178

Consolidated Financial Statements

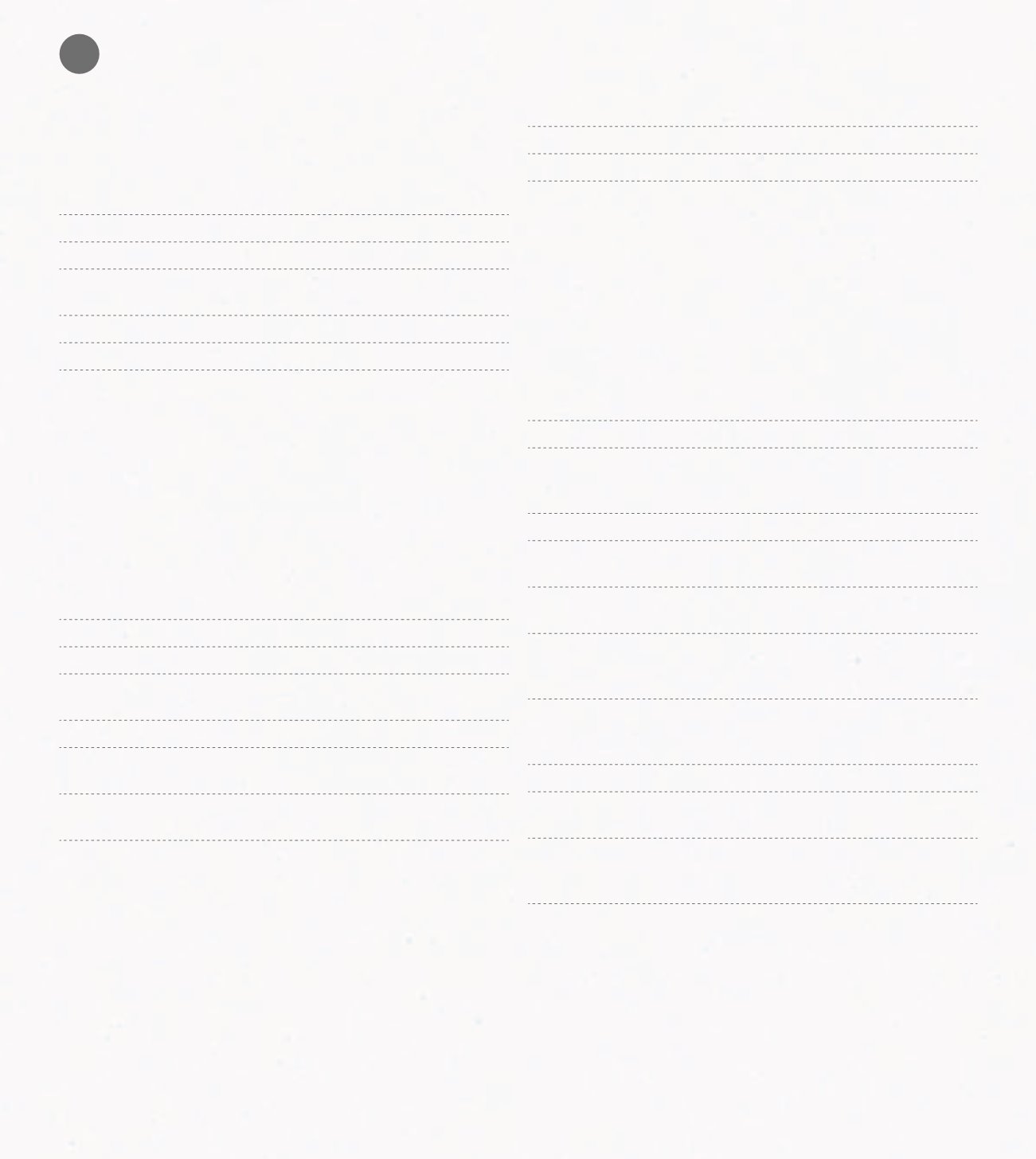

Other operating income in the years ending on 31 De-

cember 2012 and 2011 are broken down as follows:

2012

2011

Supplementary income (1)

2,528,199 3,450,940

Operation benefits

103,718 132,852

Impairment adjustments

reversion

36,246

28,338

Gains in fixed assets

12,490

-

Other operating gains

108,690

23,389

2,789,343 3,635,519

(1) mainly revenues related to contracts with suppliers.

