ANNUAL REPORT 2016

Even with reduced use of the Group has contracted a significant amount of short-term

lines. On December 31, 2016, the use of short term liquidity cash flow support was less

than 14%. Investments in term deposits and other application of 37.5 million euros,

match 22% of liabilities paid.

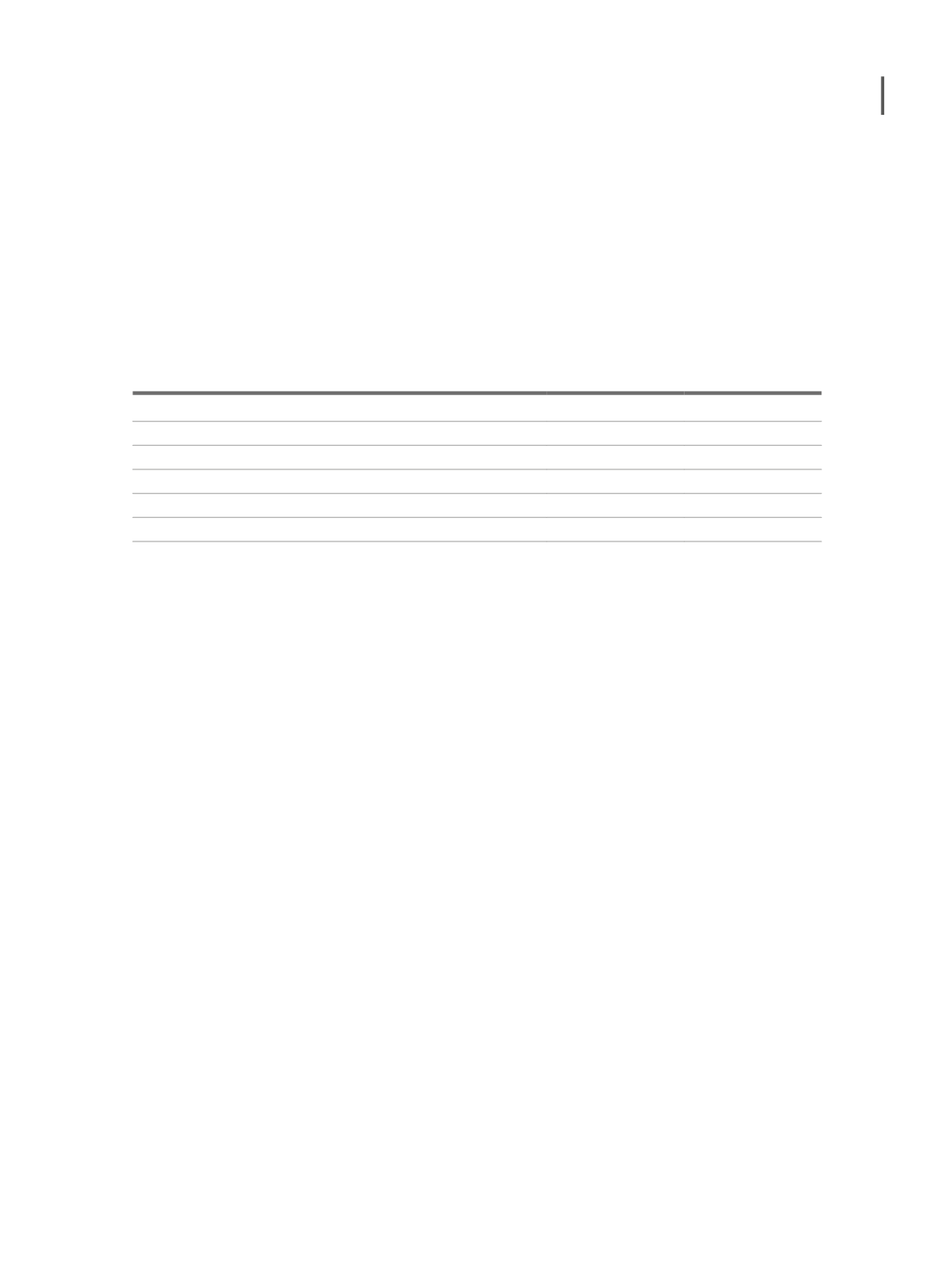

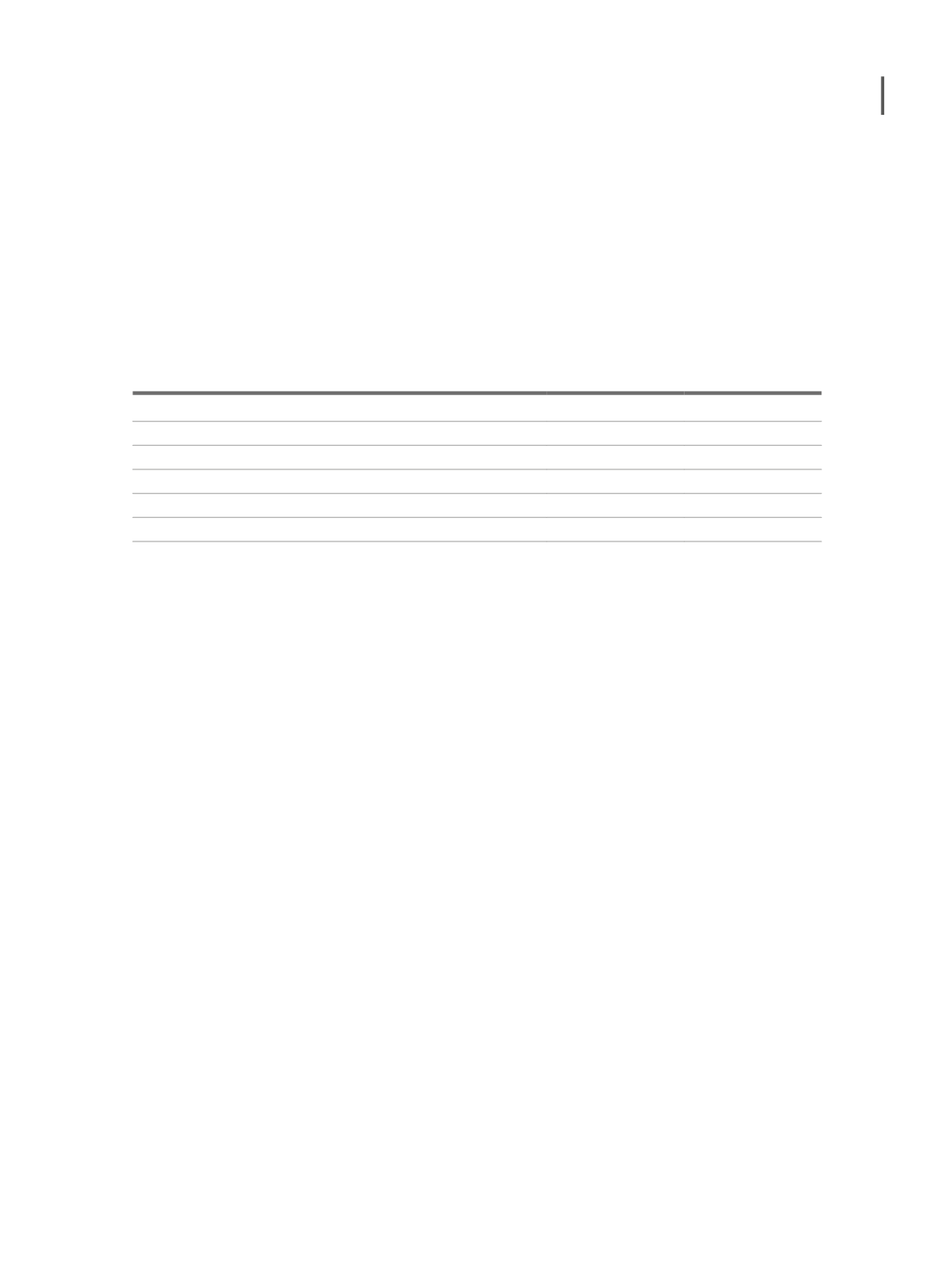

The following table shows the Group financial liabilities (relevant items), considering

contractual cash-flows:

to December

2017

from December

2017 to 2028

Bank loans and overdrafts

36,333,949

130,457,712

Other non-current liabilities

-

208,040

Accounts payable to suppliers and accrued costs

59,919,162

-

Other creditors

10,933,132

-

Accrued costs

4,691,240

8,060,785

Total

111,877,484

138,726,537

d) Capital risk

The company aims to maintain an equity level suitable to the characteristics of its main bu-

siness (cash sales and credit from suppliers) and to ensure continuity and expansion. The ca-

pital structure balance is monitored based on the gearing ratio (defined as: net remunerated

debt / net remunerated debt + equity) in order to place the ratio within a 35%-70% interval.

225