116

Corporate Governance Report

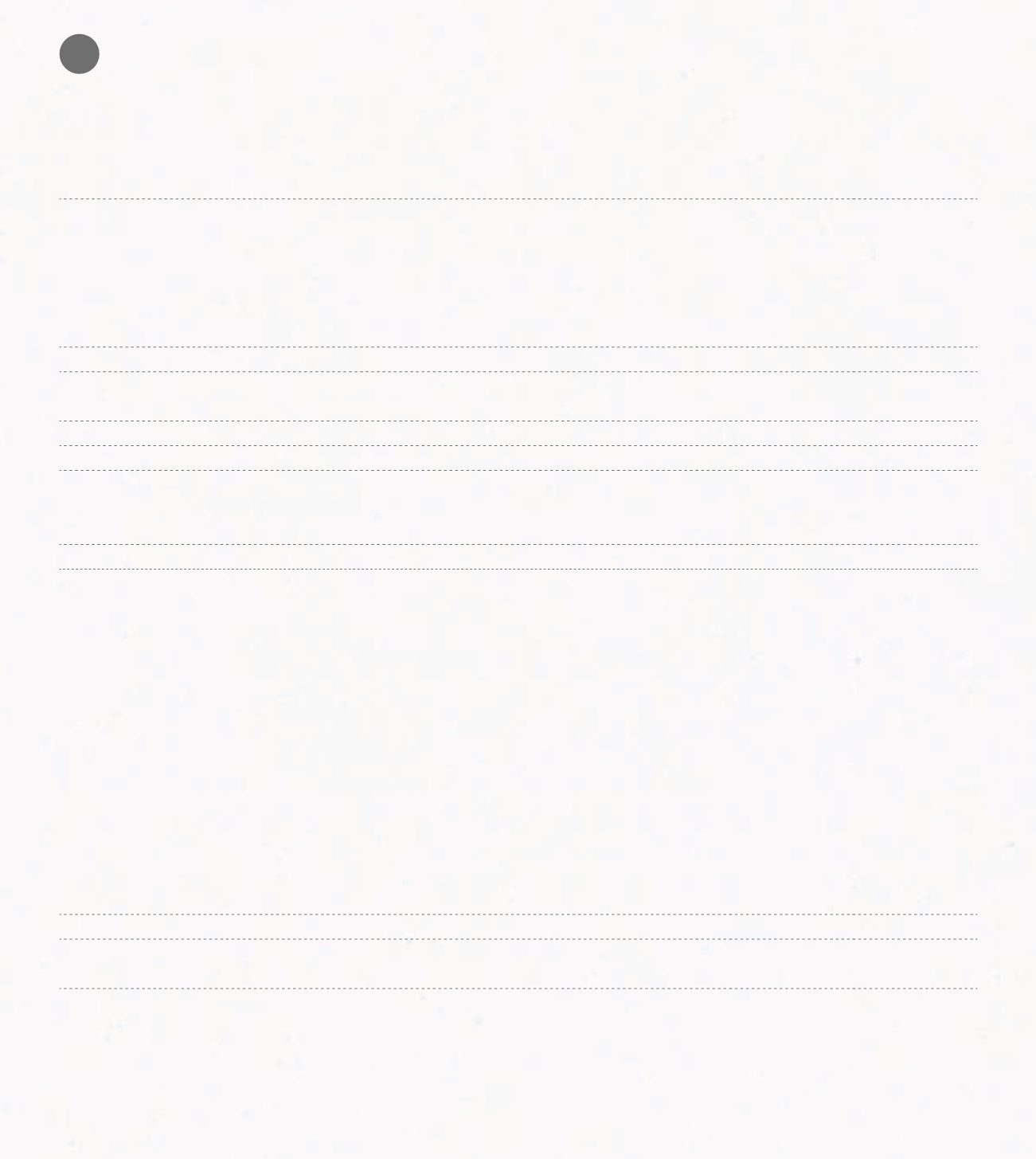

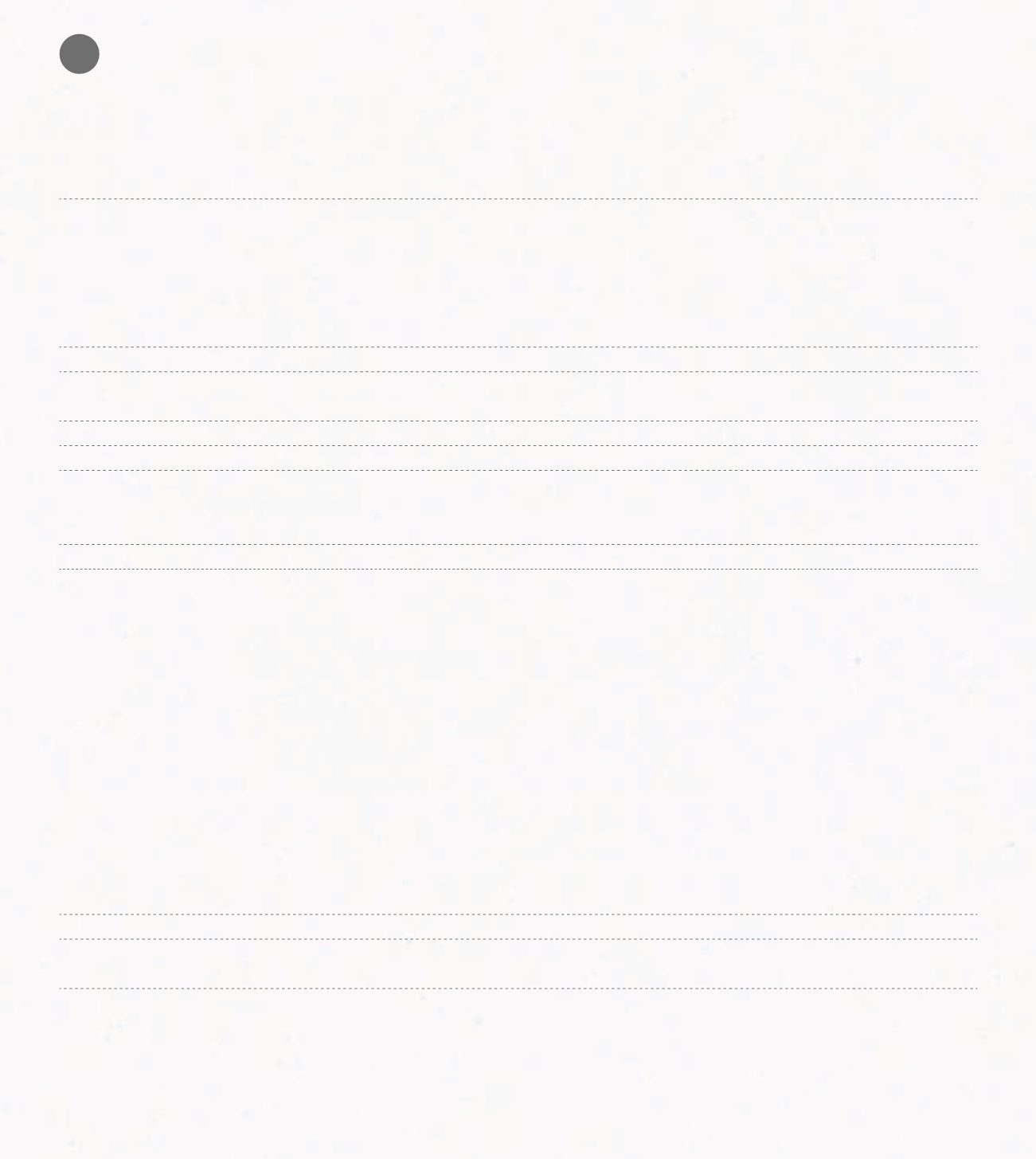

The qualified holdings as at 31/12/2012 are presented in the table below.

(*) ATPS II- SGPS, SA. is withheld in 50% by António Carlos Vaz Pinto de Sousa, and in 50% by António Alberto Guerra Leal Teixeira.

SHAREHOLDERS

nº Shares

% share

capital

ATPSII - SGPS, S.A. (*)

ATPS-SGPS, SA

786,432

3,93‰

I.E.S. - Indústria, Engenharia e Serviços, SGPS, S.A.

9,998,000

49,99‰

Regard - SGPS, SA

99,927

0,50%

António Alberto Guerra Leal Teixeira

1,400

0,01‰

António Carlos Vaz Pinto Sousa

1,400

0,01‰

Total attributable

10,887,159

54,44

‰

Banco BPI, S.A.

Fundo Pensões Banco BPI

400,000

2,00‰

Total attributable

400,000

2,00‰

Avelino da Mota Gaspar Francisco

401,000

2,01%

Santander Asset Management SGFIM, SA

Fundo Santander Acções Portugal

410,272

2,05%

Fundo Santander PPA

30,839

0,15%

Total attributable

441,111

2,21%

Bestinver Gestion

BESTINVER BOLSA, F.I.

927,021

4,64‰

BESTINFOND F.I.M.

899,032

4,50‰

BESTINER GLOBAL, F.P.

262,510

1,31‰

BESTVALUE F.I.

253,745

1,27‰

SOIXA SICAV

171,763

0,86‰

BESTINVER MISTO, F.I.M.

130,061

0,65‰

BESTINVER AHORRO, F.P.

137,598

0,69‰

BESTINVER SICAV-BESTINFUND

89,885

0,45‰

BESTINVER SICAV-IBERIAN

104,966

0,52‰

DIVALSA DE INVERSIONES SICAV, S.A.

5,771

0,03‰

BESTINVER EMPLEO, F.P.

6,414

0,03‰

LINKER INVERSIONES, SICAV, S.A.

4,571

0,02‰

BESTINVER EMPLEO II, F.P.

370

0,00‰

Total attributable

2,993,707

14,97‰

Norges Bank

Directly

764,825

3,82‰

FMR LLC

Fidelity Managemment & Research Company

400,000

2,00‰