172

CONSOLIDATED FINANCIAL STATEMENTS

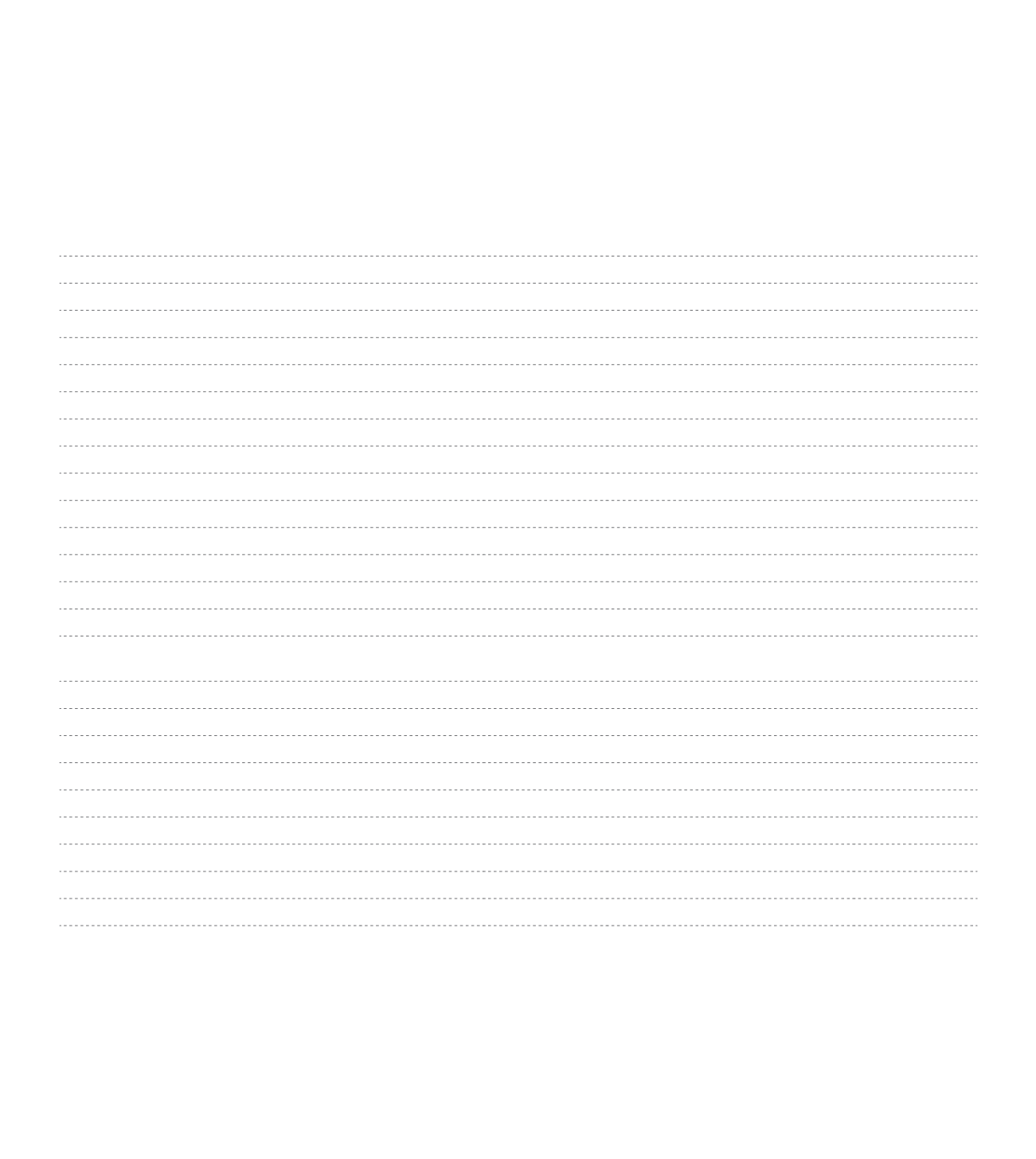

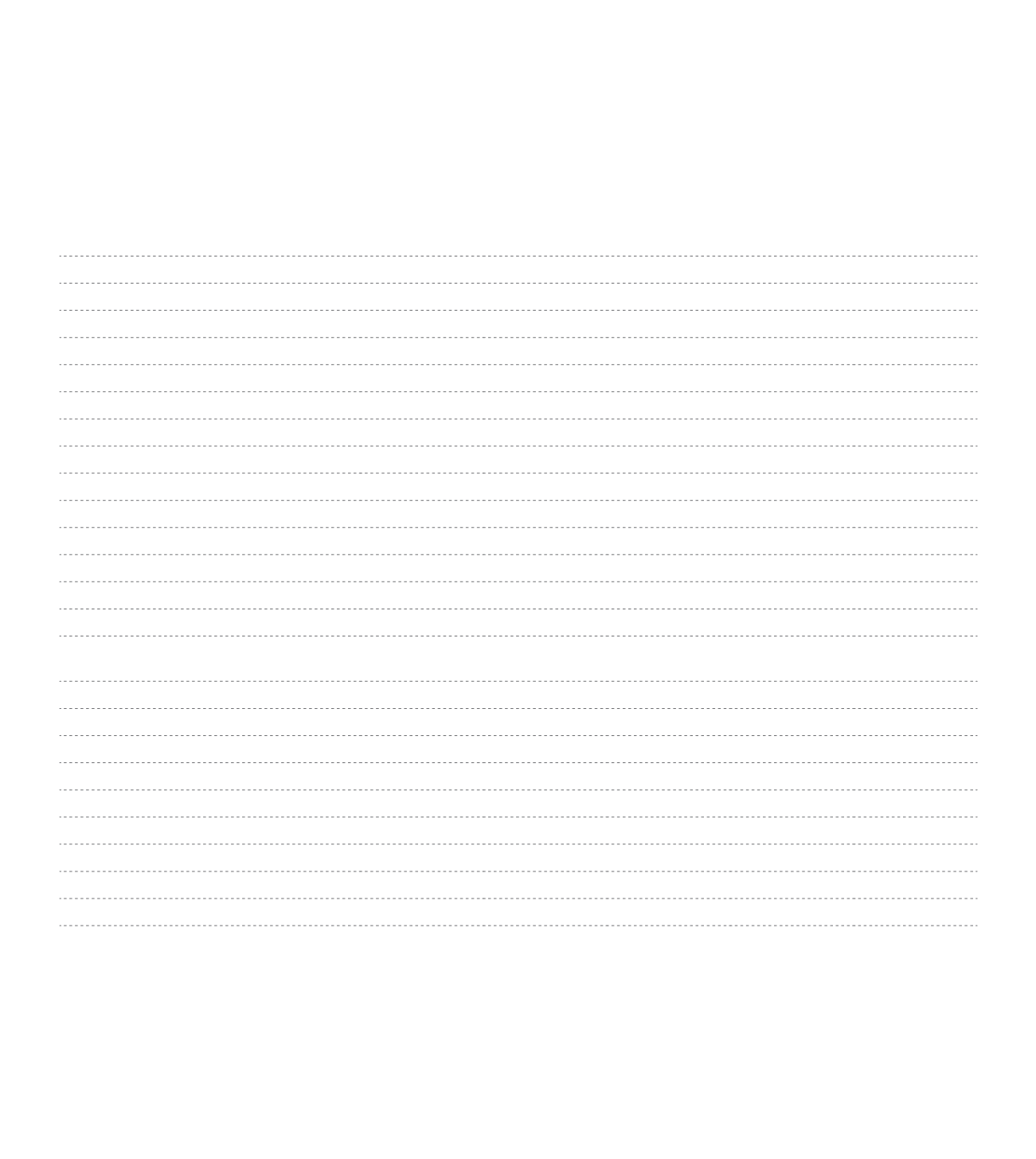

In the years ending on 31 December 2013 and 2012, the movement in the value of intangible assets, amortization

and accumulated impairment losses were as follows:

Goodwill

Industrial

property

Other

intangible

Assets

Intangible

Assets in

progress

(1)

Total

1 January 2012

Cost

44,895,940 19,567,107 4,703,952 2,284,169 71,451,168

Accumulated amortization

-

5,572,828 3,985,780

-

9,558,608

Accumulated impairment

1,861,678

720,969

70,110

-

2,652,757

Net amount

43,034,262 13,273,310

648,062 2,284,169 59,239,803

31 December 2012

Initial net amount

43,034,262 13,273,310

648,062 2,284,169 59,239,803

Changes in consolidat. perimeter

-

-

-

-

-

Additions

-

1,198,198

900,107

-

2,098,305

Decreases

536,000

8,258

394,333

-349

938,242

Transfers

-

18,077

213,291

161,283

392,651

Amortization in the year

-

987,836

528,582

-

1,516,418

Amortiz. by changes in the

perimeter

-

-

-

-

-

Impairment in the year

-

245,113

-

-

245,113

Impairment reversion

-

-

-

-

-

Final net amount

42,498,262 13,248,378

838,545 2,445,801 59,030,987

31 December 2012

Cost

44,359,940 20,788,413 5,394,349 2,445,801 72,988,503

Accumulated amortization

-

6,572,385 4,485,694

-

11,058,079

Accumulated impairment

1,861,678

967,650

70,110

-

2,899,438

Net amount

42,498,262 13,248,378

838,545 2,445,801 59,030,987

(1) intangible assets in progress balance refers mainly to the 3 new concessions yet to be open, in service areas of the following motorways:

Guimarães, Fafe and Paredes. These service areas are still in the design stage and waiting for platforms delivery. It is expected that the

platforms will not be delivered and their contracts cancel with the consequent repayment of principal invested.