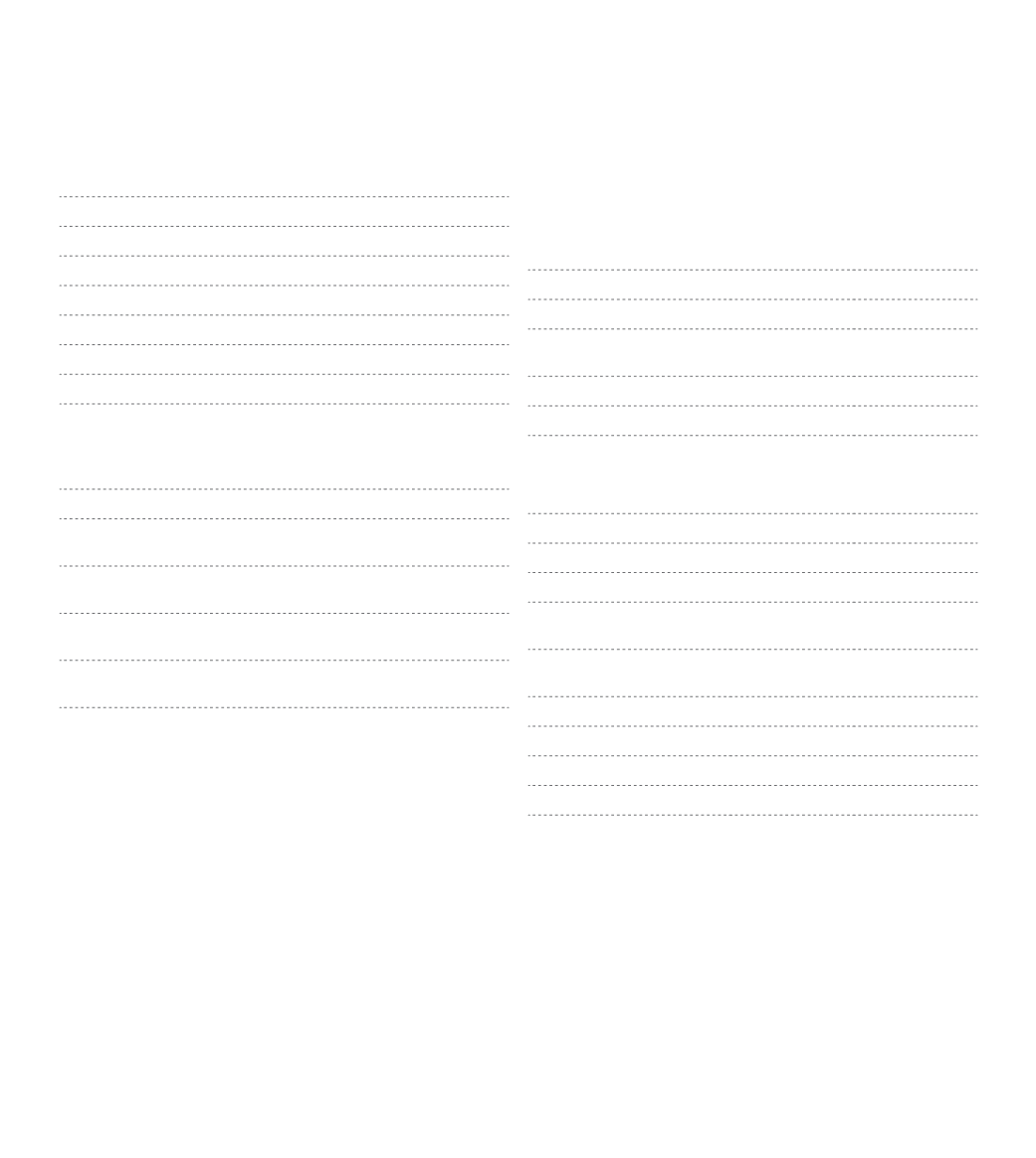

180

CONSOLIDATED FINANCIAL STATEMENTS

Dec-13

Dec-12

Operating income

13,587,424 14,760,085

Operating costs

-13,201,317 -13,635,442

Net financing cost

393,684

382,223

Pre-tax income

779,791 1,506,866

Income tax

-155,242

-361,138

Net profit

624,550 1,145,728

Dec-13

Dec-12

Flows from operating

activities

607,069 2,827,184

Flows from investment

activities

28,091

376,139

Flows from financing

activities

-9,712,366

-307,468

Change in cash &

cash equivalents

-9,077,206 2,895,855

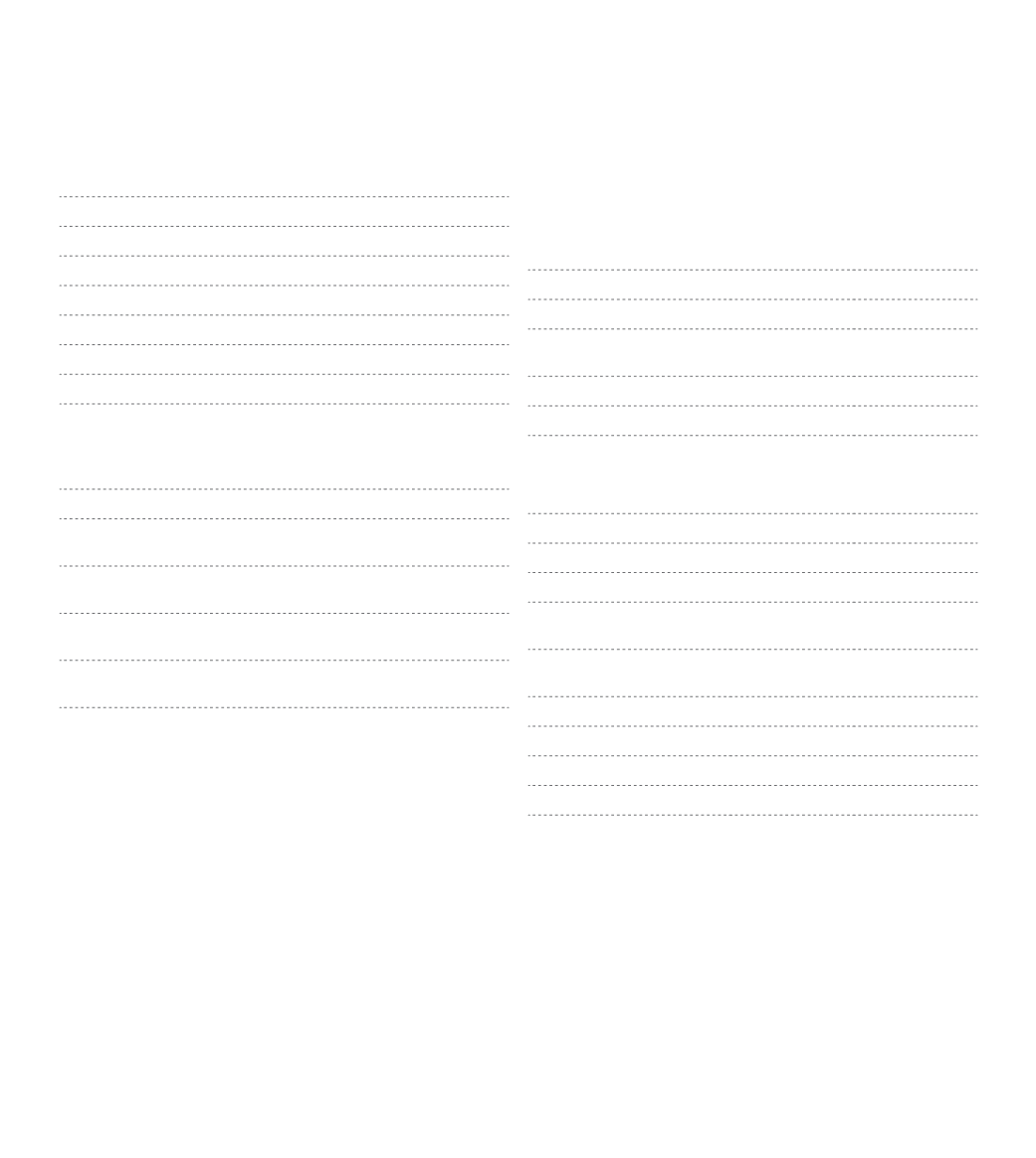

16. LOANS

On 31 December 2013 and 2012, current and non-cur-

rent loans were broken down as follows:

Non-current

Dec-13

Dec-12

Bank loans

6,417,821 12,921,531

Commercial paper

programmes

17,000,000 24,000,000

Financial leasing

-

61,514

23,417,821 36,983,045

Current

Dec-13

Dec-12

Bank overdrafts

833,014

834,765

Bank loans

15,223,159 8,526,365

Commercial paper

programmes

7,000,000 8,000,000

Derivative financial

instrument

138,195

278,234

Financial Leasing

61,483

216,205

23,255,851 17,855,569

Total loans

46,673,672 54,838,614

Average interest rate

5.0%

4.7%