182

Transfers or transactions between segments are performed according to normal commercial terms and in the

conditions applicable to independent third parties.

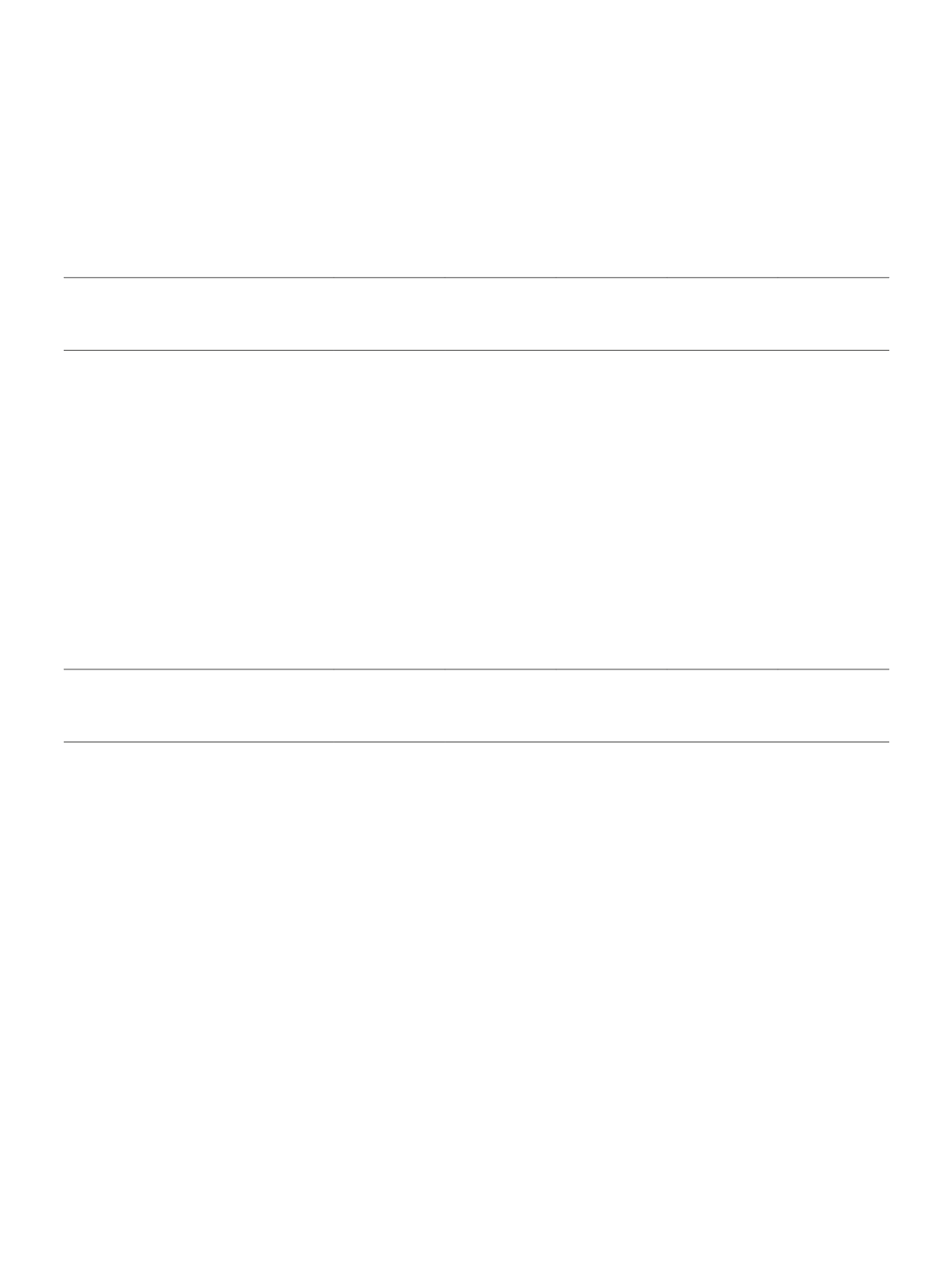

The consolidated statement of comprehensive income also includes the following parts on the segments:

Year ending on 31 December 2014

Restaurants Counters

Concessions

and Catering

Other,

write off and

adjustments

Total

Group

Depreciation (Note 8)

2.451.409

4.054.146

1.450.901

274.280

8.230.736

Amortization (Note 9)

407.593

495.159

618.276

19.425

1.540.454

Impairment of fixed tangible

assets (Note 8)

914.881

326.453

2.174.929

-

3.416.263

Impairment of goodwill (Note 9)

-

-

-

-

-

Impairment of intangible

assets (Note 9)

-

-

1.301.200

-

1.301.200

Impairment of accounts

receivable (Note 14)

