Cash and Bank deposits

102.624.258

820.994

156.443

129.291

Others

60.063.999

480.511

90.000

74.280

162.688.257

1.301.505

246.443

203.571

Financial Liabilites

Loans

610.208.343

4.881.603

3.125.000 2.582.644

Suppliers

138.567.748

1.108.541

1.030.828

851.924

Others

51.066.768

408.534

65.341

54.001

799.842.859

6.398.678

4.221.169

3.488.569

Additionally in Angolan subsidiaries we have

debts to suppliers in EUR that, after conversion,

generate exchange differences in the consoli-

dated financial statements (net financing costs),

although mostly are debts with group compa-

nies. Furthermore, the same subsidiaries hold fi-

nancial assets indexed to USD, a value equivalent

to about 80% of liabilities in foreign currency.

Based on simulations performed on December

31, 2015, a decrease from 10% to 15% in AOA,

concerning EUR and USD currency, keep-

ing everything else constant, would have a

negative impact of 189 thousand euros and

271 thousand euros, respectively, on the con-

solidated financial statements (net financing

cost) of the group.

A similar simulation of exchange rate deprecia-

tion applied to the net investment, would have

a negative impact on the equity of the Group of

232 and 333 thousand euros, respectively.

227