186

A variation of the discount rate in perpetuity of 1% and 2% would result in a further loss of 620.000 euros and

1.400.000 euros, respectively.

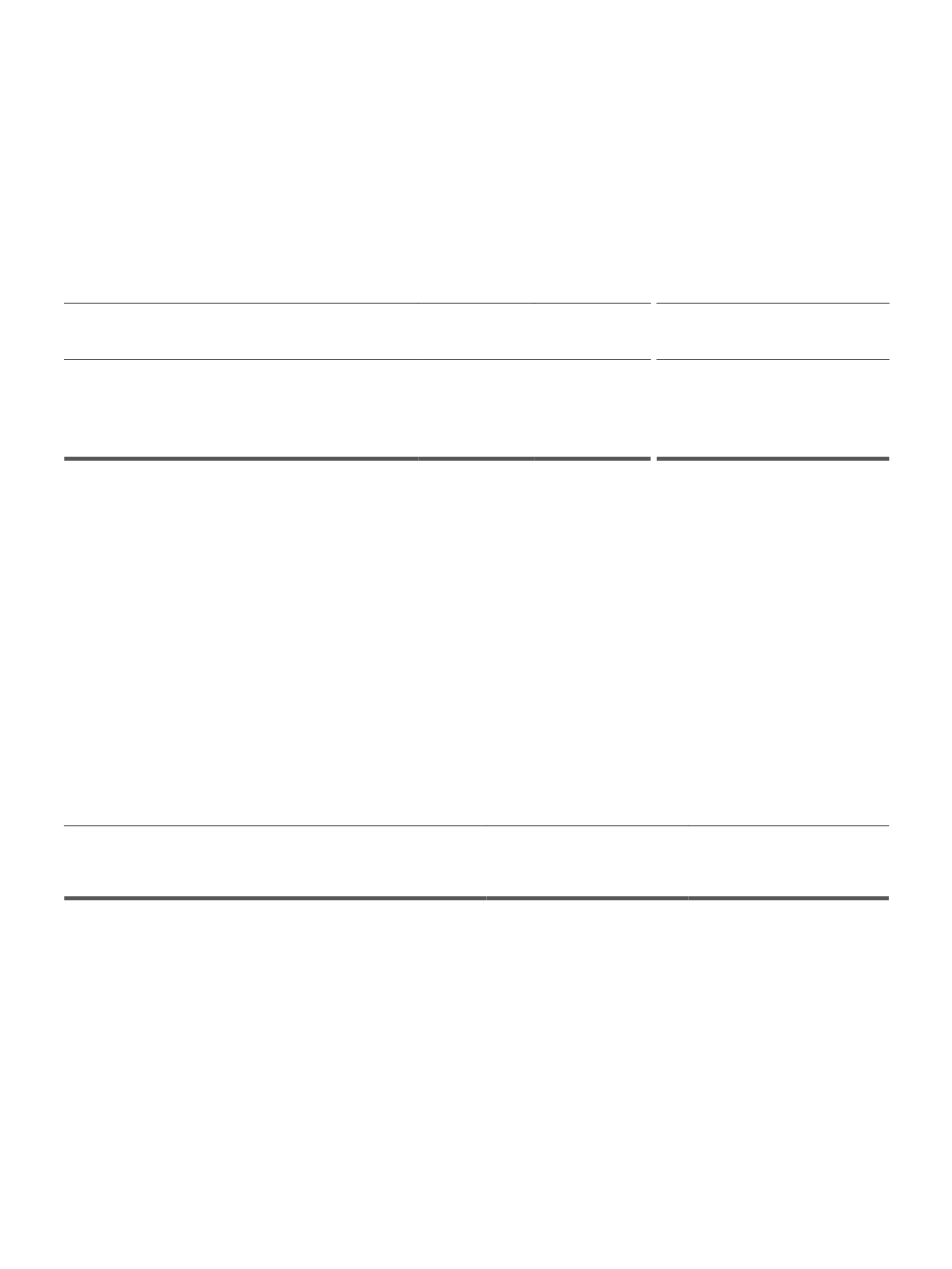

Further to the termination of lease contracts in the years ended on 31 December 2014 and 2013, the following

assets were used under a financial lease:

2014

2013

Gross Amount

Accumulated

depreciation Gross Amount

Accumulated

depreciation

Land and buildings

-

-

1.789

-1.730

Equipment

-

-

393.926

-203.513

Other tangible fixed assets

-

-

23.481

-10.674

-

-

419.197

-215.917

In the years 2014 and 2013 there were no new lease agreements.

