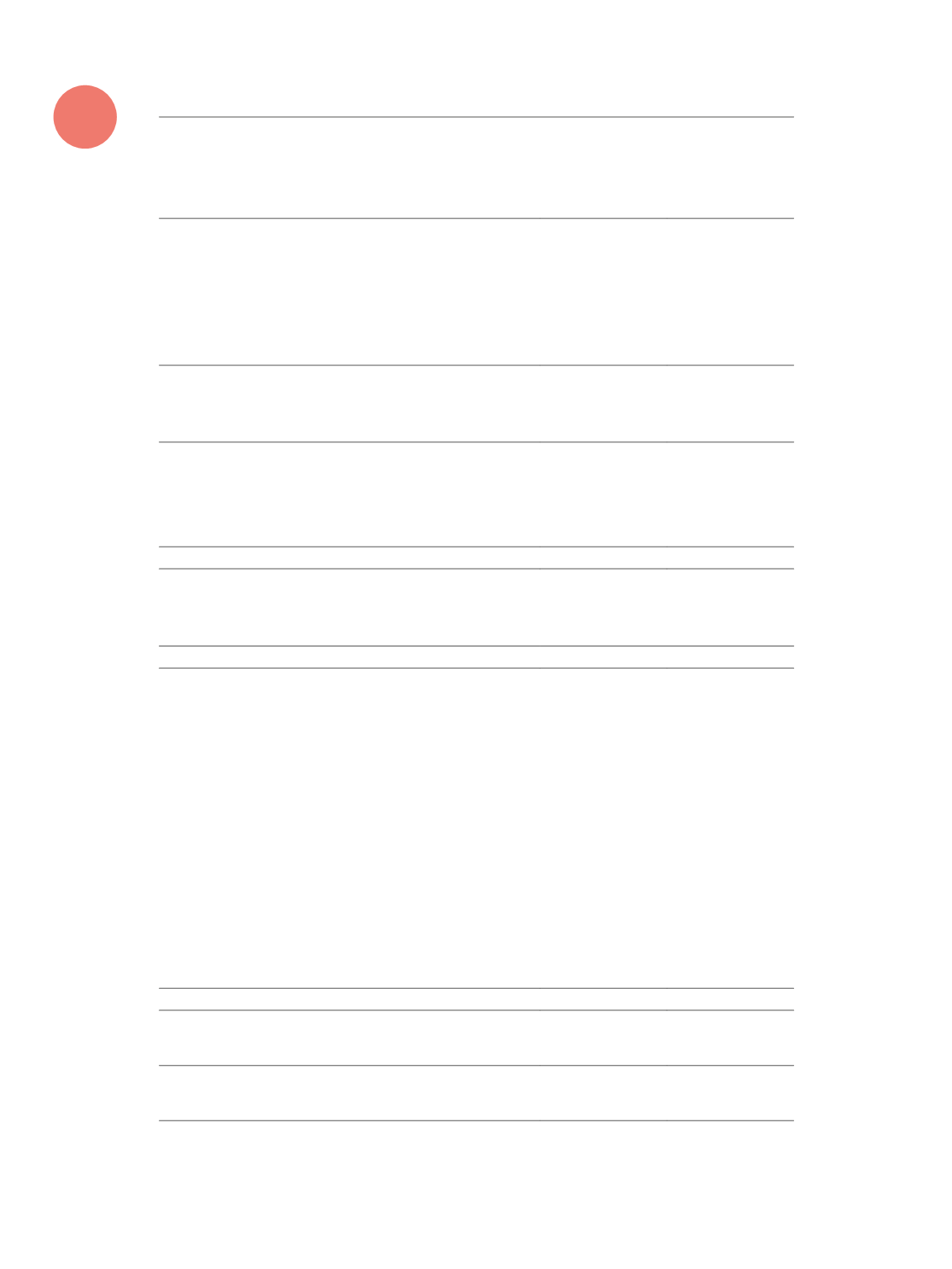

Corporate Governance Report

Shareholders

n.° Shares

% share capital

ATPSII – SGPS, SA (*)

ATPS-SGPS, SA

10.981.701

54,91%

I.E.S. - Indústria, Engenharia e Serviços, SGPS, SA

0

0,00%

Mirtal - SGPS, SA

0

0,00%

António Alberto Guerra Leal Teixeira

1.400

0,01%

António Carlos Vaz Pinto Sousa

1.400

0,01%

Total attributable

10.984.501

54,92%

Banco BPI, SA

Fundo de Pensões Banco BPI

400.000

2,00%

Total attributable

400.000

2,00%

Magallanes Iberian Equity FI

Magallanes Iberian Equity FI

325.019

1,625%

SOIXA SICAV SA

100.000

0,500%

Total attributable

425.019

2,13%

Santander Asset Management SGFIM, SA

Fundo Santander Acções Portugal

476.878

2,38%

Fundo Santander PPA

13.357

0,07%

Total attributable

490.235

2,45%

Bestinver Gestion

BESTINVER BOLSA, F.I.

1.076.549

5,38%

BESTINFOND F.I.M.

763.338

3,82%

BESTINVER GLOBAL, FP

215.551

1,08%

BESTVALUE F.I..

173.687

0,87%

BESTINVER MIXTO, F.I.M.

92.296

0,46%

BESTINVER AHORRO, F.P.

61.966

0,31%

BESTINVER SICAV-BESTINFUND

34.249

0,17%

BESTINVER SICAV-IBERIAN

87.747

0,44%

DIVALSA DE INVERSIONES SICAV, SA

3.970

0,02%

BESTINVER EMPLEO FP

6.065

0,03%

BESTINVER FUTURO EPSV

2.210

0,01%

BESTINVER EMPLEO II, F.P.

1.415

0,01%

BESTINVER EMPLEO III, F.P.

795

0,00%

Total attributable

2.519.838

12,60%

Norges Bank

Directly

743.147

3,72%

FMR LLC

Fidelity Management & Research Company

400.000

2,00%

(*) The voting rights attributable to the ATPS are also attributable to António Pinto Sousa and Alberto Teixeira under subparagraph b)

of paragraph 1 of Article 20 and Article 21 paragraph 1, both of the Securities Code, by virtue of the latter are holding the domain of that

company, in which participate indirectly in equal parts by, respectively, of CALUM – SERVIÇOS E GESTÃO, SA. with the NIPC 513799486

and DUNBAR – SERVIÇOS E GESTÃO, SA with the NIPC 513799257, which together hold the majority of the capital of ATPS.

132