168

Consolidated Financial Statements

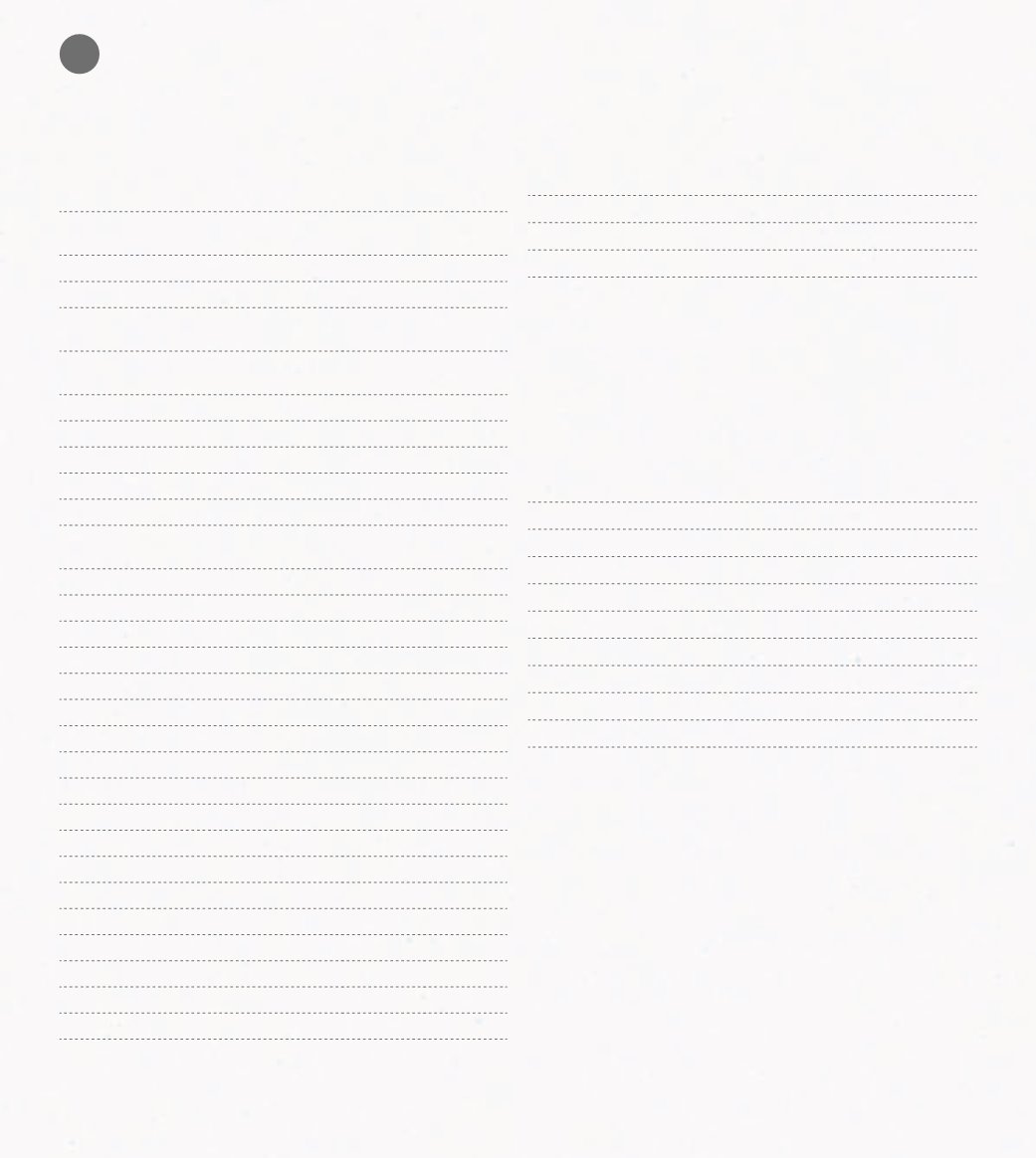

On 31 December 2012, the group’s concessions, territo-

rial rights and related lifetime are shown below:

Termina-

tion Date

Territorial Rights

N.º of

years

Pans & Company

10 2016

Burger King

20 2021

Termina-

tion Date

Concession Rights

N.º of

years

Lusoponte Service Areas

33 2032

Expo Marina

28 2026

Repsol Service Area - 2ª Circular

18 2017

Fogueteiro Service Area

16 2015

Portimão Marina

60 2061

A8 Torres Vedras (motorway)