About 163 thousand euros were capitalized in the year 2014 related to bank loans expense in Angola, the ac-

cumulated value at December 31, 2014 was of about 567 thousand euros.

9. INTANGIBLE ASSETS

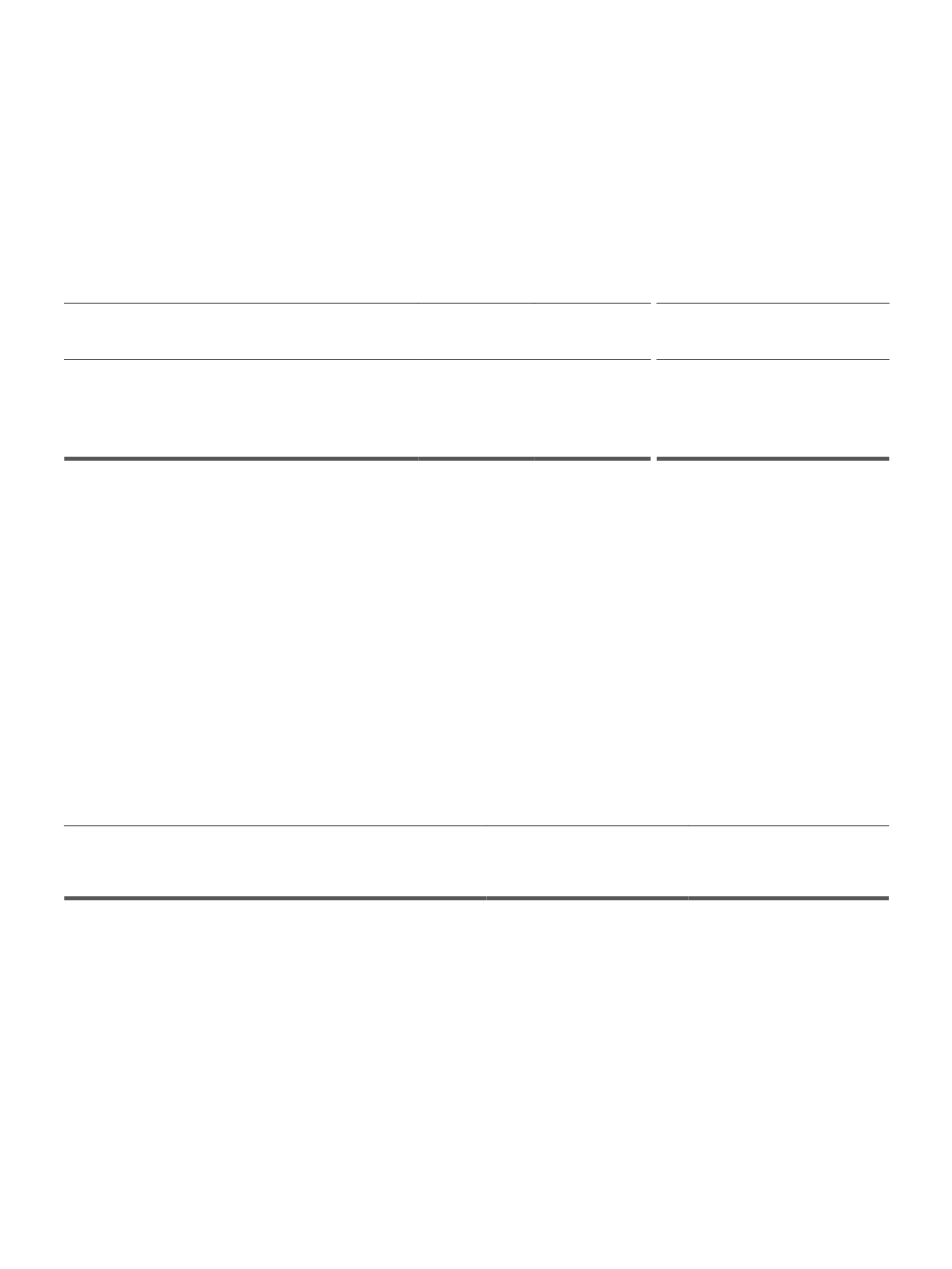

Goodwill and intangible assets are broken down as follows:

Dec. 2014

Dec. 2013

Goodwill

40.594.588

40.509.009

Intangible assets

13.493.705

15.253.659

54.088.293

55.762.668

In the years ending on 31 December 2014 and 2013, the movement in the value of intangible assets, amortiza-

tion and accumulated impairment losses were as follows: