CONSOLIDATED FINANCIAL STATEMENTS

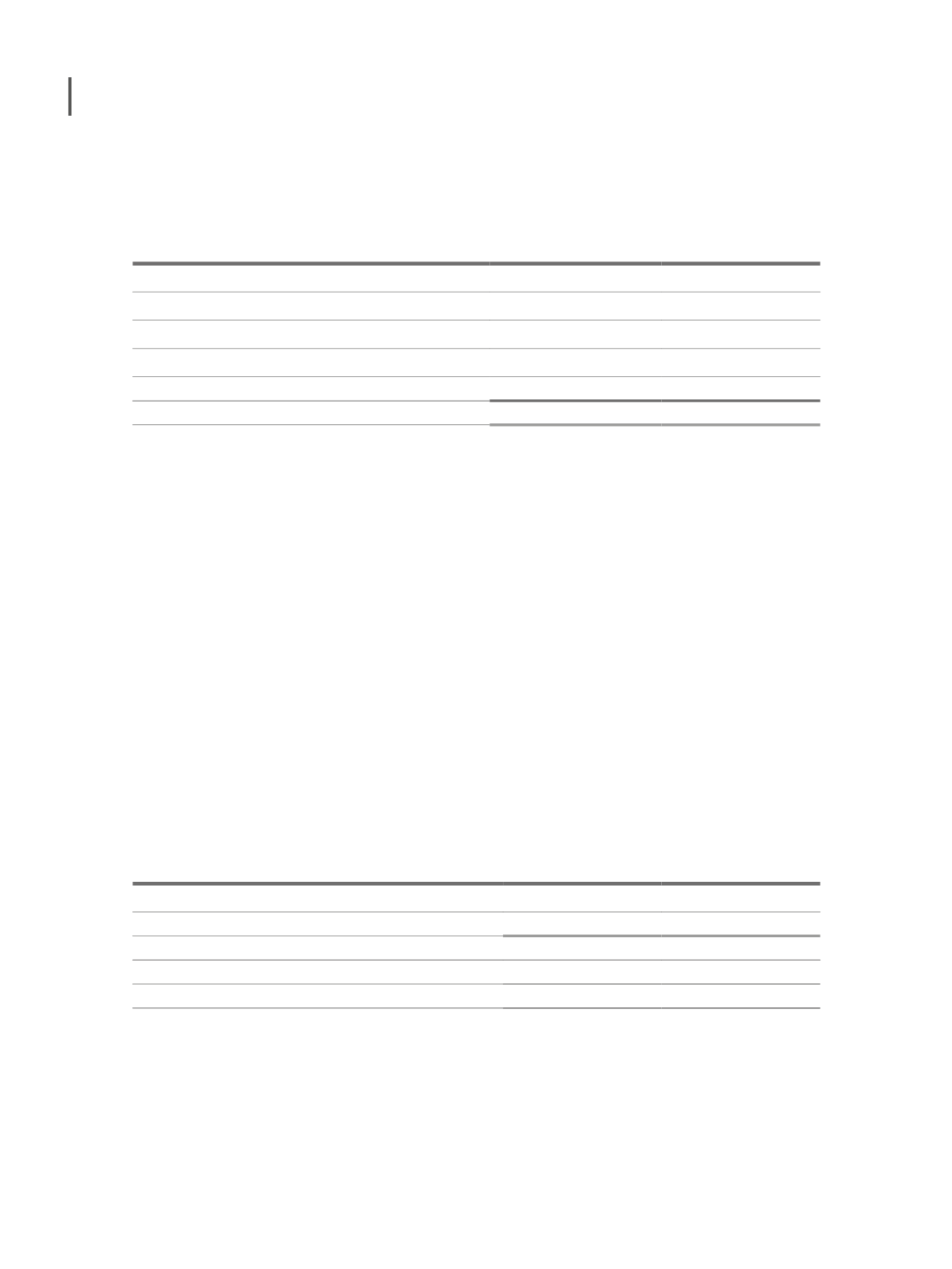

The distribution of goodwill allocated to segments is presented as follows:

Dec. 2016

Dec. 2015

Eat Out

70,647,649

-

Restaurants

11,104,988

11,104,988

Counters

25,349,831

25,349,831

Concessions and Catering

3,874,469

3,874,469

Other, write off and adjustments

179,721

179,721

111,156,658

40,509,009

Based on the Discounted Cash Flow (DCF) method, use value evaluations were made that

sustain the recoverability of Goodwill.

With the same assumptions of the discount rate and growth (note 8) the impairment test are

sustained by historical performance, the development expectations of the markets and the

strategic development plans of each business.

