Annual Report and Consolidated Accounts 2015

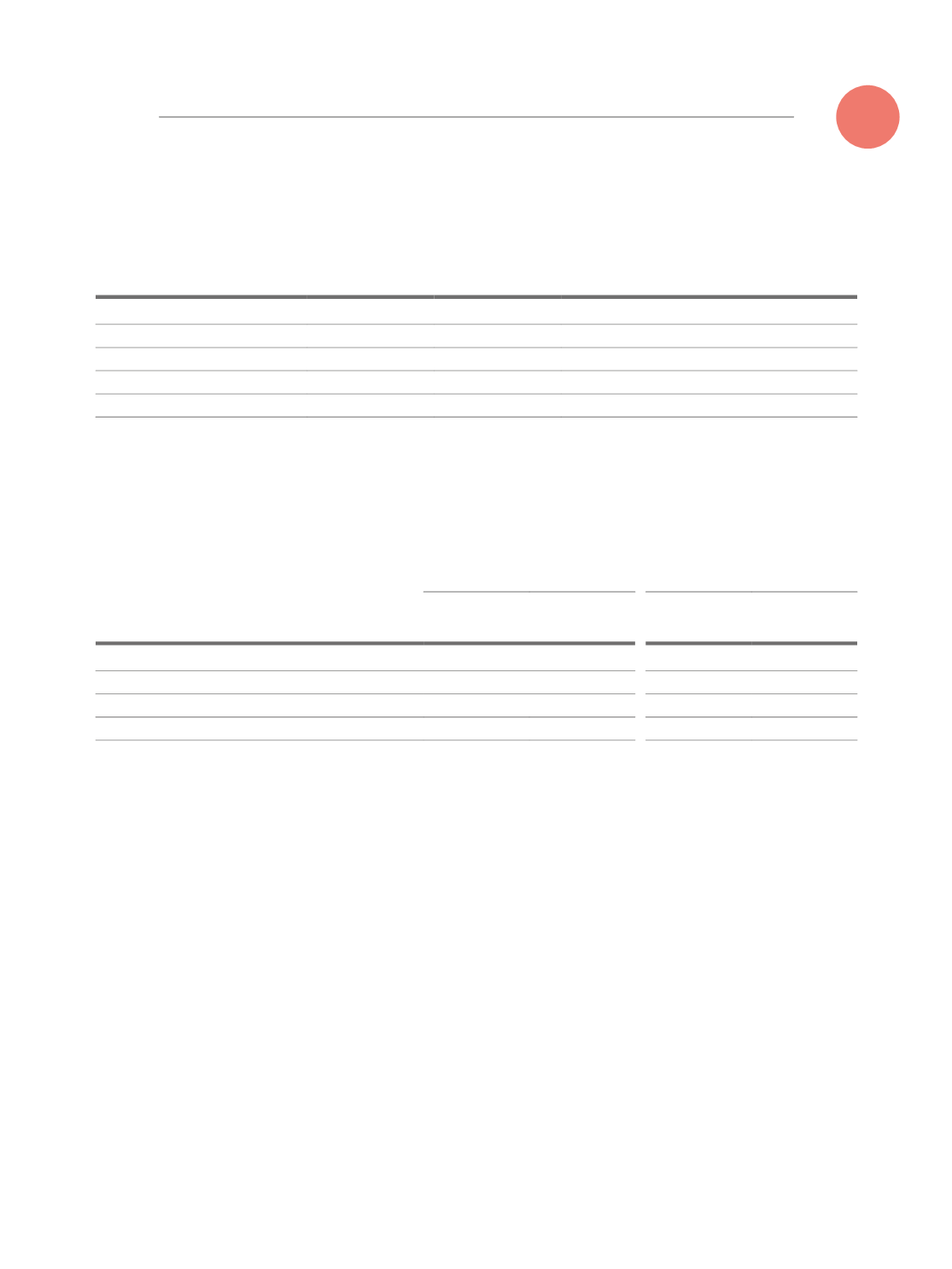

In 2015, the sensitivity analysis of the sales growth rate is presented as follows:

Sales growth in

the period

Impairment

Additional

impairment Notes

over 2% of the base

2.492.664

over 1% of the base

3.343.331

base: between 2% and 6%

(*)

4.080.721

impairment recorded value

less 1% of the base

4.747.327

666.606

less 2% of the base

5.556.998

1.476.277

* according to the location and the traffic development trend of 2015.

