170

Consolidated Financial Statements

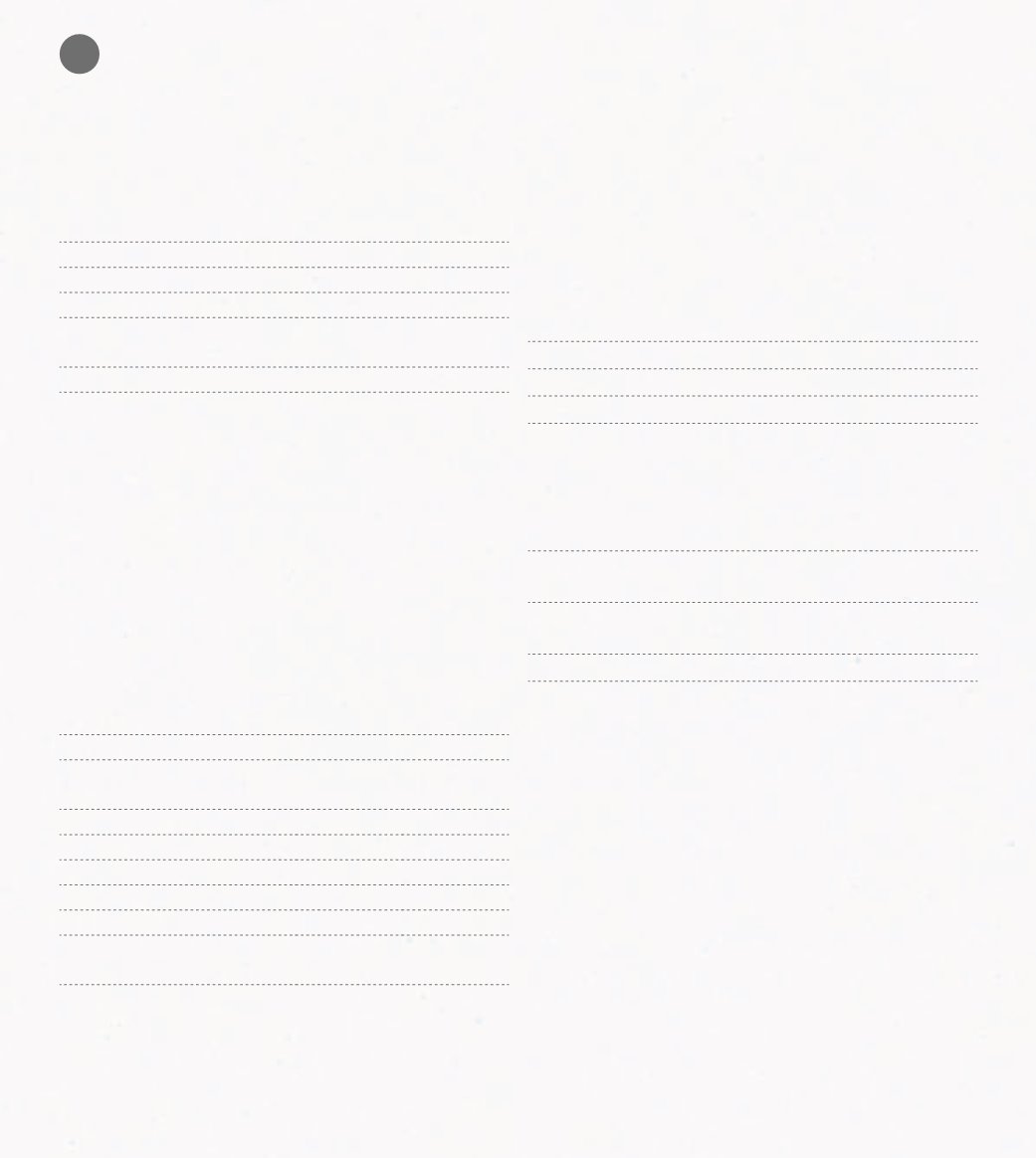

13. CASH AND CASH EQUIVALENTS

On 31

st

December 2012 and 2011, cash and cash equiva-

lents are broken as follows:

Dec-12 Dec-11

Cash

614,184 892,376

Bank deposits

17,583,881 28,197,787

Treasury applications

8,550,725 225,906

Cash and cash equivalents

in the balance sheet

26,748,790 29,316,069

Bank overdrafts

-834,765 -834,630

Cash and cash equivalents

in the cash flow statement

25,914,025 28,481,439

Bank overdrafts include the creditor balances of current

accounts with financial institutions, included in the con-

solidated statement of financial position in the “bank

loans” item.