305.390

98.050

-25.828

-

377.612

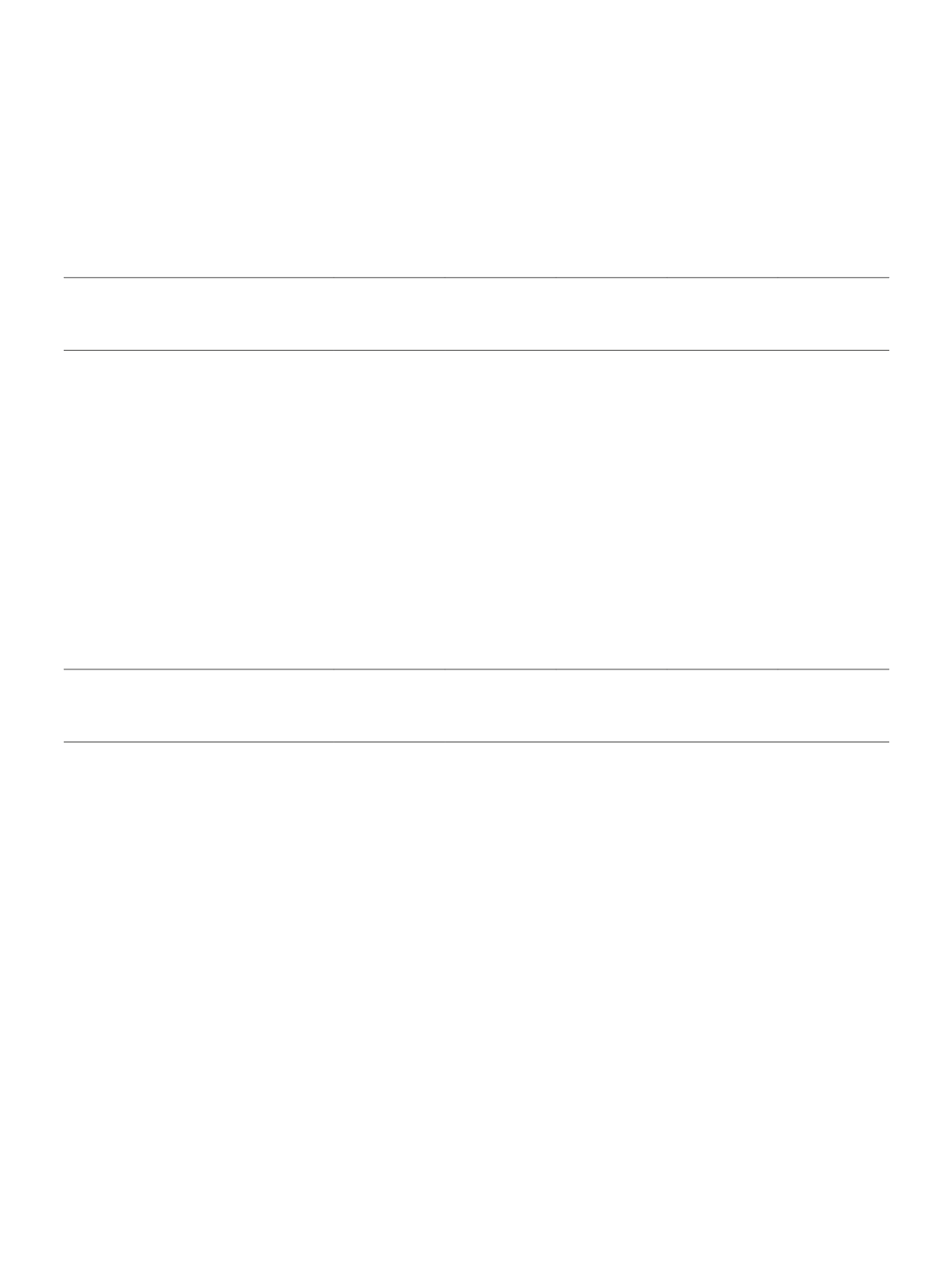

Year ending on 31 December 2013

Restaurants Counters

Concessions

and Catering

Other,

write off and

adjustments

Total

Group

Depreciation (Note 8)

2.566.337

3.595.900

1.515.751

253.373

7.931.361

Amortization (Note 9)

421.852

529.660

653.247

18.390

1.623.149

Impairment of fixed tangible

assets (Note 8)

1.450.343

462.456

313.095

-

2.225.894

Impairment of goodwill (Note 9)

-

-

-

-

-

Impairment of intangible assets

(Note 9)

75

-

242.672

-

242.747

Impairment of accounts

receivable (Note 14)

156.524

-

-22.453

-6.000

128.071