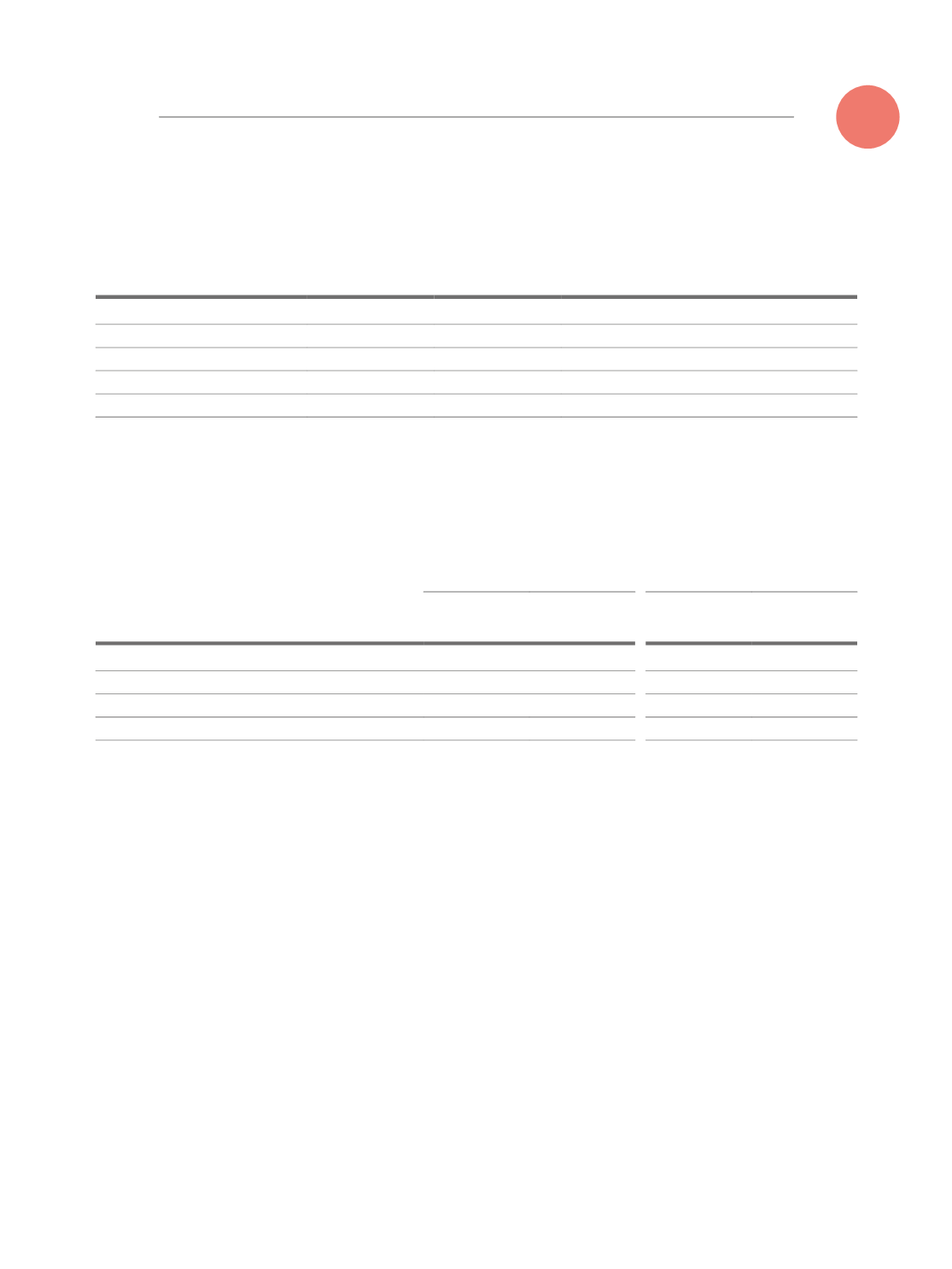

In the years ended on 31 December 2015 and 2014, the following assets were used under a financial

lease:

2015

2014

Gross

Amount

Accumulated

depreciation

Gross

Amount

Accumulated

depreciation

Land and buildings

4.168

104

-

-

Equipment

638.400

44.459

-

-

Other tangible fixed assets

53.517

3.345

-

-

696.086

47.908

-

-

In the years 2015 new lease agreements were

signed with the amount of 696.086 eur.

About 151 thousand euros were capitalized in the

year 2015 related to bank loans expense in Ango-

la, the accumulated value at December 31, 2015

was of about 679 thousand euros.

245