190

CONSOLIDATED FINANCIAL STATEMENTS

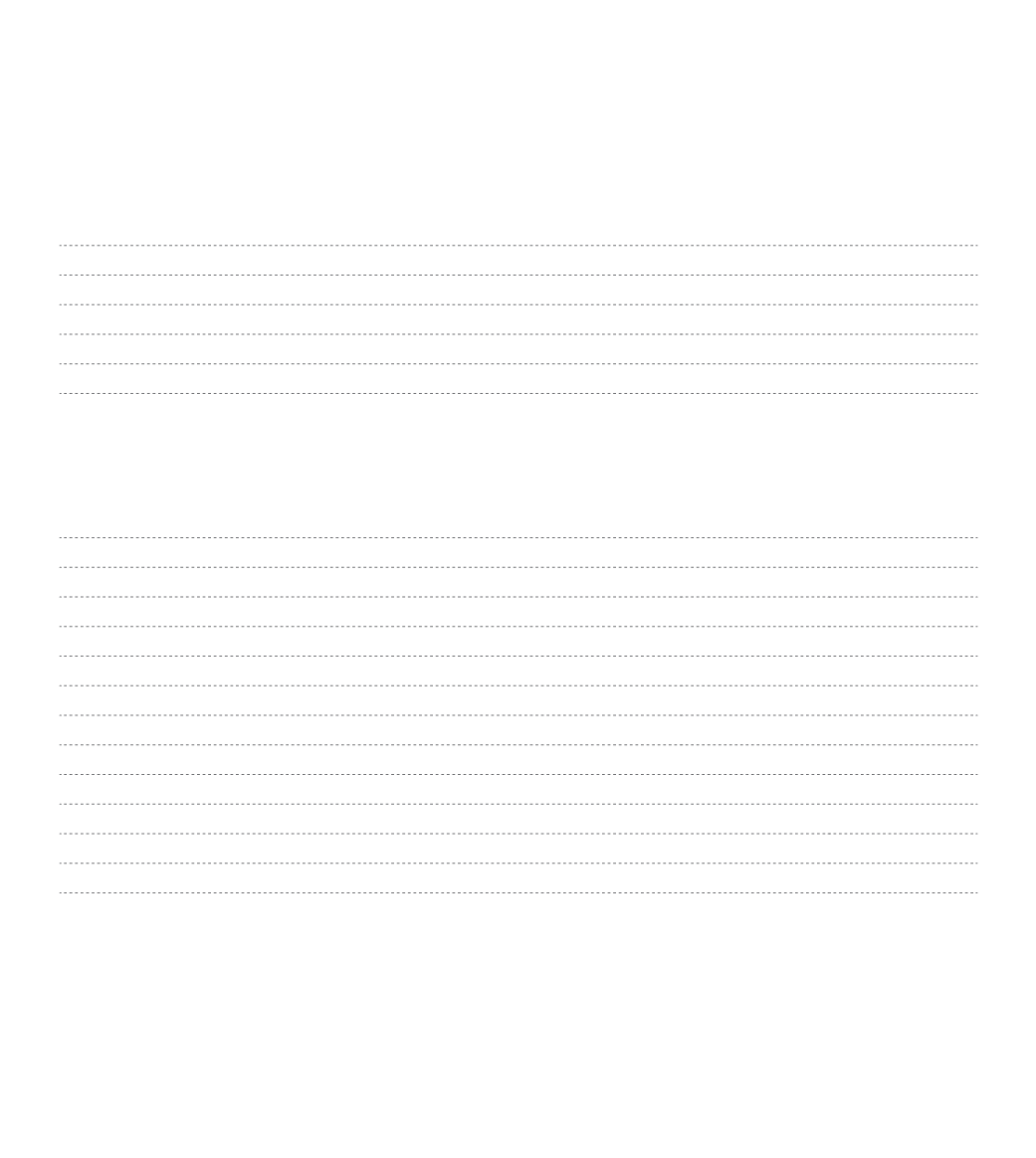

26. INCOME TAX

Income tax recognised in the years 2013 and 2012 are broken down as follows:

2013

2012

Current taxes

927,156

Deferred taxes (Note 17)

