Annual Report and Consolidated Accounts 2015

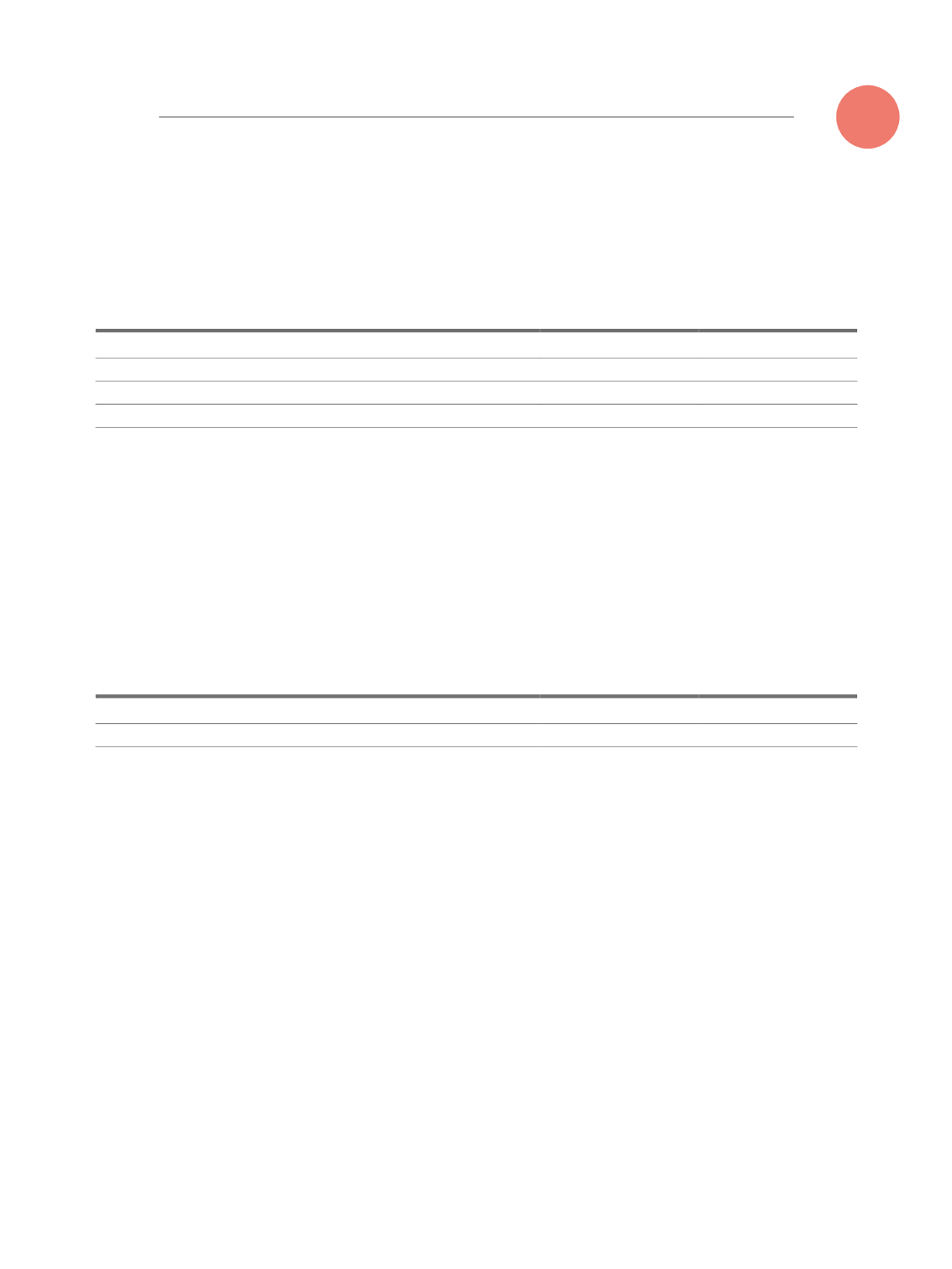

19. PROVISIONS

On 31 December 2015 and 2014, provisions were broken down as follows:

Dec. 2015

Dec. 2014

Legal processes

5.257

5.257

Income tax

(1)

828.705

-

Other

28.000

26.861

Provisions

861.962

32.118

(1) Provisão referente a benefícios fiscais decorrente do cálculo do IRC do exercício de 2014 em fase de confirmação da respetiva concretização.