Although the impairment of tangible and intangible fixed assets result in the amount of

817.744 eur, this did not result in impairment in the cash-generating units to which Goodwill

is allocated.

No sensitivity analyzes were carried out for goodwill because the impairment tests carried out

revealed that the recoverable amount is greater than 20% of the book value if there were a

reasonable change in the key assumptions.

10. FINANCIAL INVESTMENTS

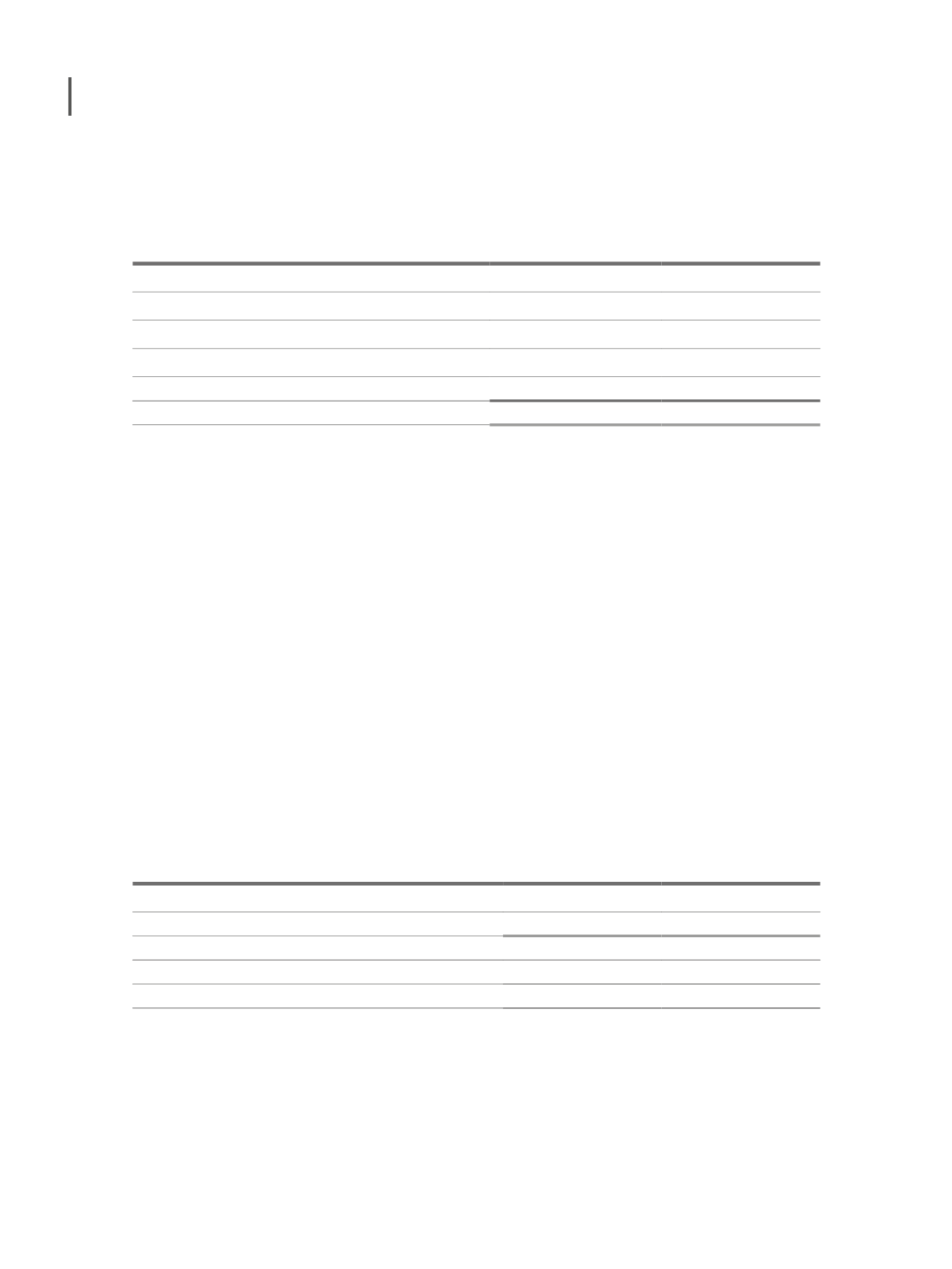

10.1. INVESTMENTS IN JOINTLY CONTROLLED ENTITIES

Dec. 2016

Dec. 2015

Financial investments - joint controlled subsidiaries

2,417,631

2,417,891

2,417,631

2,417,891

Accumulated impairment losses

-

-

2,417,631

2,417,891

244