-455,204

1,105,513

471,952

-414,466

691,047

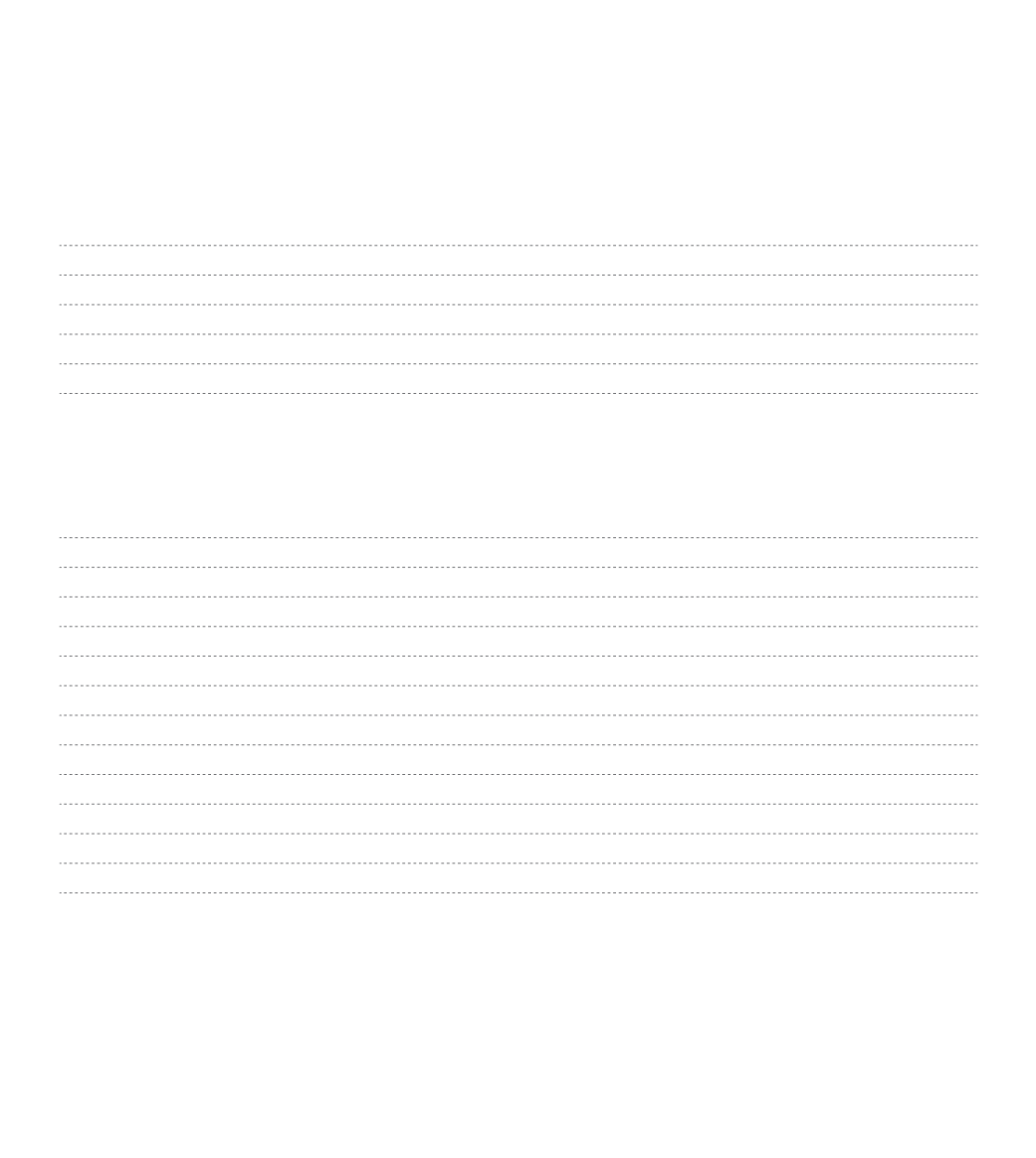

The group’s income tax prior to taxes is not the same as the theoretical amount that would result from applying

the mean weighted income tax rate to the consolidated profit, as follows:

2013

2012

Pre-tax profit

4,168,891

3,435,180

Tax calculated at the appliacble tax rate in Portugal (26,5%)

1,104,756

910,323

Fiscal effect caused by:

Tax rate difference in other countries

55,354

48,450

Deferred taxes not recognised due to prudence

15,382

60,306

Insufficient/(excess) estimate in the previous year

-1,979

-3,868

Correction deferred tax

57,843

-

Unaccounted deferred tax assets (in previous years)

-132,833

-83,288

Credit tax investment (CFEI) effects

-650,077

-

Alter. of taxable income due to fiscal adj. consol. and other effects

23,506

-240,875

Income Tax Expenses

471,952

691,047

The income tax rate was of 11% (2012: 20%). Reduction in the year was due mainly to the tax benefit (CFEI) of the

year 2013.