202

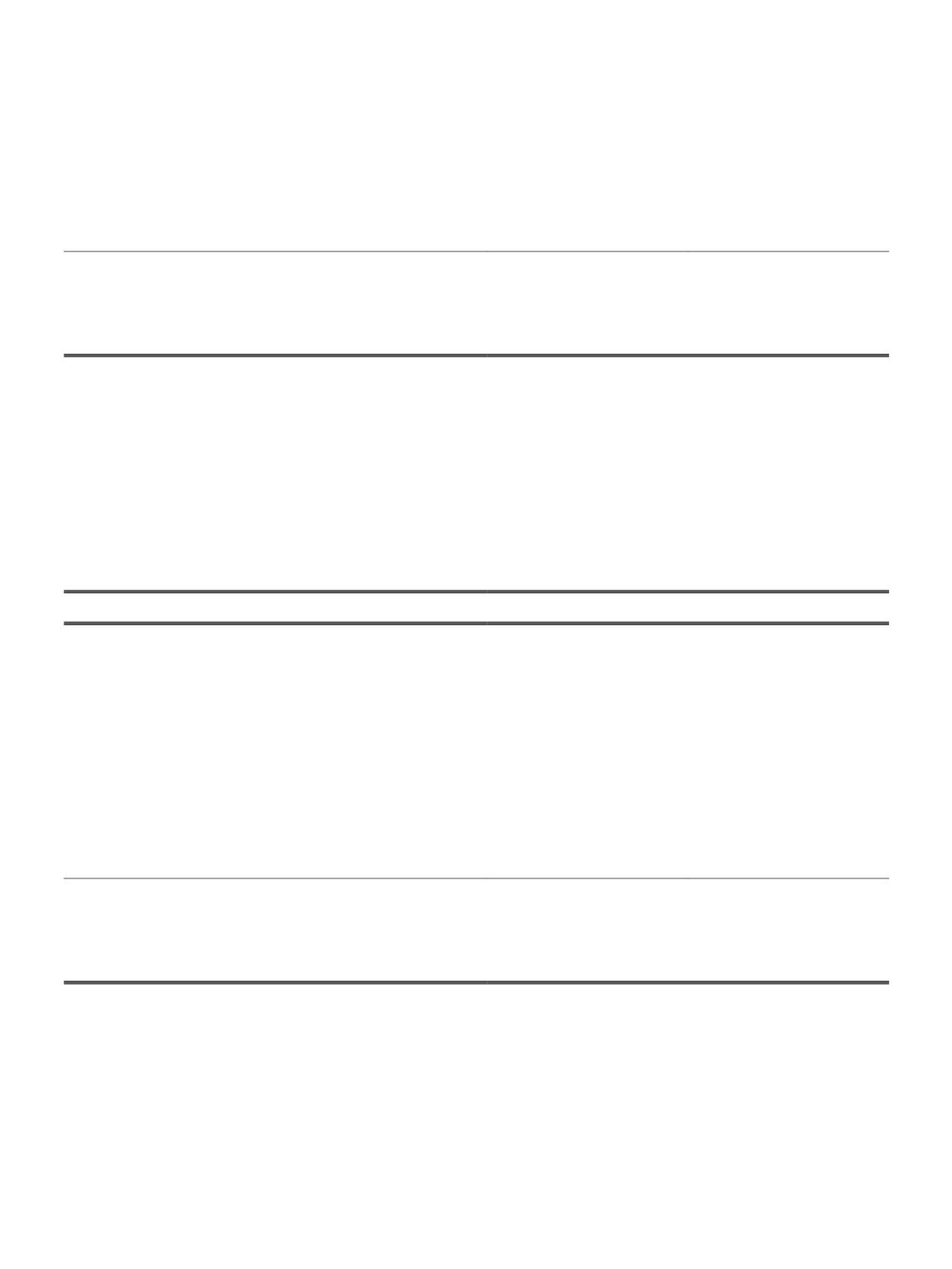

20. ACCOUNTS PAYABLE TO SUPPLIERS AND ACCRUED COSTS

On 31

st

December 2014 and 2013, accounts payable to suppliers and accrued costs were broken down as follows:

Dec. 2014

Dec. 2013

Suppliers c/a

19.093.772

17.177.227

Suppliers - invoices pending approval

1.749.007

1.481.967

Suppliers of fixed assets c/a

6.303.369

4.916.549

Total accounts payable to suppliers

27.146.148

23.575.743

Accrued costs - Payable insurance

40.865

10.894

Accrued costs - Payable remunerations

4.484.987

4.444.699

Accrued costs - Performance bonus

746.991

-

Accrued costs - Payable interest

117.740

103.923

Accrued costs - External services

(1)

3.081.901

1.780.993

Accrued costs - Other

(1)

915.468

483.061

Total acrrued costs

9.387.952

6.823.570

Total accounts payable to suppl.and accrued costs

36.534.100

30.399.313

1. Changes are the result of conservation and repairs and royalties invoices not yet invoiced by suppliers. Farther, in 2013, 834.160 eur was transfer

from subheading other to external services.

