193

ANNUAL REPORT AND CONSOLIDATED ACCOUNTS 2013

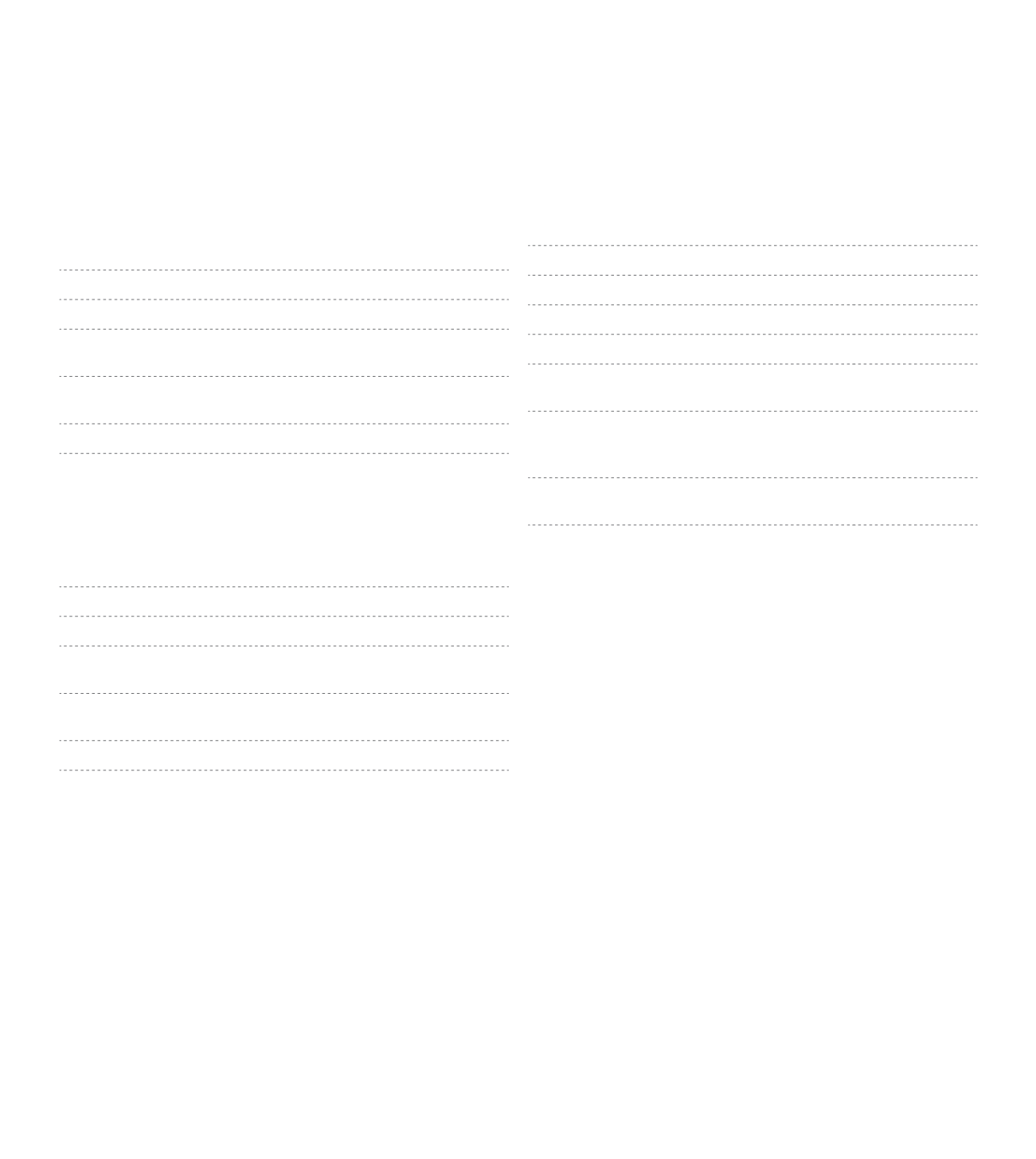

Only Financial Assets (such as Clients and Other Debtors)

presents impairment losses, as Note 14. On 31st Decem-

ber 2013 and 2012, gains or losses related with these fi-

nancial assets and liabilities were as follows:

Profit/ (Loss)

