208

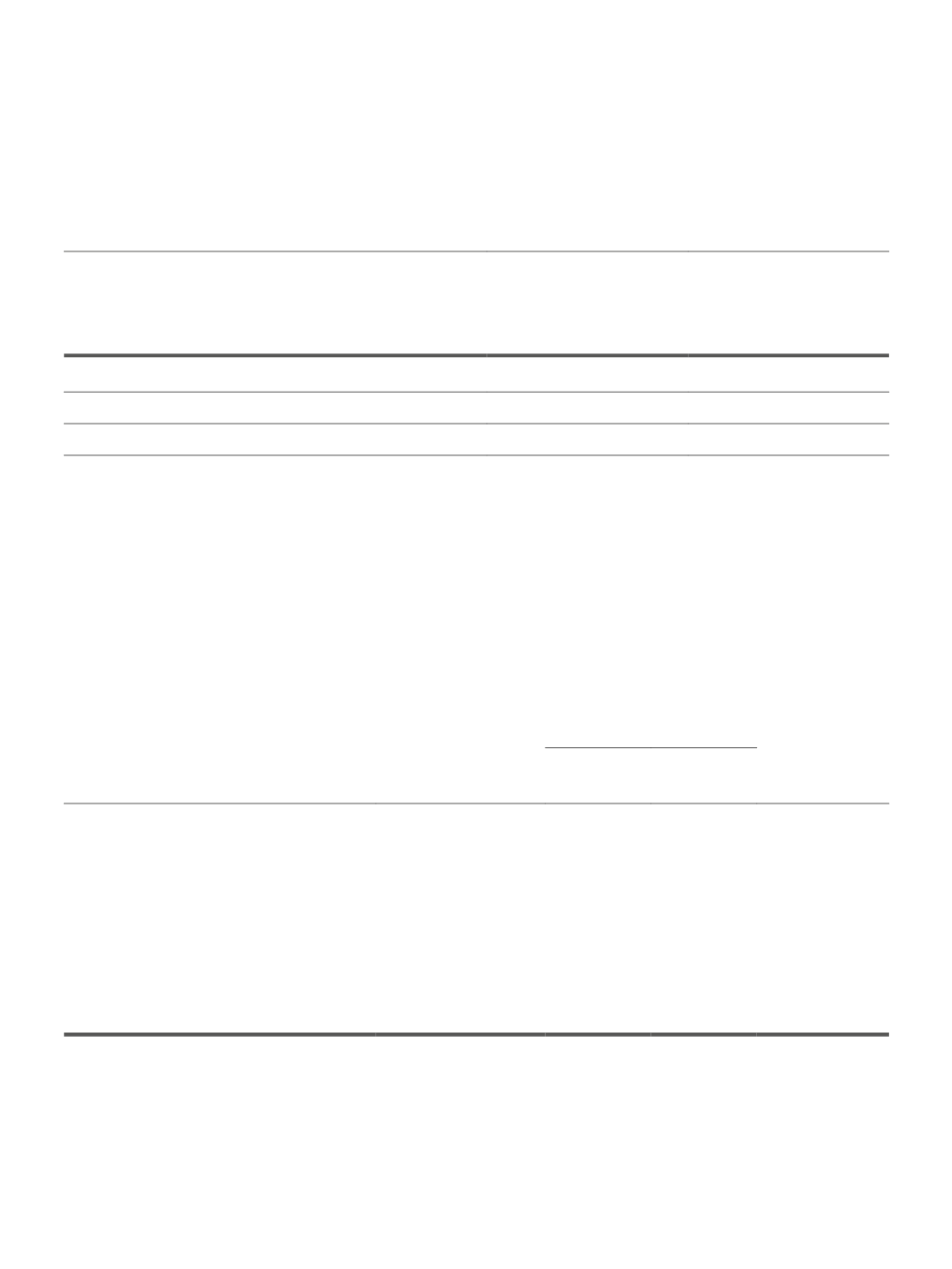

27. INCOME PER SHARE

Income per share in the years ending on 31

st

December 2014 and 2013 was calculated as follows:

Dec. 2014

Dec. 2013

Profit payable to shareholders

7.756.088

3.576.462

Mean weighted number of ordinary shares issued

20.000.000

20.000.000

Mean weighted number of own shares

-2.000.000

-2.000.000

18.000.000

18.000.000

Basic earnings per share (€ per share)

0,43

0,20

Earnings diluted per share (€ per share)

0,43

0,20

Number of own shares at the end of the year

2.000.000

2.000.000

Since there are no potential voting rights, the basic earnings per share is equal to earnings diluted per share.

