CONSOLIDATED FINANCIAL STATEMENTS

c) Financial statements

Financial statements assets and liabilities of foreign entities are converted to euro using the

exchange rates at the balance sheet date, profit and loss as well as the cash flows state-

ments are translated into euro using the average exchange rate recorded during the period.

The resulting exchange difference is recorded in equity under the heading of exchange rate

differences.

“Goodwill” and fair value adjustments arising from the acquisition of foreign entities are trea-

ted as assets and liabilities of that entity and translated into euro according to the exchange

rate at the balance sheet date.

When a foreign entity is disposed, the accumulated exchange rate difference is recognised in

the income statement as a gain or loss on disposal.

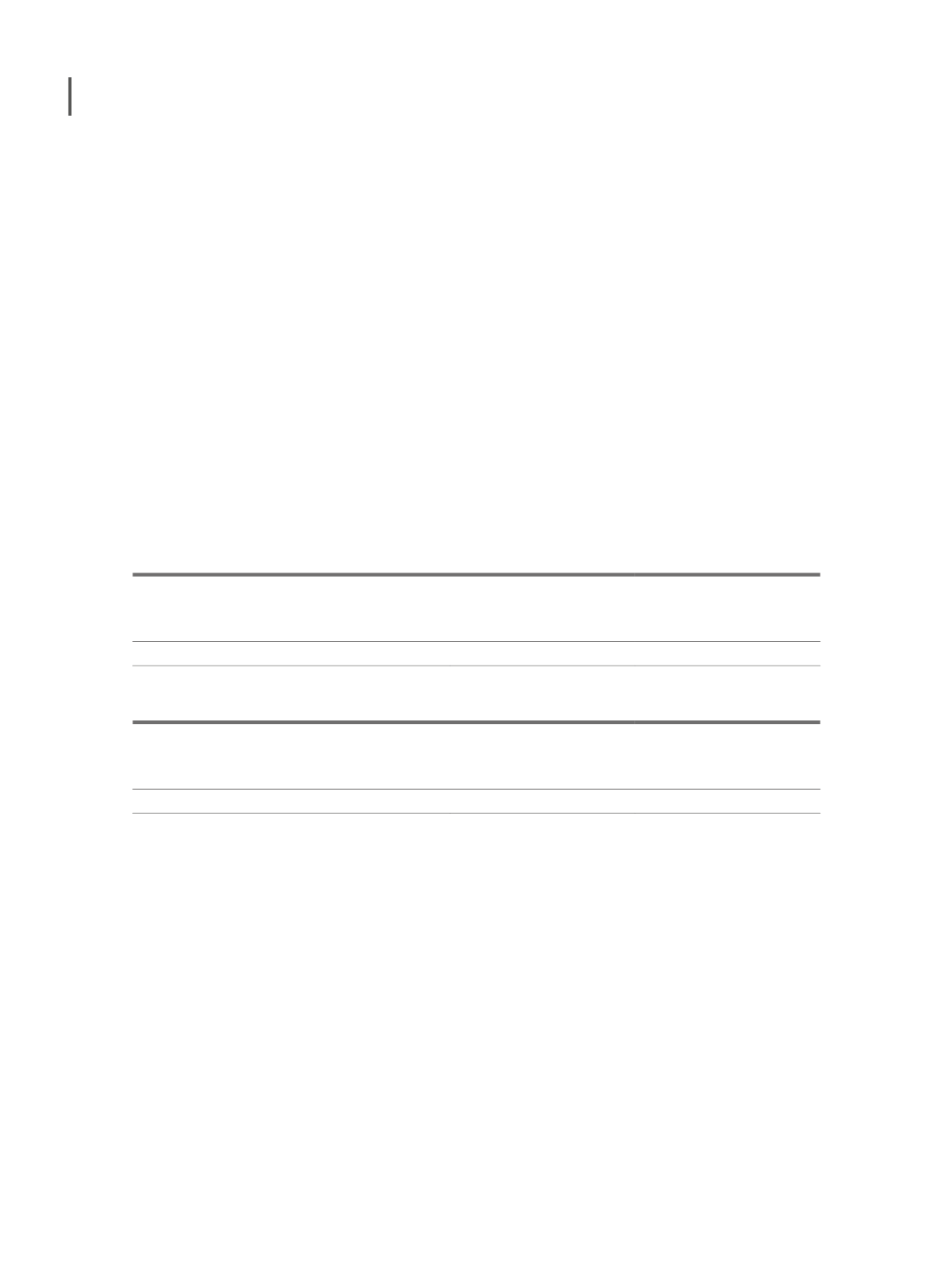

Currency exchange rate used for conversion of transactions and balances denominated in

Kwanzas in December 31st, 2016 and 2015 were respectively:

Dec. 2016

Euro exchange rates

(x foreign currency per 1 Euro)