Dez-13

Dez-12

Accounts receivable

-128,071

-11,050

Assets available

for sale

-

-

Assets at

amortised cost

-

-

-128,071

-11,050

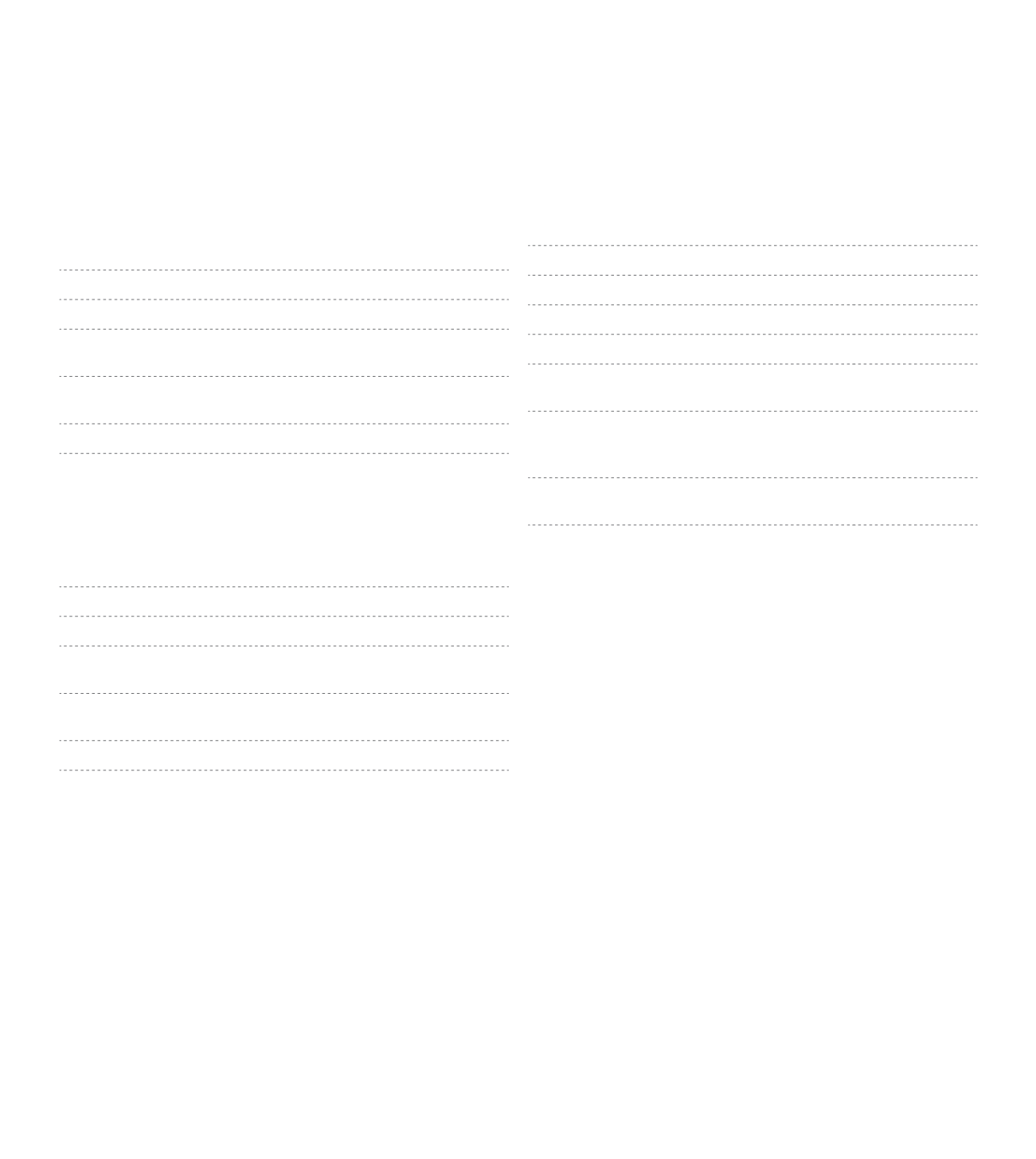

The interest of financial assets and liabilities were as

follows:

Interest

Dez-13

Dez-12

Accounts receivable

-

-

Assets available

for sale

-

-

Liabilities at

amortised cost

2,148,382 2,157,199

2,148,382 2,157,199

29. DIVIDENDS

At the General Meeting of 6th May 2013, the compa-

ny decided to pay a gross dividend of 0,055 euros per

share (0,055 euros in 2012), which was paid on 5th June

2013 corresponding to a total value of 990.000 euros

(990.000 euros in 2012).

30. CASH FLOWS FROM OPERATIONS

Cash flows from operations are broken down as follows:

2013

2012

Receipts from clients

173,273,777 169,654,587

Payments to supliers

-107,167,869 -103,241,372

Staff payments

-41,622,124 -47,620,023

Payments/receipt of

income tax

43,092 -1,984,087

Other paym./receipts

related with operating

activities

(1)

-7,062,335 -2,047,145

Cash flow generated

by the operations

17,464,541 14,761,960

(1) includes mainly social security payments, VAT and other debtors

and creditors debt.

31. CONTINGENT ASSETS AND LIABILITIES

The group has contingent liabilities regarding bank and

other guarantees and other contingencies related with

its business operations (as licensing, advertising fees,

food hygiene and safety and employees, and the rate of

success of these processes is historically high in Ibersol).

No significant liabilities are expected to arise from the

said contingent liabilities.