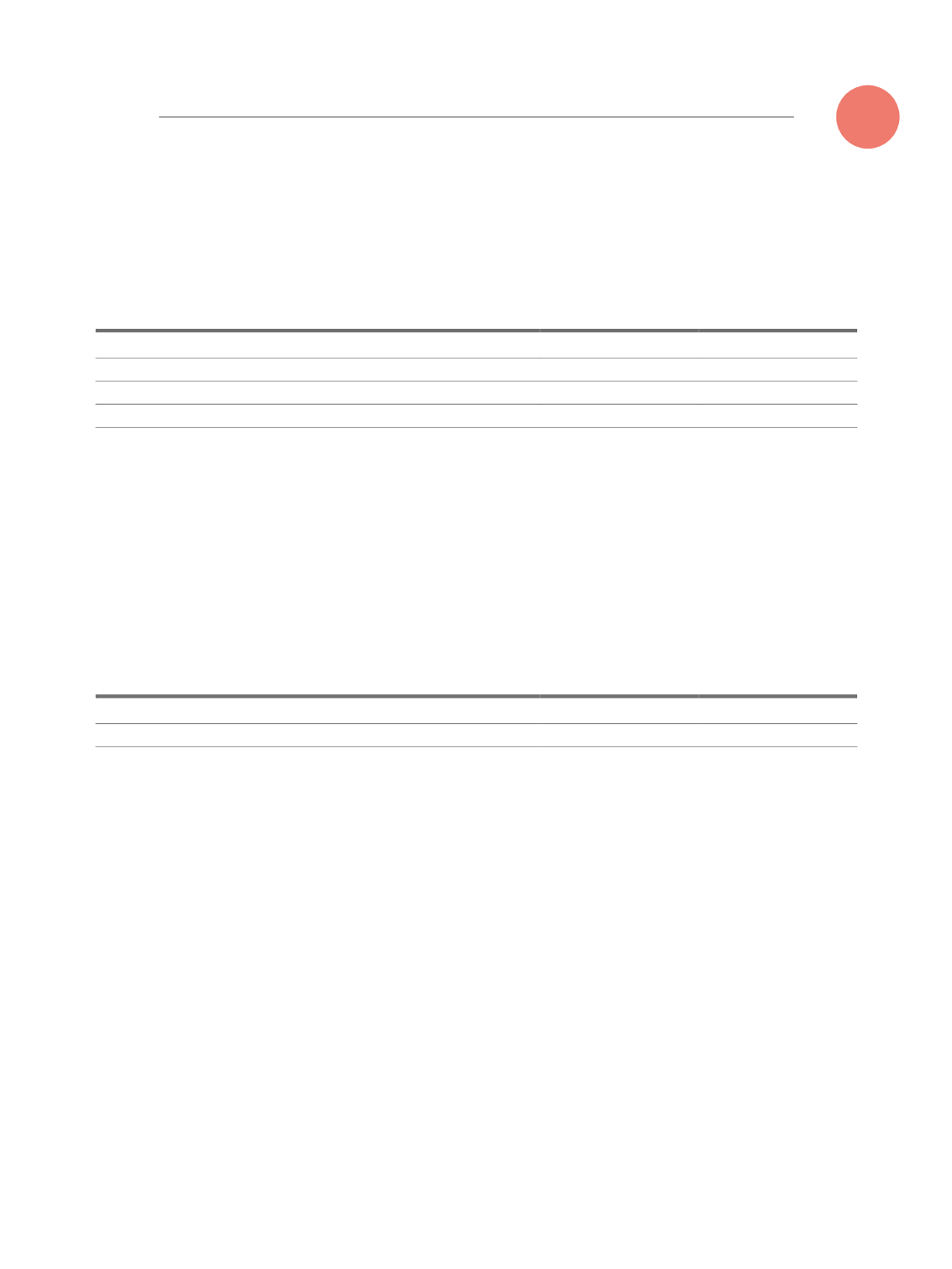

20. DERIVATIVE FINANCIAL INSTRUMENT

On December 31, 2015 and 2014 the detail of Ibersol derivative financial instruments is presented as

follows:

Dec. 2015

Dec. 2014

Swaps

(1)

181.602

-

Derivative financial instruments

181.602

-

(1) Amount reclassified from the 2014 loans.

In 2012, subsidiary Asurebi subscribed a deriva-

tive financial instrument for cash-flows hedging

with an interest rate Swap. In 2014 due to chang-

es in the related loan swap conditions were ad-

justed as follows:

- Initial date: September, 5 2015;

- expiration date: July, 15 2019;

- fixed interest rate: 0,78%;

- variable interest rate: Euribor 1M;

- total amount: 10 million euros, reduces with

debt repayment plan.

This derivative is classified as a level 2 category

and its technical valuation based on a market ap-

proach (MTM).

As the derivative financial instrument was not

registered under hedge accounting, its changes

in fair value are reflected in the income of the

year (35.418 euros, Note 27).

265