181

ANNUAL REPORT AND CONSOLIDATED ACCOUNTS 2013

There are no significant differences between the bal-

ance sheet amounts and fair value of current and

non-current loans.

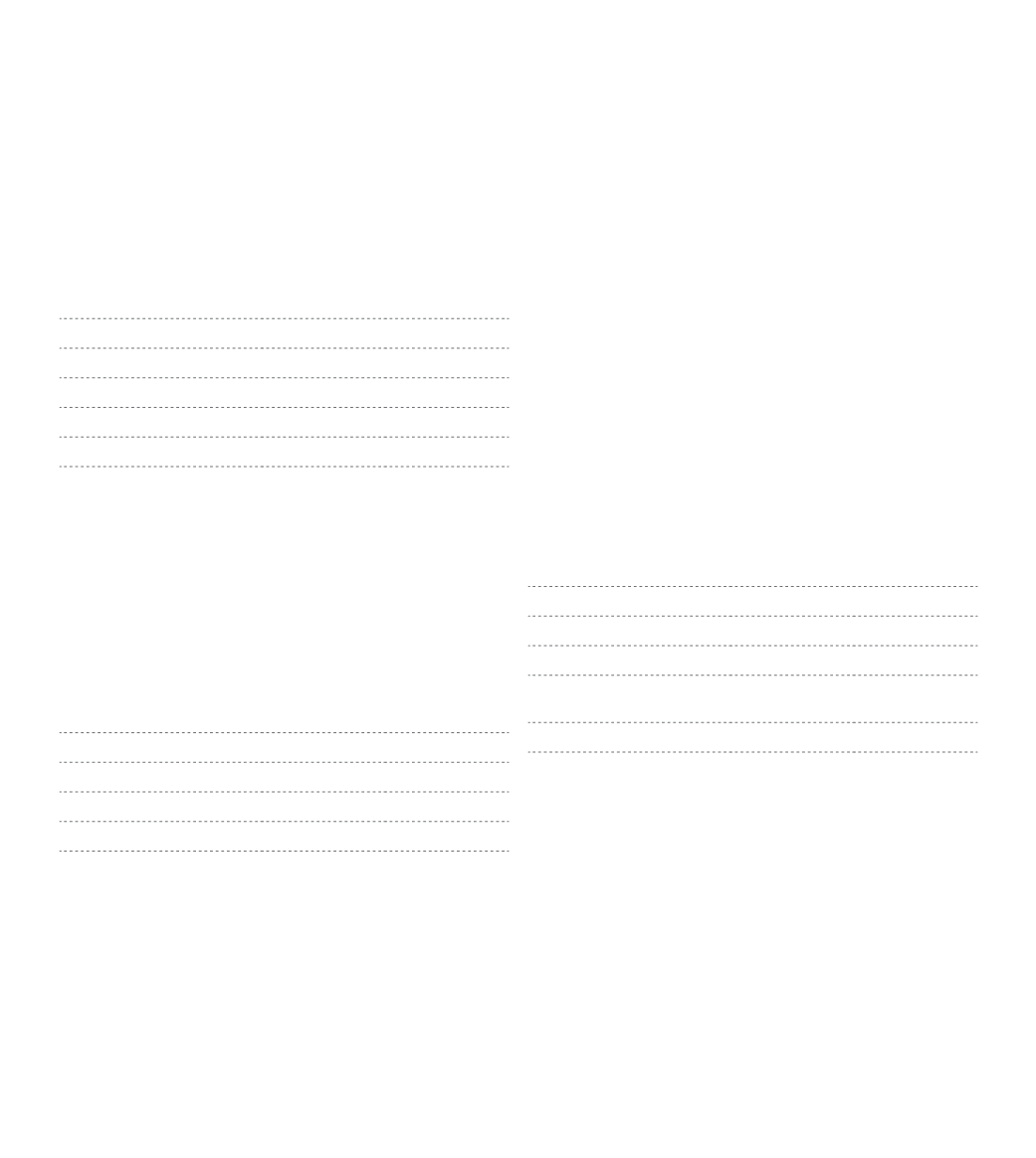

The maturities of non-current bank loans are broken

down as follows:

Dec-13

Dec-12

From 1 to 2 years

9,193,824 17,084,428

From 2 to 5 years

13,664,193 19,792,653

> 5 years

559,804

44,453

23,417,821 36,921,533

Regardless of its ending stated period, for the sub-

scribed commercial paper programmes the Group con-

siders the full repayment on its maturity date (the re-

newal date).

