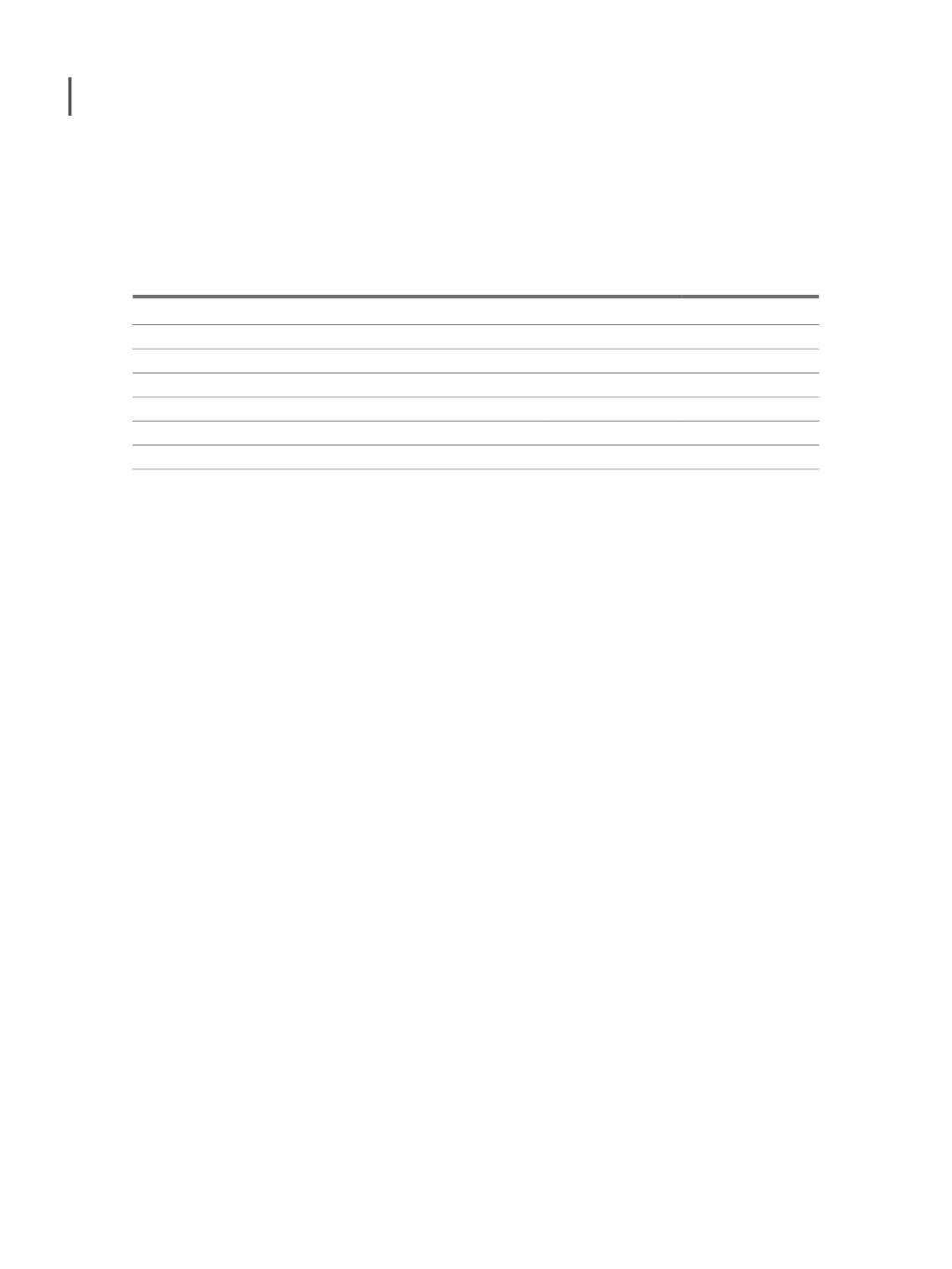

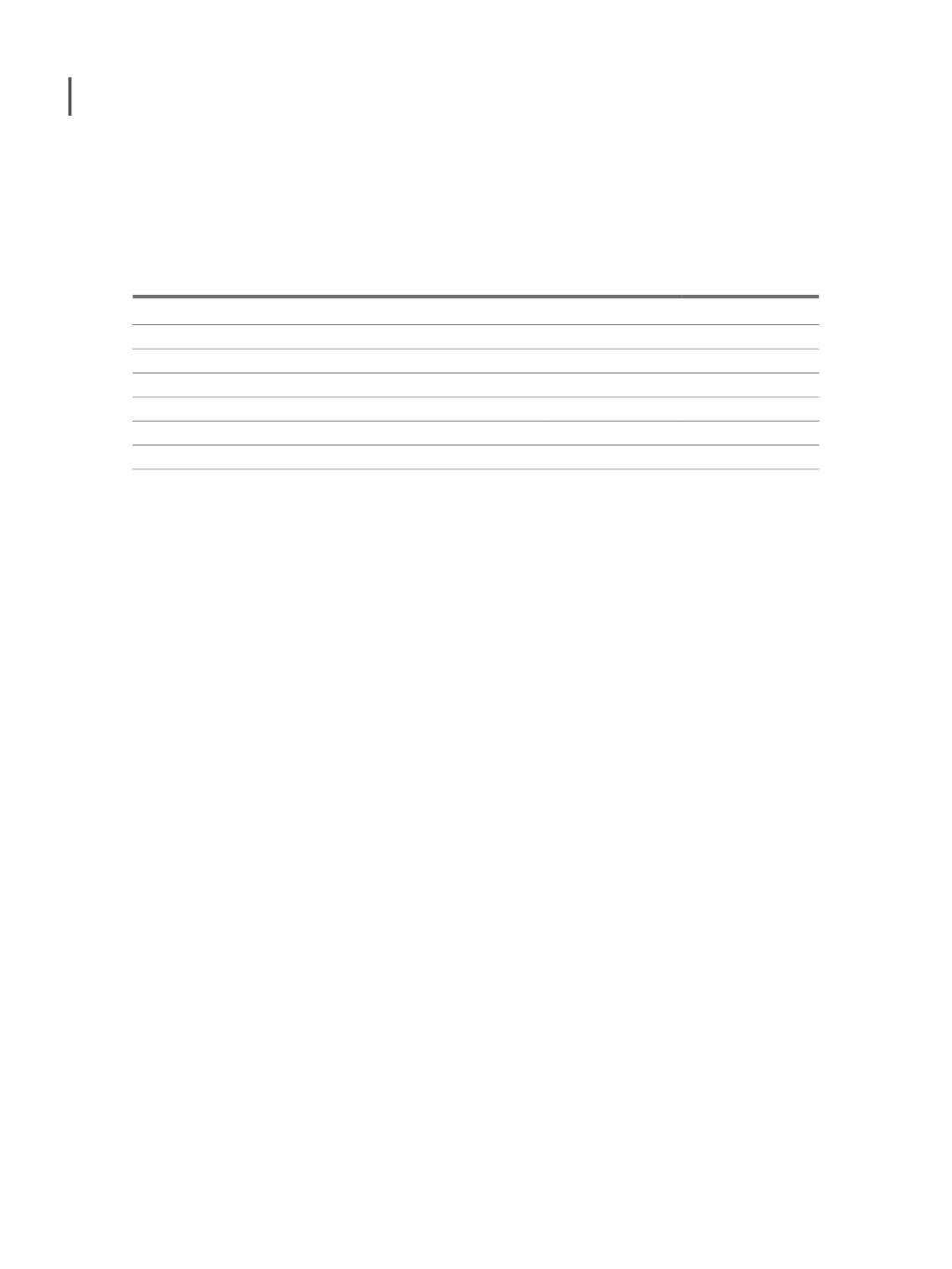

CONSOLIDATED FINANCIAL STATEMENTS

On December 31st 2016 and 2015 the gearing ratio was of 42% and 14%, respectively, as

follows:

Dec. 2016

Dec. 2015

Bank loans

166,791,662

43,435,303

Other financial assets

-17,480,341

-7,098,836

Cash and bank deposits

-39,588,532

-14,471,082

Net indebtedness

109,722,788

21,865,385

Equity

152,061,828

135,046,003

Total capital

261,784,616

156,911,388

Gearing ratio

42%

14%

The increase in the gearing ratio results from the financial effort to purchase the Eat Out

Group (Note 5.2).

3.2 ESTIMATED FAIR VALUE

The fair value of financial instruments commercialised in active markets (such as publicly

negotiated derivatives, securities for negotiation and available for sale) is determined based

on the listed market prices on the consolidated statement of financial position date. The

market price used for the Group’s financial assets is the price received by the shareholders

in the current market. The market price for financial liabilities is the price to be paid in the

current market.

The nominal value of accounts receivable (minus impairment adjustments) and accounts

payable is assumed to be as approximate to its fair value. The fair value of financial liabilities

is estimated by updating future cash flows contracted at the current market interest rate that

is available for similar financial instruments.

4. IMPORTANT ACCOUNTING ESTIMATES AND JUDGMENTS

Estimates and judgements are continuously evaluated and are based on past experience and

on other factors, including expectations regarding future events that are believed to be rea-

sonably probable within the respective circumstances.

The Group makes estimates and outlines premises about the future. Generally, accounting

based on estimates rarely corresponds to the real reported results. Estimates and premises

that present a significant risk of leading to a material adjustment in the accounting value of

the assets and liabilities in the following year are described below:

226