Service Area

20 2021

Airport Service Area

20 2021

Pizza Hut Setúbal

14 2017

Pizza Hut Foz

10 2020

Pizza Hut and Pasta Caffé Cais Gaia

20 2024

A5 Oeiras (motorway) Service Area

12 2015

Modivas Service Area

28 2031

Barcelos Service Area

30 2036

Guimarães Service Area

30 2036

Fafe Service Area

30 2036

Alvão Service Area

30 2036

Lousada (Felgueiras) Service Area

24 2030

Vagos Service Area

24 2030

Aveiro Service Area

24 2030

Ovar Service Area

24 2030

Gulpilhares Service Area

24 2030

Talhada (Vouzela) Service Area

25 2031

Viseu Service Area

25 2031

Paredes Service Area

26 2032

Maia Service Area

26 2032

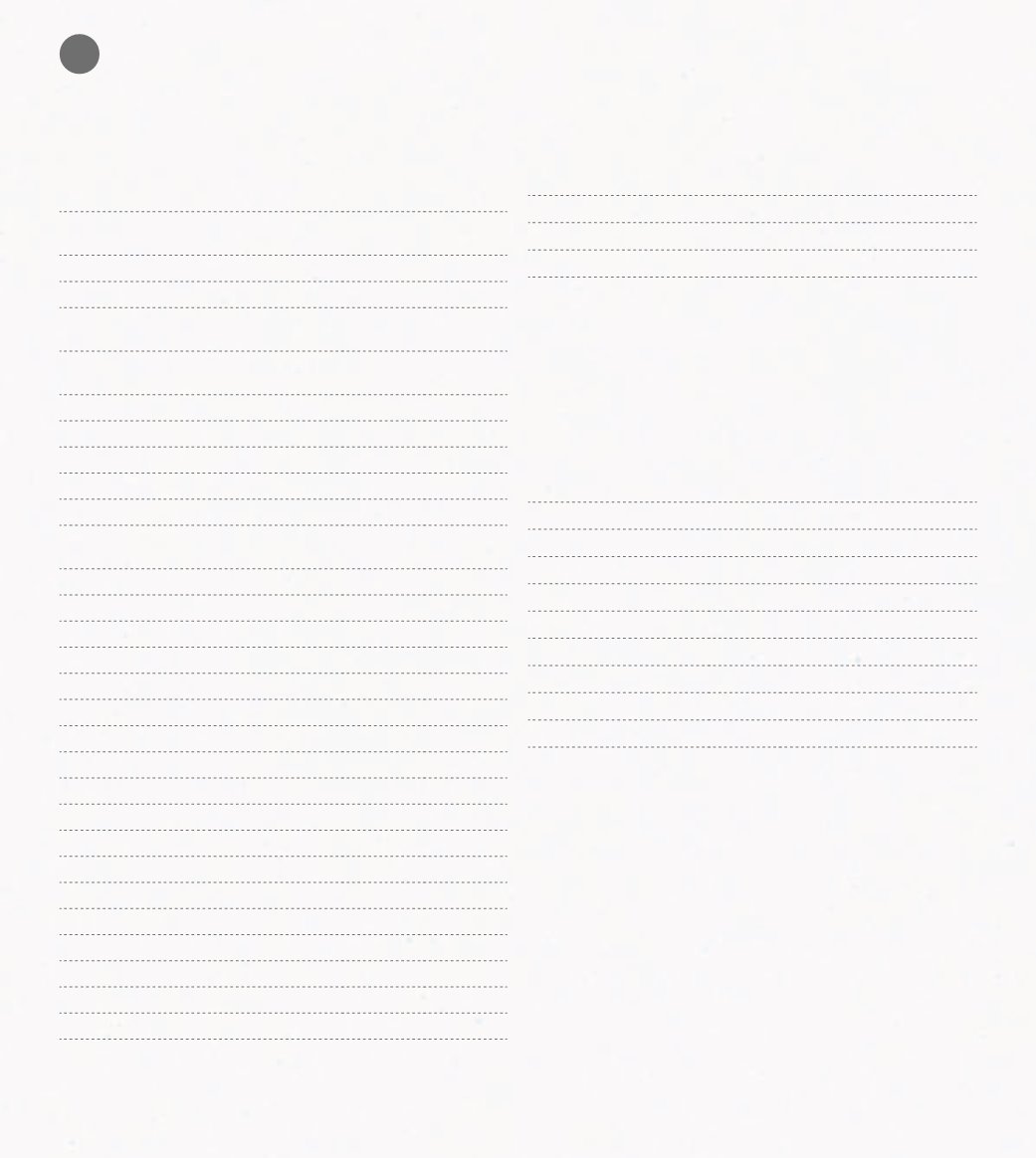

Goodwill is broken down into segments, as shown

bellow:

Dec-12

Dec-11

Portugal

9,464,021 10,000,021

Spain

32,903,527 32,903,527

Angola

130,714 130,714

42,498,262 43,034,262

Goodwill on the Spain segment refers mainly to the pur-

chase of the subsidiaries Lurca and Vidisco.

The main assumptions used in Impairment tests are de-

tailed as follow:

Perpetuity growth rate

Portugal

3.00% (1% real + 2% inflation)

Spain

3.00% (1% real + 2% inflation)

Perpetuity discount rate

Portugal

6.78%

Spain

6.15%

Discount period rate

Portugal

8.87%

Spain

7.25%

The presented pre-tax discount rate was calculated on

the bases of WACC (Weighted Average Cost of Capital)

methodology.

Based on the impairment tests performed, there was no

need to make adjustments in Goodwill.