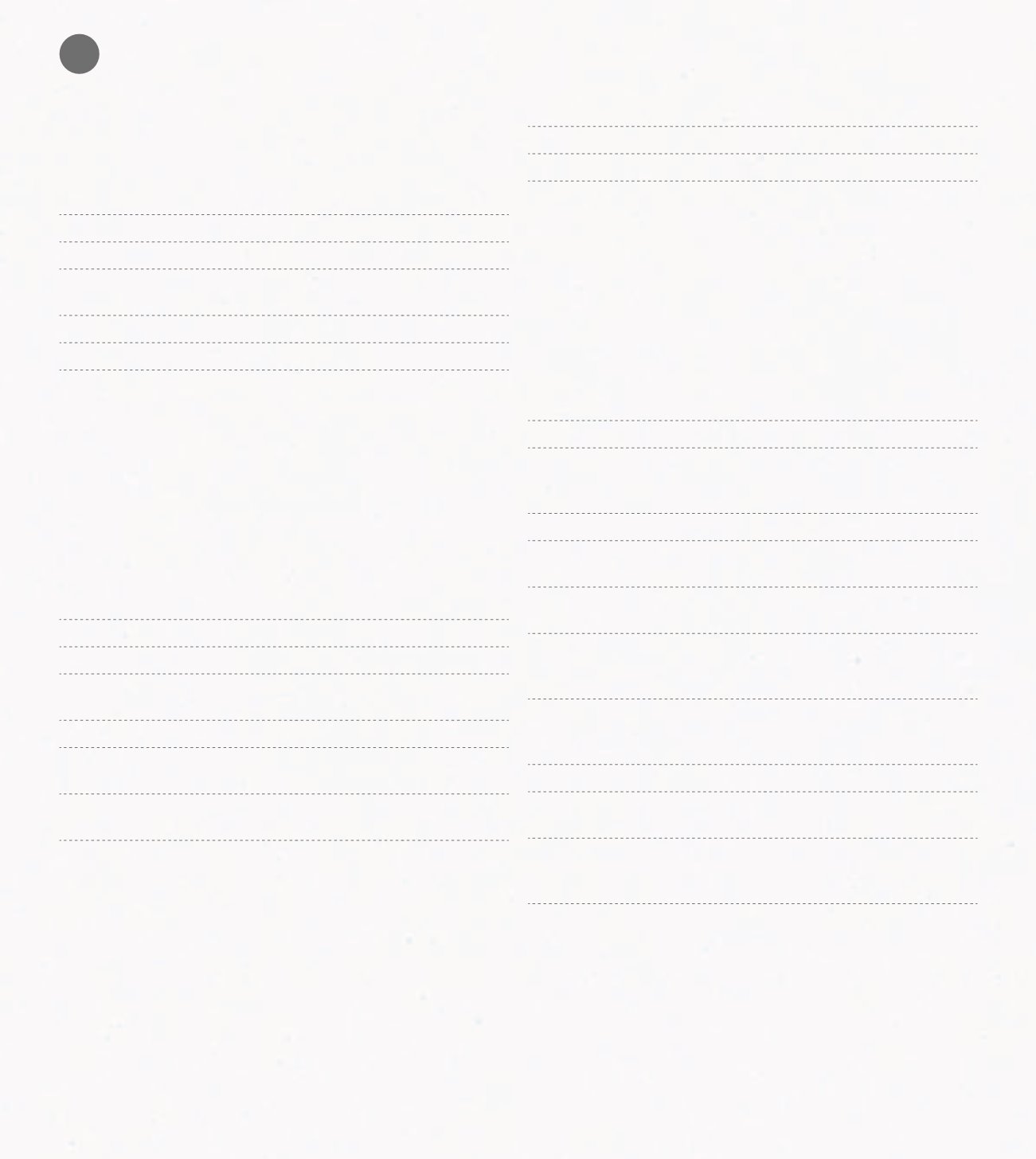

25. NET FINANCING COST

Net financing cost in the years ending on 31st Decem-

ber 2012 and 2011 are broken down as follows:

2012

2011

Interest paid

2,157,199 1,951,928

Interest earned

-838,479 -1,188,834

Currency exchange

differences

50,618

54,020

Payment discounts granted

-

342

Payment discounts

obtained

-11,592 -11,471

Other financial costs and

income

782,576 428,695

2,140,322 1,234,680

26. INCOME TAX

Income tax recognised in the years 2012 and 2011 are

broken down as follows:

Dec-12 Dec-11

Current taxes

1,105,513 2,908,835

Deferred taxes (Note 17)

-414,466 -267,935

691,047 2,640,900

The group’s income tax prior to taxes is not the same as

the theoretical amount that would result from applying

the mean weighted income tax rate to the consolidated

profit, as follows:

2012

2011

Pre-tax profit

3,435,180 9,190,537

Tax calculated at the

appliacble tax rate in

Portugal (26,5%)

910,323 2,435,492

Fiscal effect caused by:

Tax rate difference on the

islandsand archipelagos

-2,987 -46,504

Tax rate difference in other

countries

48,450

38,647

Deferred taxes not

recognised due to

prudence

60,306 101,219

Insufficient/(excess)

estimate in the previous

year

-3,868

-2,580

Correction deferred tax

-

261,227

Unaccounted deferred tax

assets (in previous years)

-83,288

-

Alter. of taxable income

due to fiscal adj. consol.

and other effects

-237,888 -146,601

Income Tax Expenses

691,047 2,640,900

The income tax rate was of 20% (2011: 29%).