176

Consolidated Financial Statements

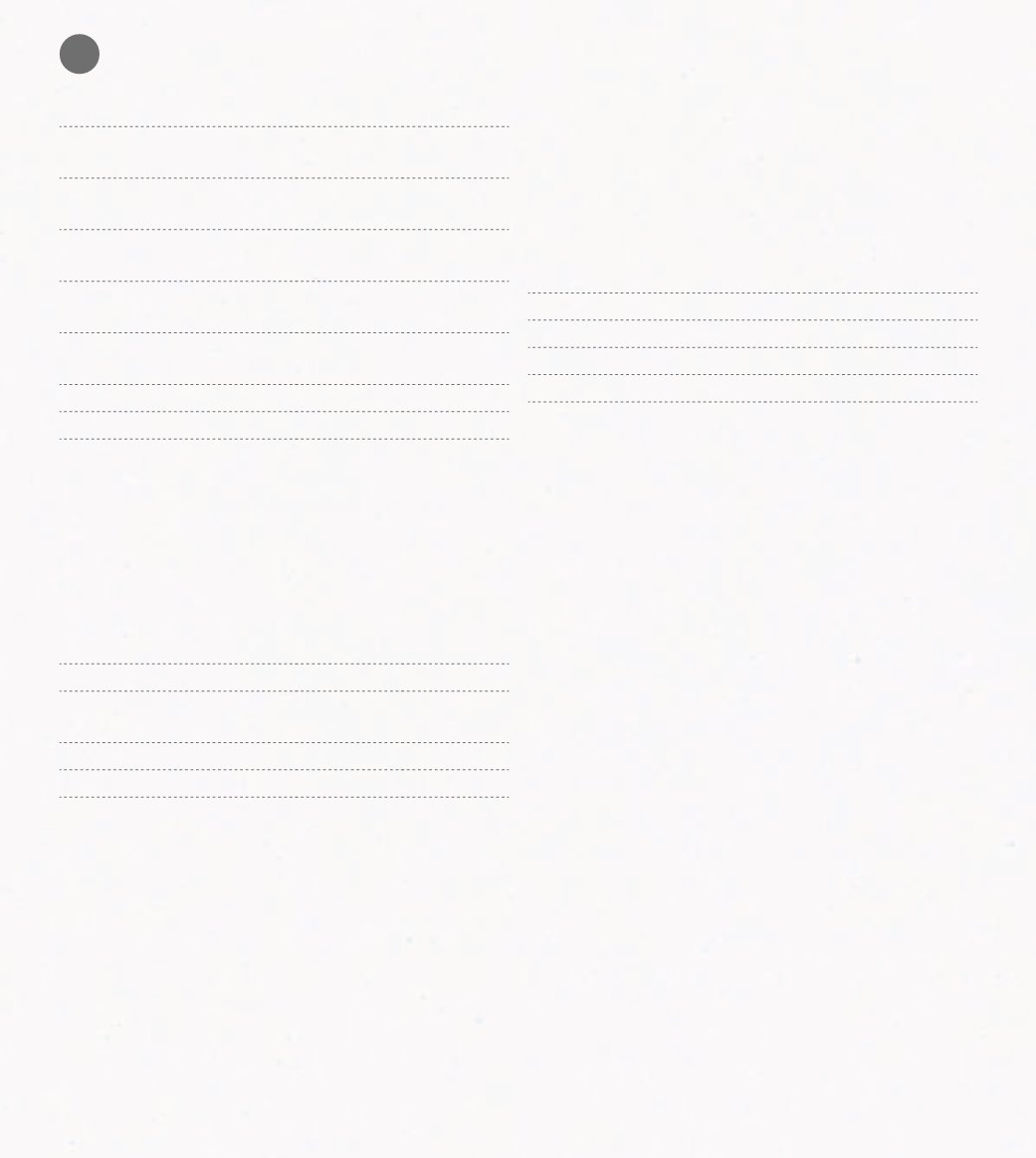

Dec-12 Dec-11

Accrued costs - Payable

insurance

8,596

12,467

Accrued costs - Payable

remunerations

4,533,941 4,800,833

Accrued costs -

Performance bonus

39,949 626,641

Accrued costs - Payable

interest

85,765

74,156

Accrued costs - External

services

1,977,179 944,886

Accrued costs - Other

1,980,918 1,486,509

Total acrrued costs 8,626,348 7,945,492

total accounts payable to

suppl.and accrued costs

30,609,428 29,712,622

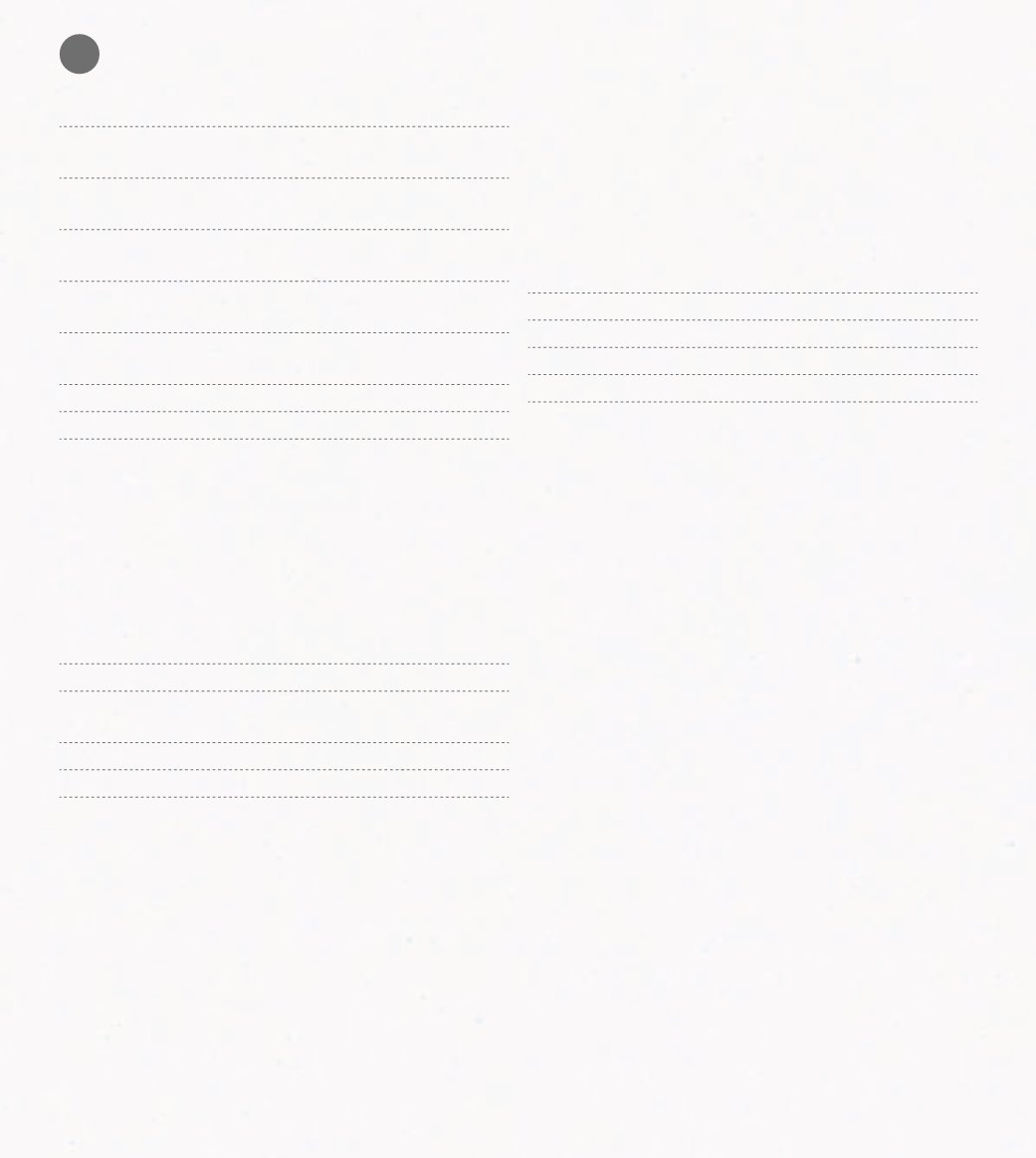

21. OTHER CURRENT LIABILITIES

On 31st December 2012 and 2011, the item “Other cur-

rent liabilities” may be broken down as follows:

Dec-12 Dec-11

Other creditors (1)

1,639,489 4,715,744

State and other public

entities (2)

5,838,198 3,886,559

Clients advance payments

7,690

-

Deferred income (3)

3,804,105 5,669,917

11,289,482 14,272,220

(1) unlike 2012, on 2011 wages of the month of Decem-

ber, were paid in early January, due to the change of

procedures in the payroll period (from the 26 of n-1

month to the 25 of n month changed to 01-30 of month

n), thereby fulfilling with all legal requirements of the

Social Security services.

(2) balance due mainly to payable VAT amounts

(2.982.700 euros), Income taxes (449.017 euros) and So-

cial Security (1.804.014 euros).

(3) the Deferred Income item includes the following

amounts:

Dec-12 Dec-11

Contracts with suppliers (1)

3,640,231 5,576,976

Franchising rights

114,235

27,645

Investment subvention

42,170

57,827

Other

7,469

7,469

3,804,105 5,669,917

(1) the value of contracts with suppliers corresponds to

revenue obtained from suppliers in 2012 and referring

to subsequent years.