Rate on

December 31st

2016

Average

interest rate

year 2016

Kwanza de Angola (AOA)

181,468

181,554

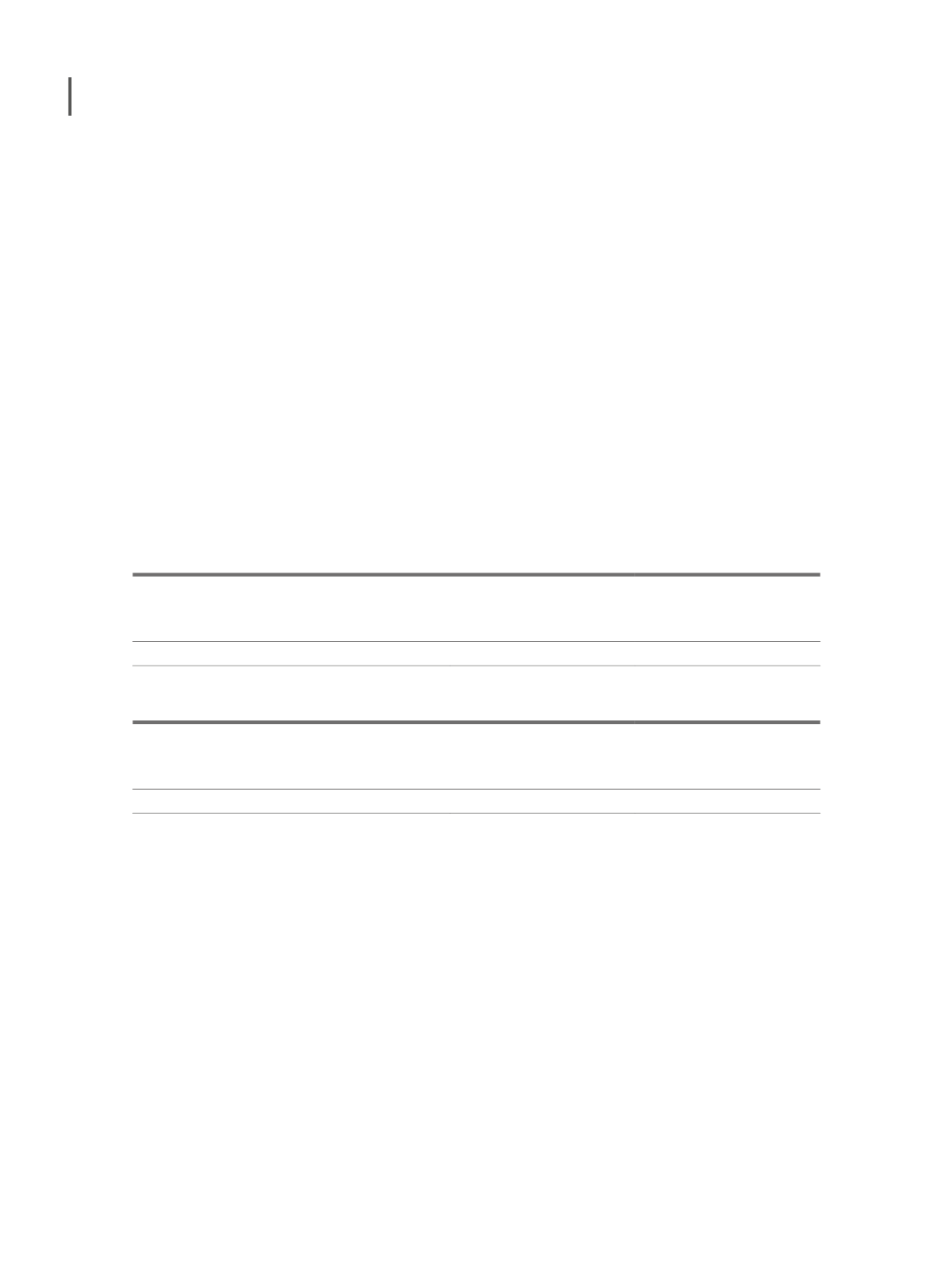

Dec. 2015

Euro exchange rates

(x foreign currency per 1 Euro)

Rate on

December 31st

2015

Average

interest rate

year 2015

Kwanza de Angola (AOA)

147,842

134,409

2.5 TANGIBLE FIXED ASSETS

Buildings and other structures include own properties assigned to the restaurant activities

and expenses on works at third-party properties, in particular those required for setting up

restaurant shops.

Tangible fixed assets are shown at the acquisition cost, net of the respective amortisation and

accumulated impairment losses.

The historic cost includes all expenses attributable directly to the acquisition of goods.

Costs with loans incurred and with loans obtained for the construction of fixed tangible assets

are recognized as part of the construction cost of the asset.

210