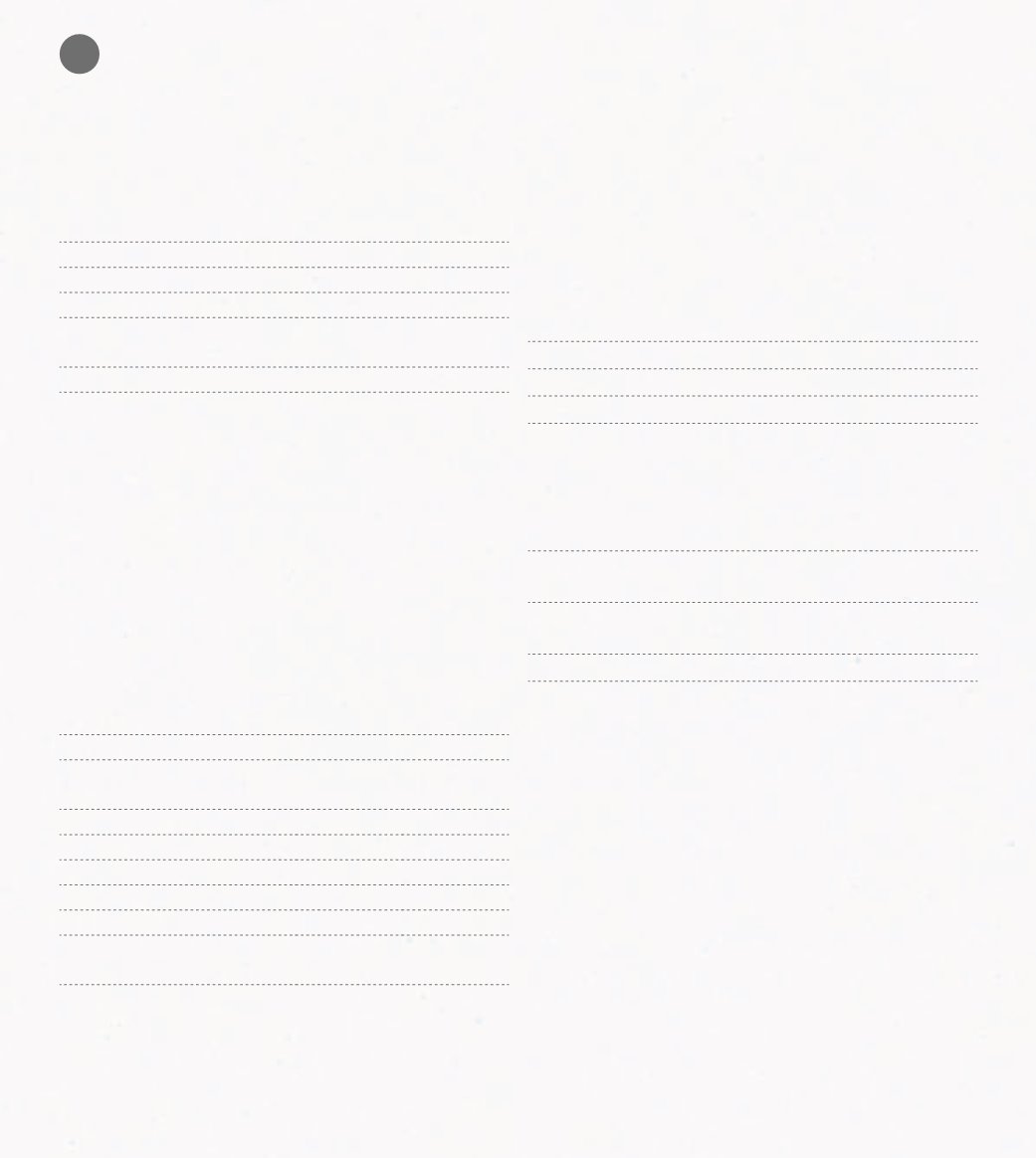

14. OTHER CURRENT ASSETS

Other current assets on 31

st

December 2012 and 2011

are broken down as follows:

Dec-12 Dec-11

Clients (1)

4,906,579 4,189,544

State and other public

entities (2)

1,810,669 871,210

Other debtors

2,062,052 1,592,231

Advances to suplliers

53,063

68,699

Accruals and income (3)

2,215,534 1,711,379

Deferred costs (4)

1,415,071 1,509,569

Other current assets

12,462,968 9,942,632

Accumulated impairment

losses

1,073,837 1,062,787

11,389,131 8,879,845

(1) Current balance arising essentially by the Catering

activity developed by Ibersol.

(2) Current balance of recoverable VAT amounts

(488.418 euros) and Income tax (1.322.237 euros).

(3) The other debtors item is broken down into the fol-

lowing items:

Dec-12 Dec-11

Interest

53,110

67,557

Suppliers contracts

1,664,858 1,417,572

Other

497,566 226,251

2,215,534 1,711,379

(4) Accruals and income are broken down as follows:

Dec-12 Dec-11

Rents and condominium

fees

902,074 993,322

External supplies and

services

177,457 196,524

Other

335,540 319,723

1,415,071 1,509,569