CONSOLIDATED FINANCIAL STATEMENTS

Deposits and other financial investments are spread over several credit institutions; therefore

there is not a concentration of these financial assets.

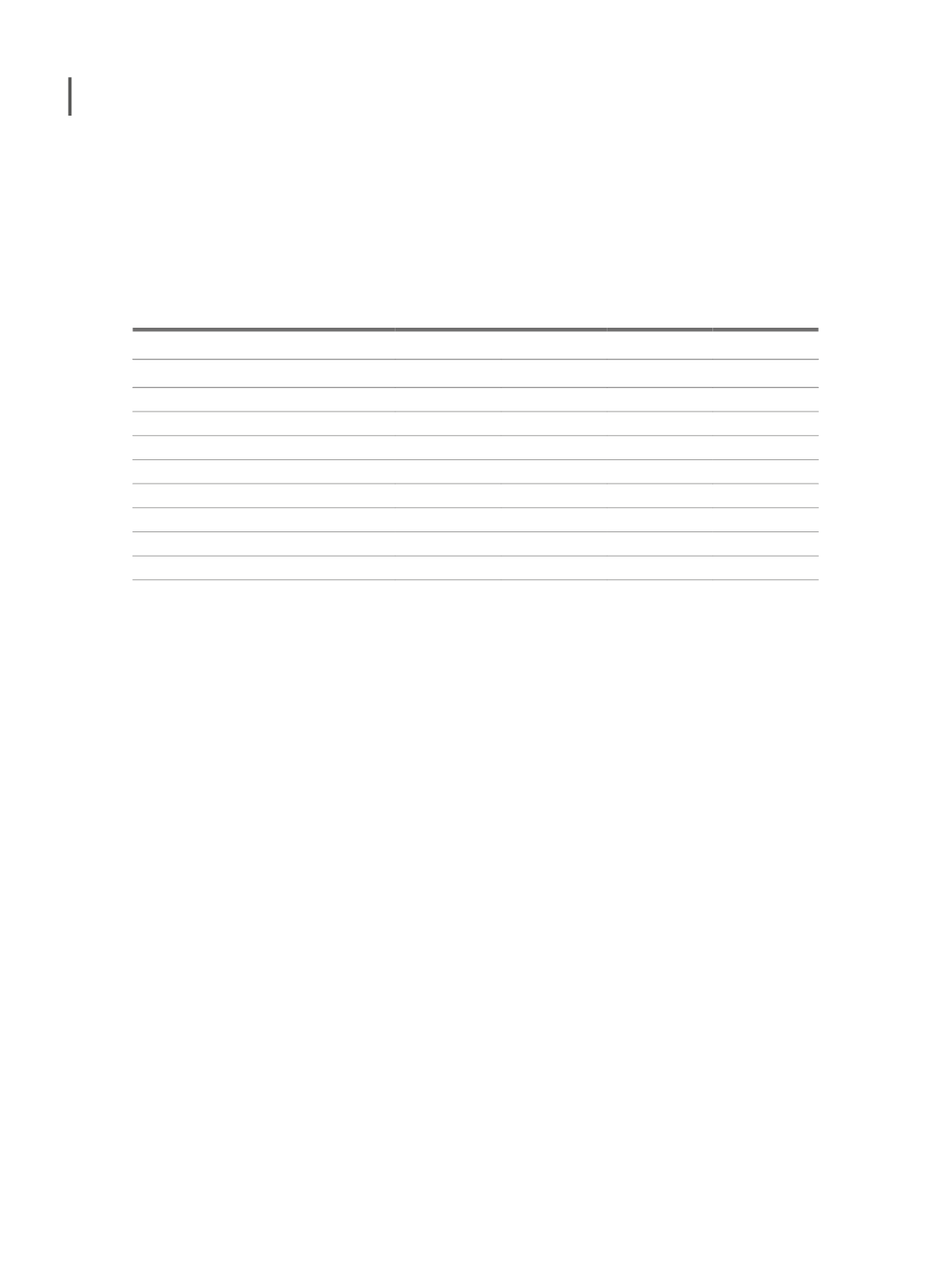

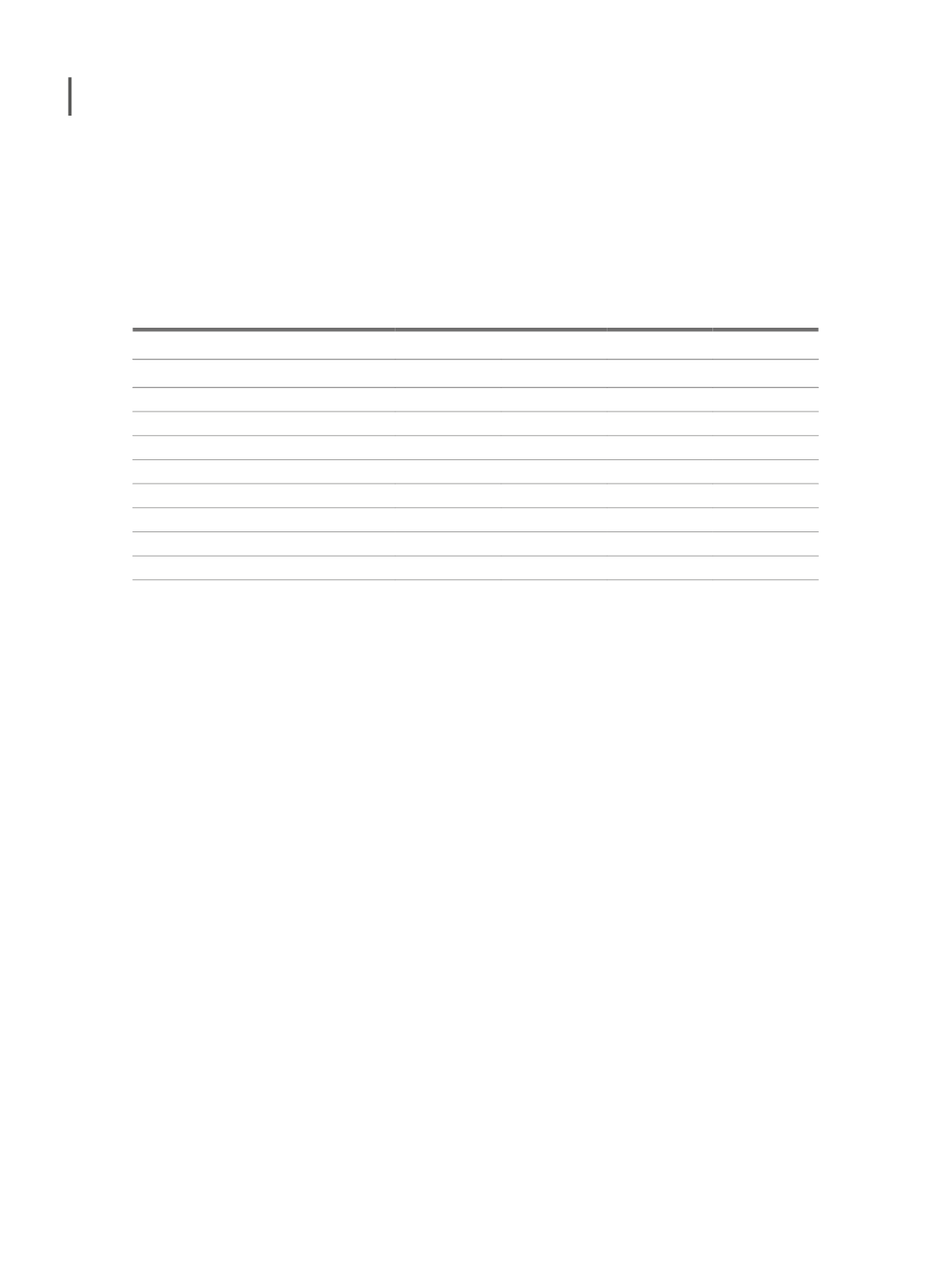

The ratings of the major credit institutions where Ibersol Group has its deposits on December

31, 2016 and 2015 are presented as follows:

Year 2016

Year 2015

Agency

Deposits Rating

Deposits Rating

Standard & Poor´s

243,424 A-

Standard & Poor´s

6,026,676 BBB+

536,022 BBB+

Standard & Poor´s

10,979,707 BB+

621,658 BB+

Standard & Poor´s

756,940 B

6,192,649 B+

Standard & Poor´s

3,909,284 BB-

Moody's

932,315 Caa1

809,708 Caa1

Moody's

3,880,101 Baa2

Moody's

1,968,656 Baa3

Unavailable (Angola)

8,334,192 n/a

3,115,250 n/a

Deposits in Angola are distributed by three of the largest commercial banks in Angola - BFA,

BCGA and BAI - that do not have a rating. In addition, part of the deposits of about 2.5 million

euros, are in the National Bank of Angola.

The quality of financial assets not due or impaired is detailed in Note 15.

c) Liquidity risk

Liquidity risk management implies maintaining a sufficient amount of cash and bank

deposits, the feasibility of consolidating the floating debt through a suitable amount of

credit facilities and the capacity to liquidate market positions. Treasury needs are mana-

ged based on the annual plan that is reviewed every quarter and adjusted daily. Related

with the dynamics of the underlying business operations, the Group’s treasury strives to

maintain the floating debt flexible by maintaining credit lines available.

The Group considers that the short-term bank loans are due on the renewal date and that

the commercial paper programmes matured on the dates of denunciation.

At the end of the year, current liabilities reached 127 million euros, compared with 89

million euros in current assets. This disequilibrium is, on one hand, a financial characte-

ristic of this business and, on the other hand, due to the use of commercial paper pro-

grammes in which the Group considers the maturity date as the renewal date, regardless

of its initial stated periods. In order to ensure liquidity of the short term debt it is expec-

ted in the year 2017 the renewal of the commercial paper programmes (7.250.000 euros).

However, the expected operating cash flows and, if necessary, contracted credit lines, on

the amounts of which have not yet been used, are sufficient to settle current liabilities.

224