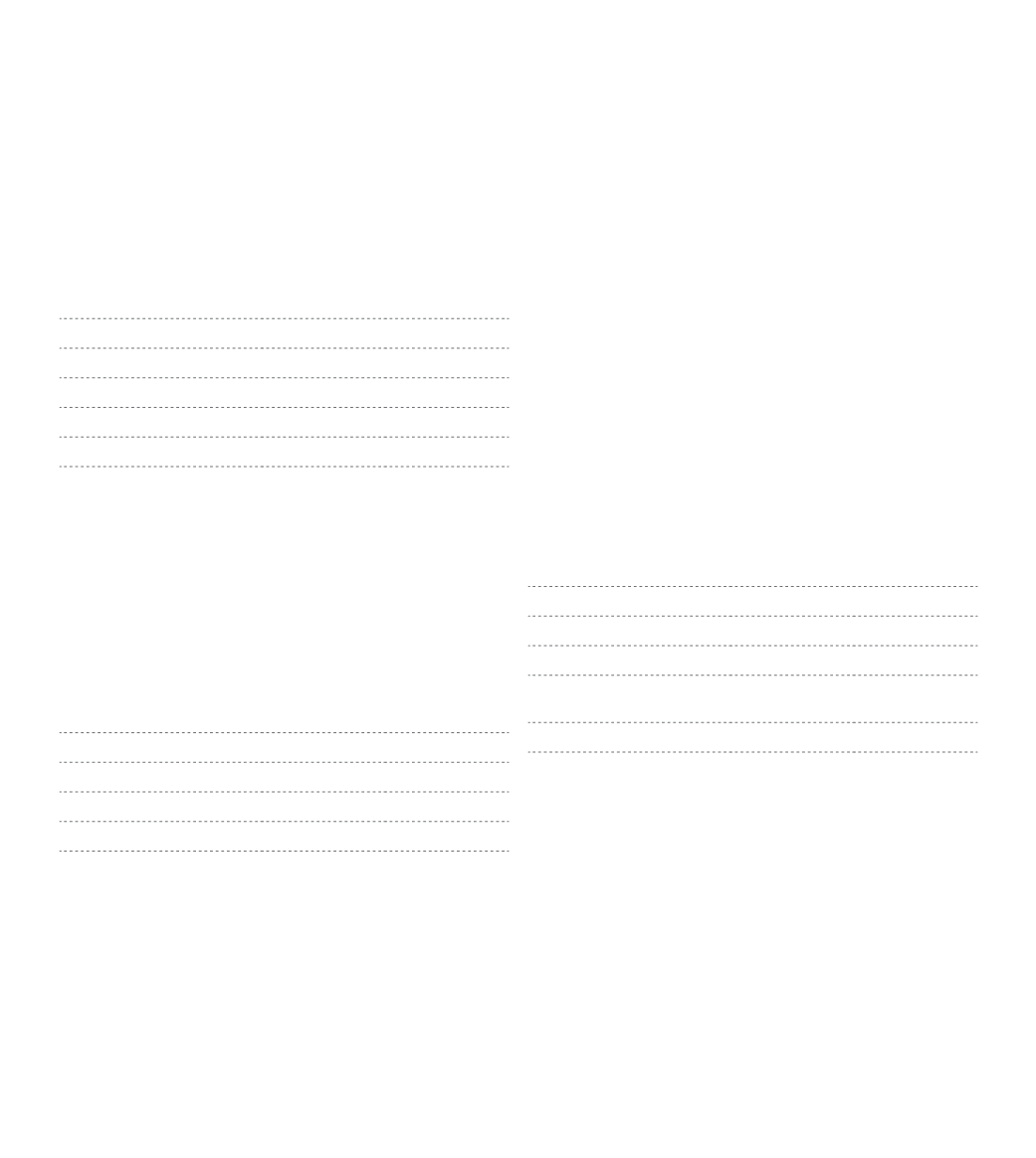

Using the functional currency in which they were sub-

scribed, total loans on 31st December 2013 and 2012

were as follows:

Dec-13

Dec-12

EUR

40,872,340 50,963,668

USD

3,750,000 1,875,000

AOA

295,208,333 170,000,000

At the end of the year the Group had 16,6 million euros

of unissued commercial paper programmes and availa-

ble but not disposable credit lines.

In 2012, subsidiary Asurebi subscribed a derivative fi-

nancial instrument for cash-flows hedging with an inte-

rest rate Swap, as follows:

– initial date: June, 15 2012;

– expiration date: January, 15 2017;

– fixed interest rate: 0,78%;

– variable interest rate: Euribor 1M;

– total amount: 20 million euros, reduces

with debt repayment plan.

As the derivative financial instrument was not registe-

red under hedge accounting, its changes in fair value

are reflected in the income of the year (140.040 euros).

The liabilities from financial leasing may be broken

down as follows:

Dec-13

Dec-12

Capital em dívida:

Up to 1 year

61,483

216,205

Over 1 year and

until 5 years

-

61,514

61,483

277,719