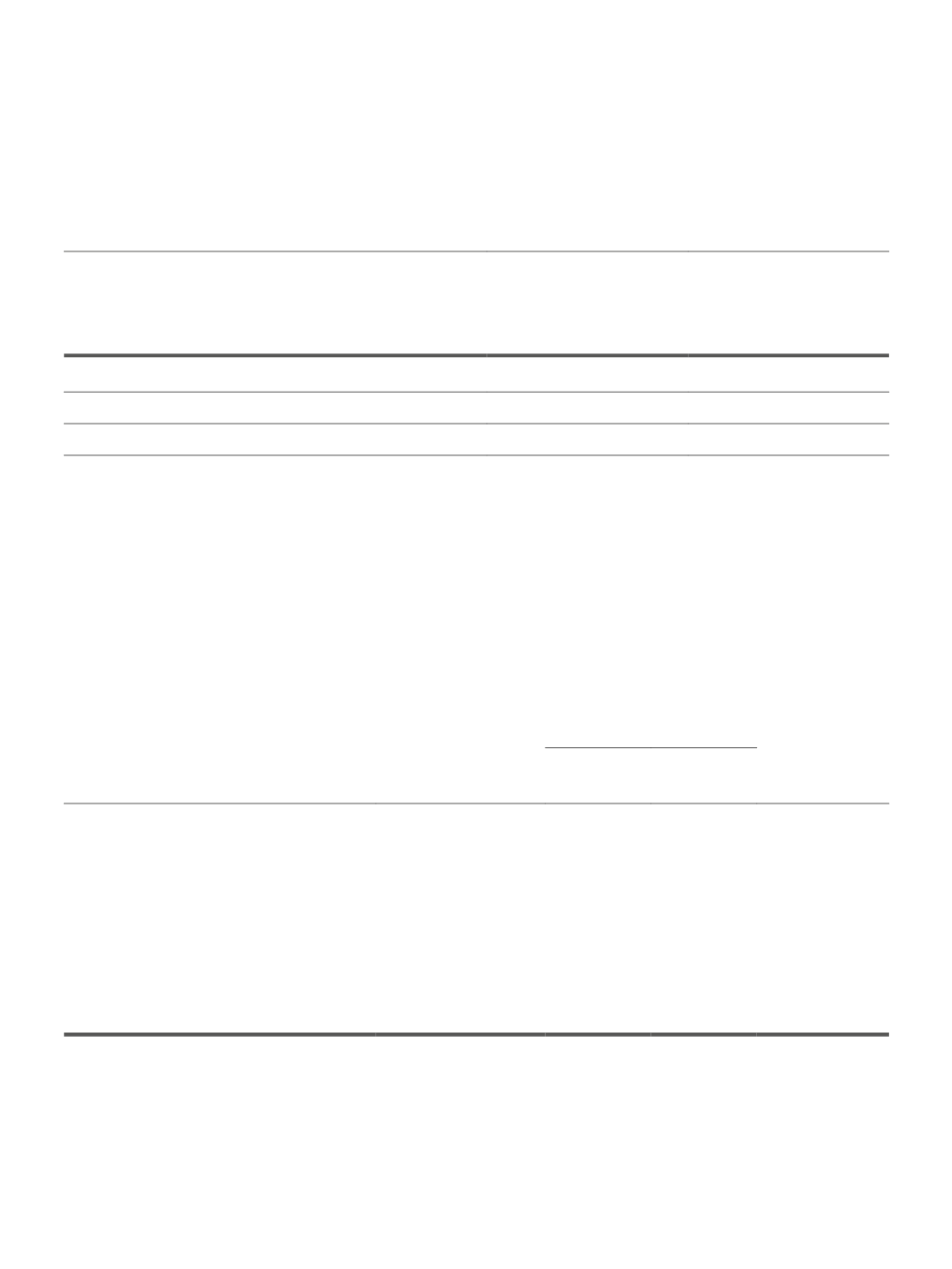

28. FINANCIAL ASSETS AND LIABILITIES

At the end of the year, financial assets and liabilities were broken down as follows:

Accounting Value

Financial Assets

Category

Dec.

2014

Dec.

2013

Valuation

Method

Other non-current assets

Accounts receivable 1.487.814

1.632.344

Amortized cost

Financial assets available for sale

Available for sale

2.818.914

2.852.488

Cost

Cash and cash equivalents

Accounts receivable 13.566.782 22.138.608 Amortized cost

Clients

Accounts receivable 3.733.279

3.894.539

Amortized cost

State and other public entities

Accounts receivable 229.293

860.989

Amortized cost

Other debtors

Accounts receivable 3.331.421

2.460.813

Amortized cost

Advances to suppliers

Accounts receivable 321.639

12.483

Amortized cost

25.489.142 33.852.264