171

ANNUAL REPORT AND CONSOLIDATED ACCOUNTS 2012

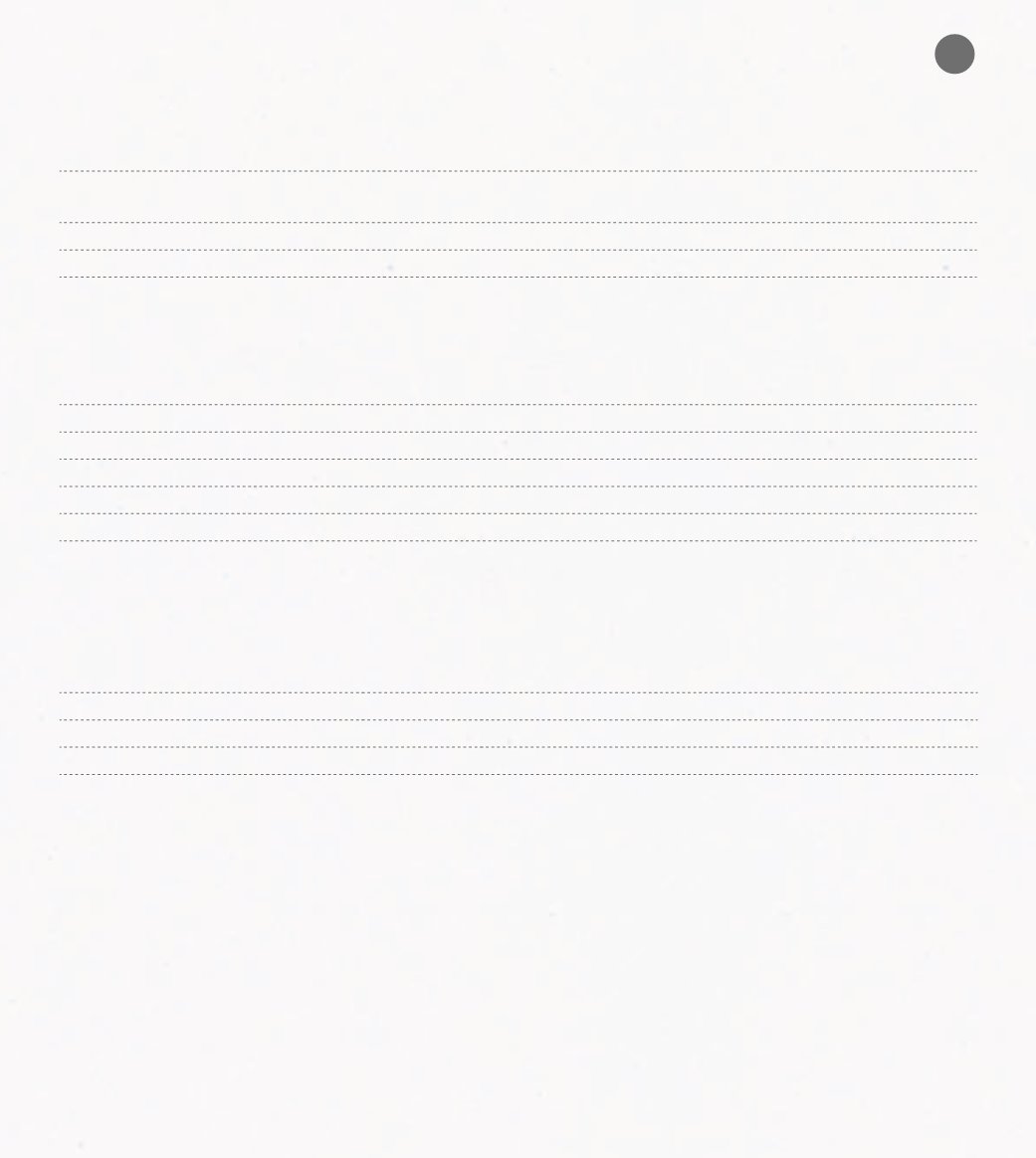

Financial assets impairment is broken down as follows:

Dec/12

Dec/11

With

Impairment

Without

Impairment

With

Impairment

Without

Impairment

Clients c/a

877,350

4,029,229

862,019

3,327,525

Other debtors

196,486

1,865,566

200,768

1,391,463

1,073,837

5,894,794

1,062,787

4,718,988

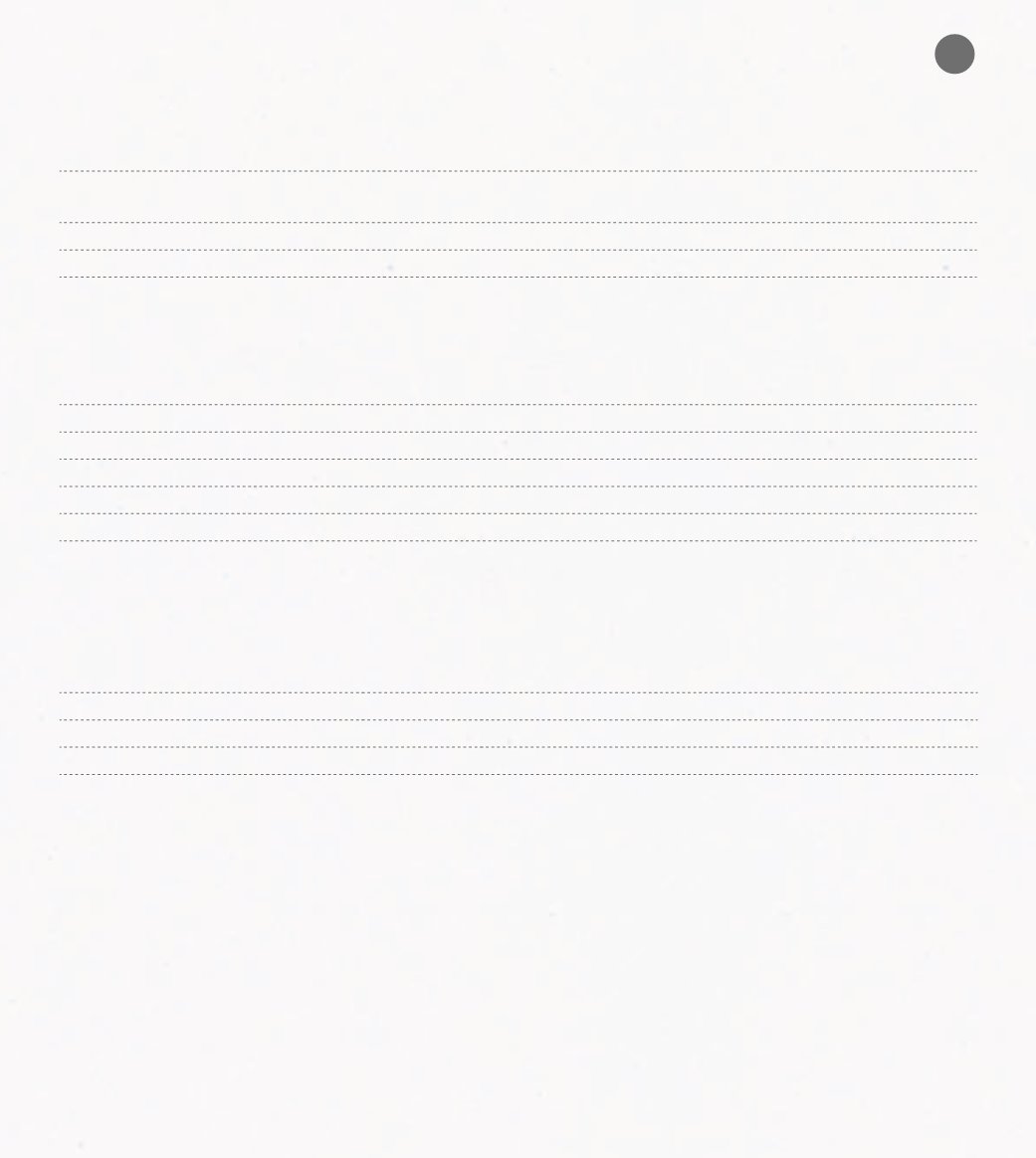

As for clients and other debts without impairment, the amounts are broken down as follows:

Dec-12

Dec-11

Debt not due

1,589,417

1,292,572

Debt due:

For less than 1 month

659,859

452,930

From one to three months

674,263

764,268

Over three months

2,971,256

2,209,218

5,894,794

4,718,988

Impairment losses in the year regarding other current assets are broken down as follows:

Starting

balance

Cancellation

Losses in

the Year

Impairment

reversion

Closing

balance

Clients c/ a

862,019

-

47,296

-31,964 877,350

Other debtors

200,768

-

-

-4,282 196,486

1,062,787

-

47,296

-36,246 1,073,837

15. SHARE CAPITAL

On 31

st

December 2012 and 2011, fully subscribed and paid up share capital was represented by 20.000.000 shares

to the bearer with a par value of 1 euro each.

In the years 2012 and 2011 the group did not acquired nor sold any own shares. This shares are subordinated

to the policy stipulated for own shares which specifies that the respective voting rights are suspended whilst the

shares are held by the group, although the group may sell these shares.