CONSOLIDATED FINANCIAL STATEMENTS

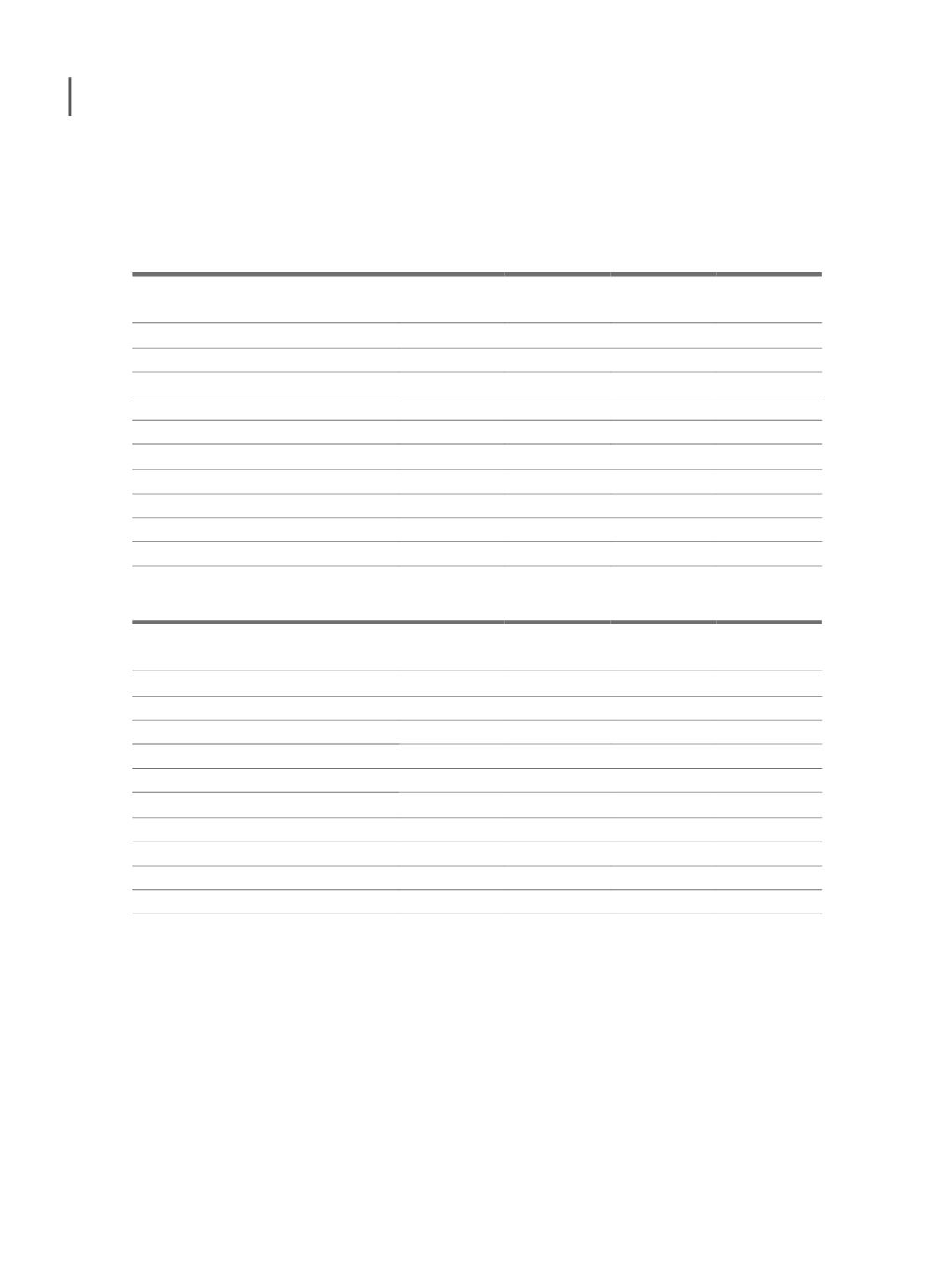

In December 31st, 2016 and 2015 currency exchange risk was as follows:

Year 2016

Kwanzas Equivalent

EUR

USD Equivalent

EUR

Financial Assets

Cash and Bank deposits

1.301.850.100

7.057.329

6.128

5.705

Treasury bonds

3.224.560.292

17.480.341

-

-

Others

70.347.511

381.354

989

920

4.596.757.903 24.919.025

7.117

6.625

Financial Liabilites

Loans

2.931.708.332

15.892.791

1.500.000

1.396.422

Suppliers

206.301.398

1.118.360

3.568.393

3.321.990

Others

5.054.977

27.403

106.613

99.251

3.143.064.707 17.038.554

5.175.006

4.817.663

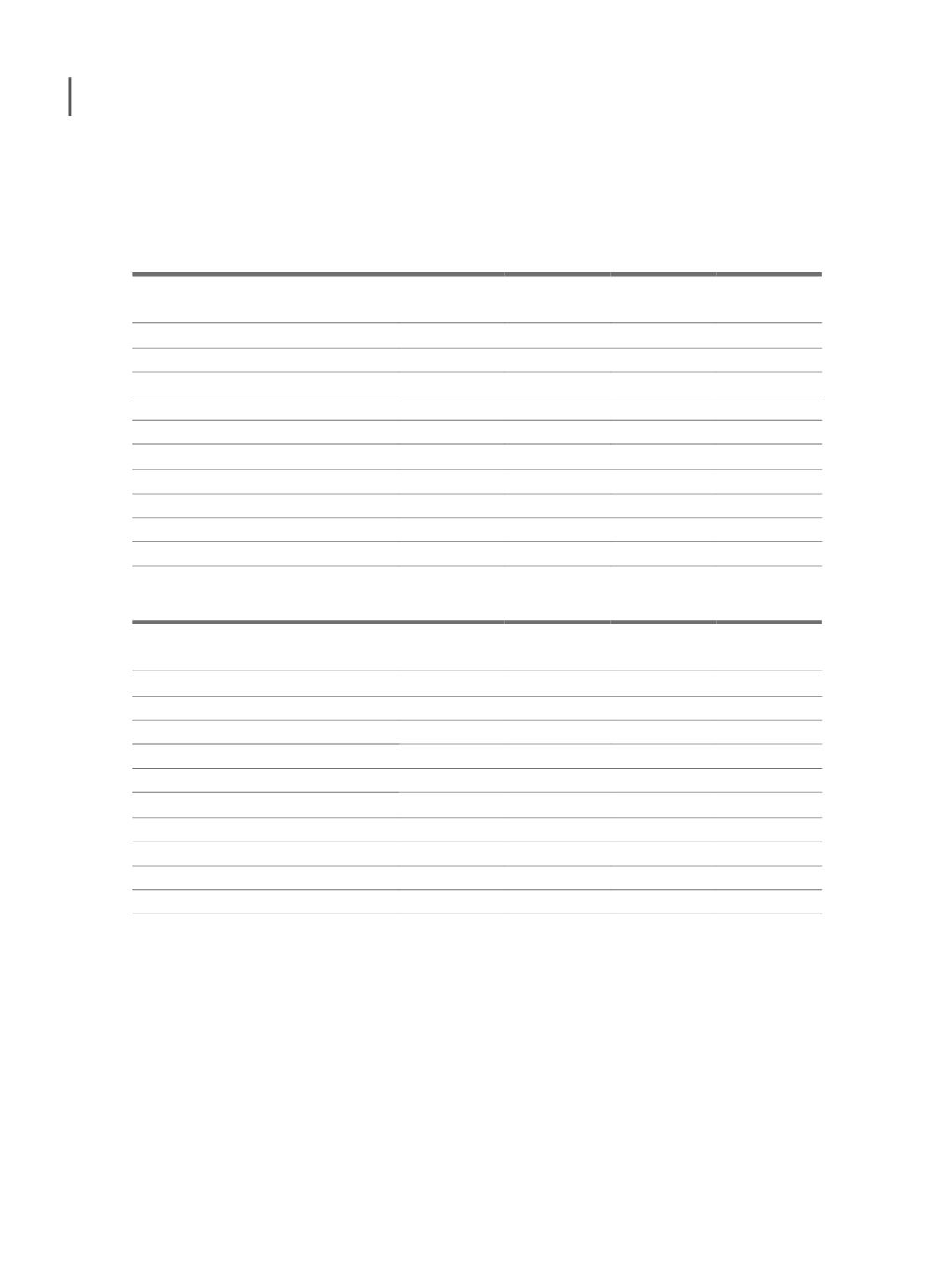

Year 2015

Kwanzas Equivalent

EUR

USD Equivalent

EUR

Financial Assets

Cash and Bank deposits

203.488.292

1.376.395

6.754

6.212

Treasury bonds

1.049.502.607

7.098.836

-

-

Others

36.965.132

250.032

400

368

1.289.956.031

8.725.263

7.154

6.580

Financial Liabilites

Loans

1.747.708.332

11.821.499

2.000.000

1.839.646

Suppliers

431.519.912

2.918.801

2.019.561

1.857.638

Others

33.405.550

225.955

109.006

100.266

2.212.633.793 14.966.255

4.128.567

3.797.550

Additionally in Angolan subsidiaries we have debts to suppliers in EUR that, after conversion,

generate exchange differences in the consolidated financial statements (net financing costs),

although mostly are debts with Group companies. Furthermore, the same subsidiaries hold

financial assets indexed to USD, a value equivalent to about 96% of liabilities in foreign cur-

rency.

Based on simulations performed on December 31, 2015, a decrease from 10% to 15% in AOA,

concerning EUR and USD currency, keeping everything else constant, would have a negative

impact of 79 thousand euros and 119 thousand euros, respectively, on the consolidated finan-

cial statements (net financing cost) of the Group.

222