173

ANNUAL REPORT AND CONSOLIDATED ACCOUNTS 2013

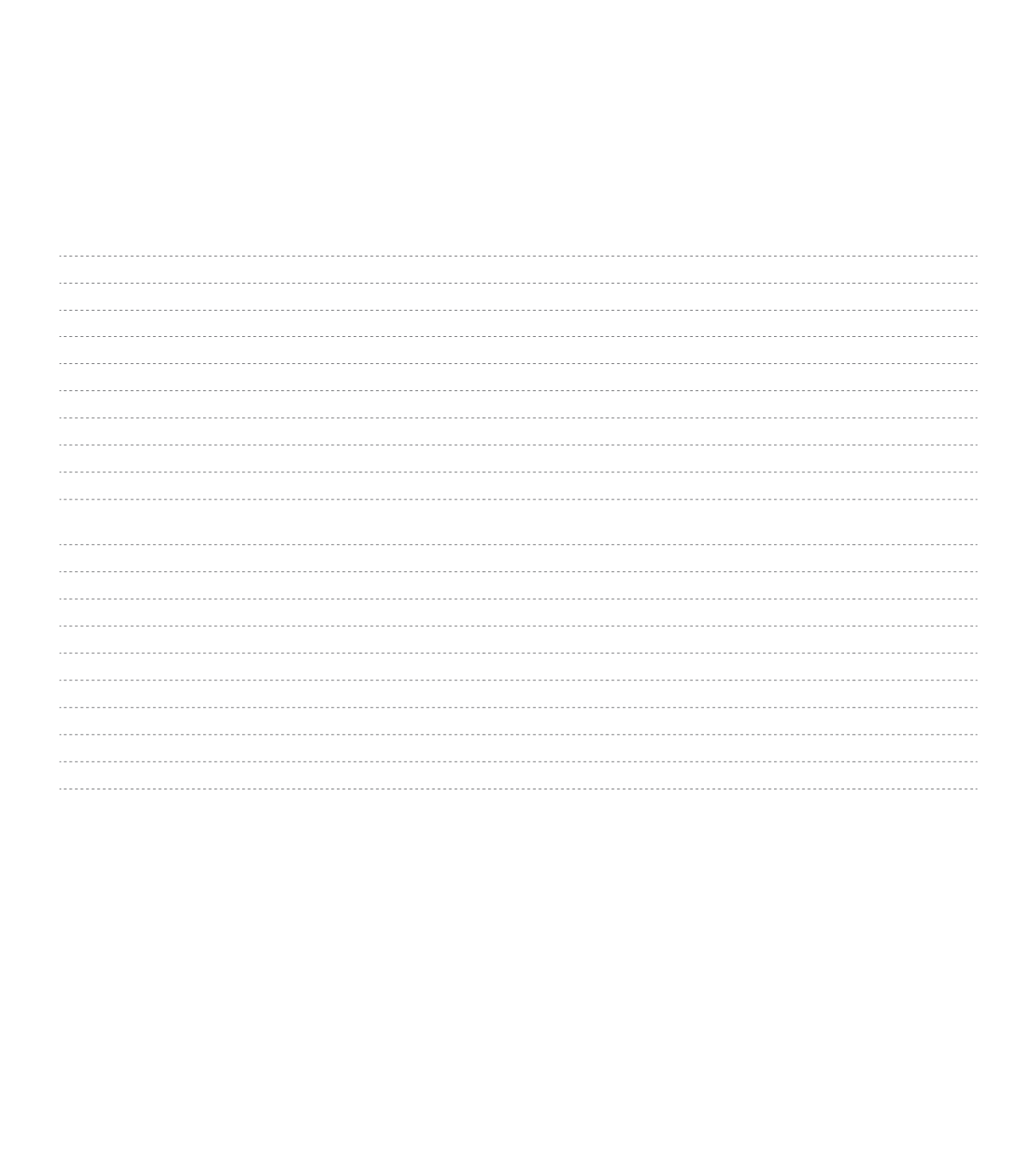

Goodwill

Industrial

property

Other

intangible

Assets

Intangible

Assets in

progress

(1)

Total

31 December 2013

Initial net amount

42,498,262 13,248,378

838,545 2,445,801 59,030,987

Changes in consolidat. Perimeter

-

-

-

-

-

Currency conversion

-

-47,390

-114

-14,151

-61,655

Additions

179,729

818,821

19,952

5.900 1,024,402

Decreases

-

96,679

11,896

-

108,575

Transfers

-

1,438

-

-

1,438

Amortization in the year

-

1,111,648

544,676

-

1,656,324

Amortiz. by changes

in the perimeter

-

-

-

-

-

Impairment in the year

-

242,747

-

-

242,747

Impairment reversion

-

-

-

-

-

Final net amount

42,677,991 12,570,173

301,811 2,437,550 57,987,526

31 December 2013

Cost

44,539,669 21.425.978 5.386.885 2.437.550 73.790.082

Accumulated amortization

-

7.645.408 5.014.964

-

12.660.372

Accumulated impairment

1,861,678 1.210.397

70.110

-

3.142.185

Net amount

42,677,991 12.570.173

301.811 2.437.550 57.987.526

(1) intangible assets in progress balance refers mainly to the 3 new concessions yet to be open, in service areas of the following motorways:

Guimarães, Fafe and Paredes. These service areas are still in the design stage and waiting for platforms delivery. It is expected that the

platforms will not be delivered and their contracts cancel with the consequent repayment of principal invested.

With the same assumptions of the sensitivity analysis set out in the previous note (Note 8) it was concluded the

absence of additional impairment charges for intangible assets.