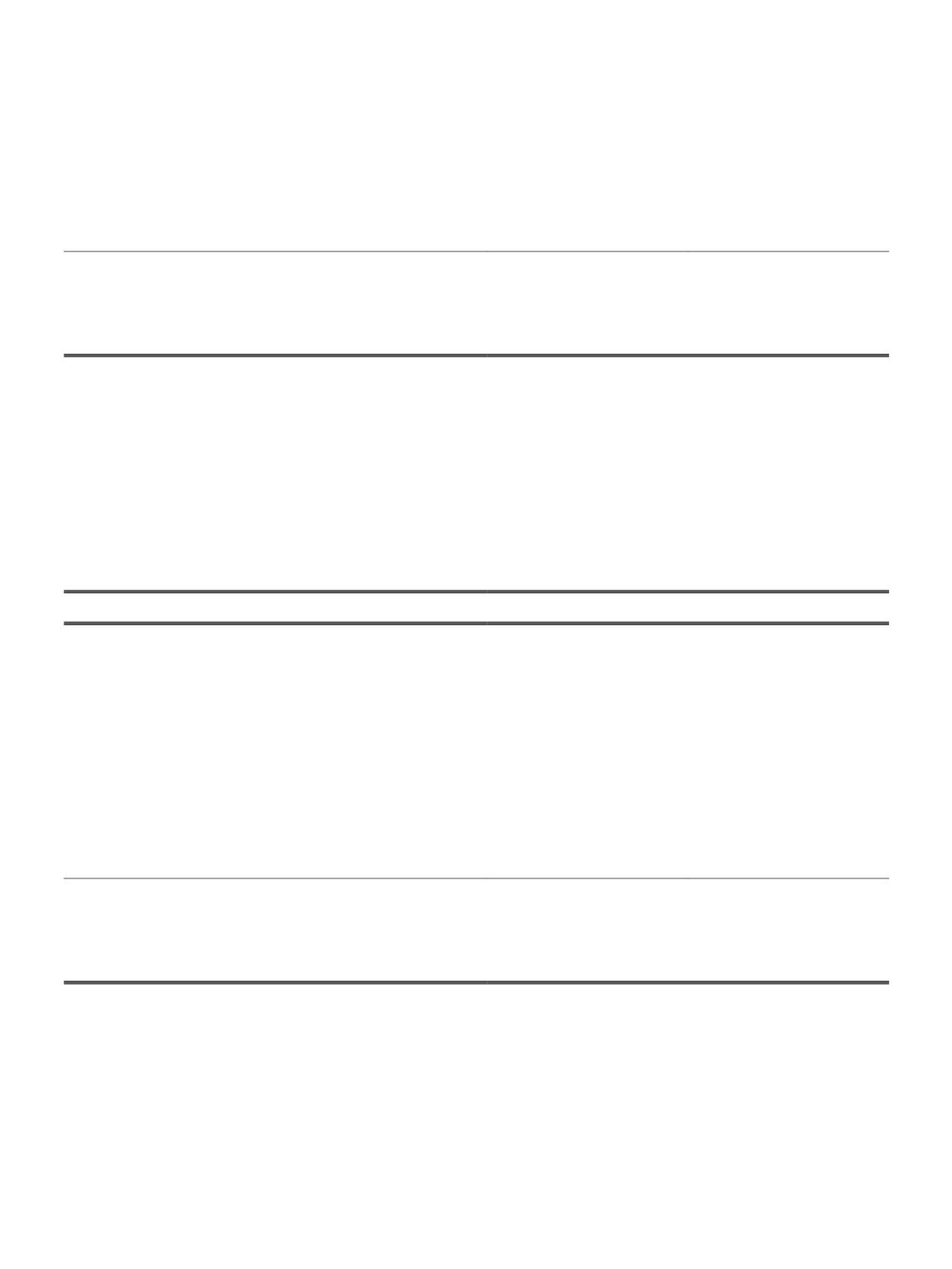

21. OTHER CURRENT LIABILITIES AND INCOME TAX PAYABLE

On 31

st

December 2014 and 2013, the item “Other current liabilities” may be broken down as follows:

Dec. 2014

Dec. 2013

Other creditors

(1)

1.603.073

3.340.537

State and other public entities

(2)

5.587.781

4.940.928

Deferred income

(3)

1.374.807

2.562.299

Other

8.565.661

10.843.764

(1) Unlike 2014, on 2013 wages of the month of December, were paid in early January 2014 (1.989.905 euros), due to the change of procedures in

the payroll period (from the 26 of n-1 month to the 25 of n month changed to 01-30 of month n), thereby fulfilling with all legal requirements of

the Social Security services.

(2) Balance due mainly to payable VAT amounts (3.290.222 euros) and Social Security (1.731.776 euros).

(3) The Deferred Income item includes the following amounts: