180

Consolidated Financial Statements

Only Financial Assets (such as Clients and Other Debtors) presents impairment losses, as Note 14. On 31

st

De-

cember 2012 and 2011, gains or losses related with these financial assets and liabilities were as follows:

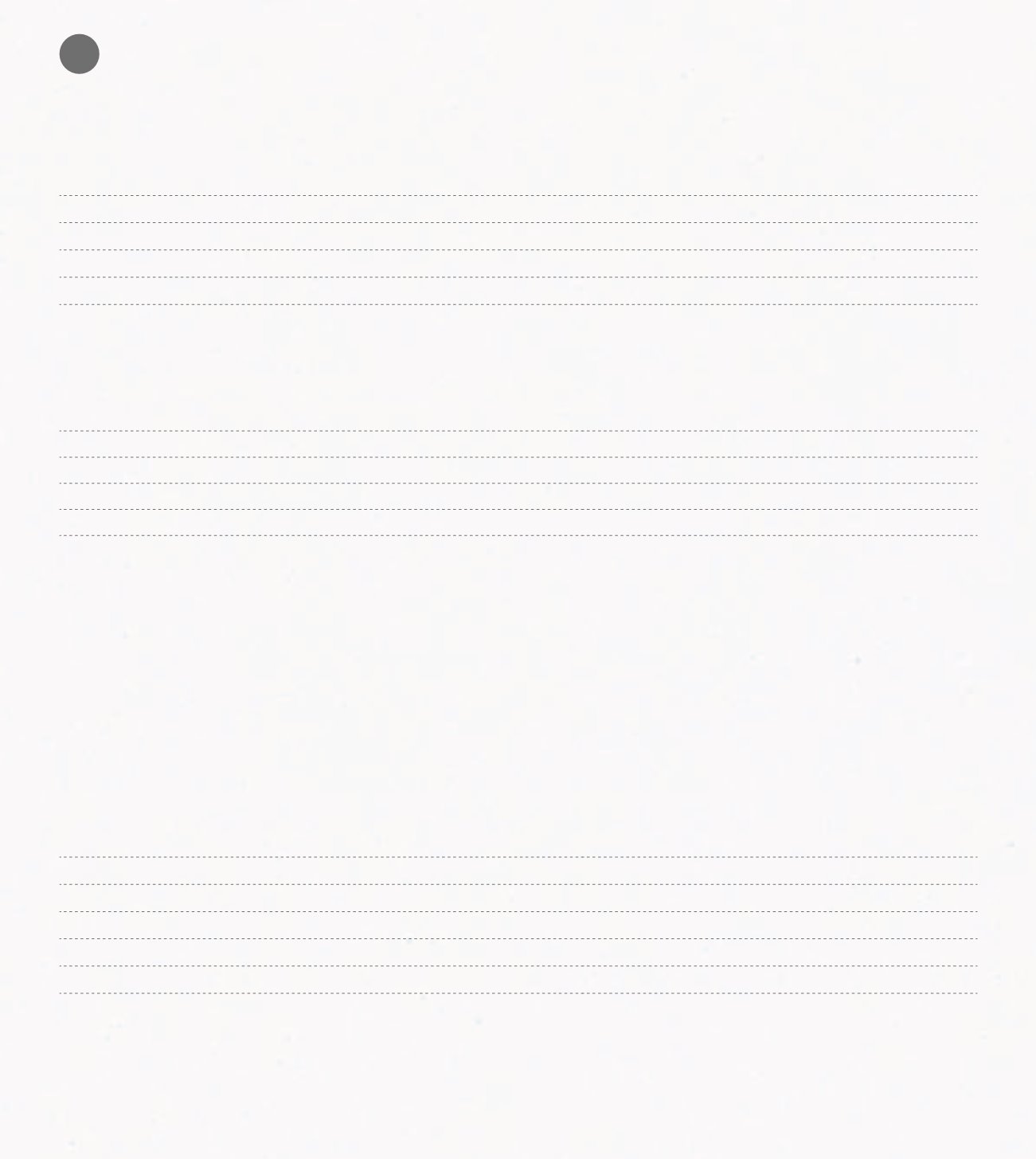

Profit/ (Loss)

Dec-12

Dec-11

Accounts receivable

-11,050

-232,375

Assets available for sale

-

-

Assets at amortised cost

-

-

-11,050

-232,375

The interest of financial assets and liabilities were as follows:

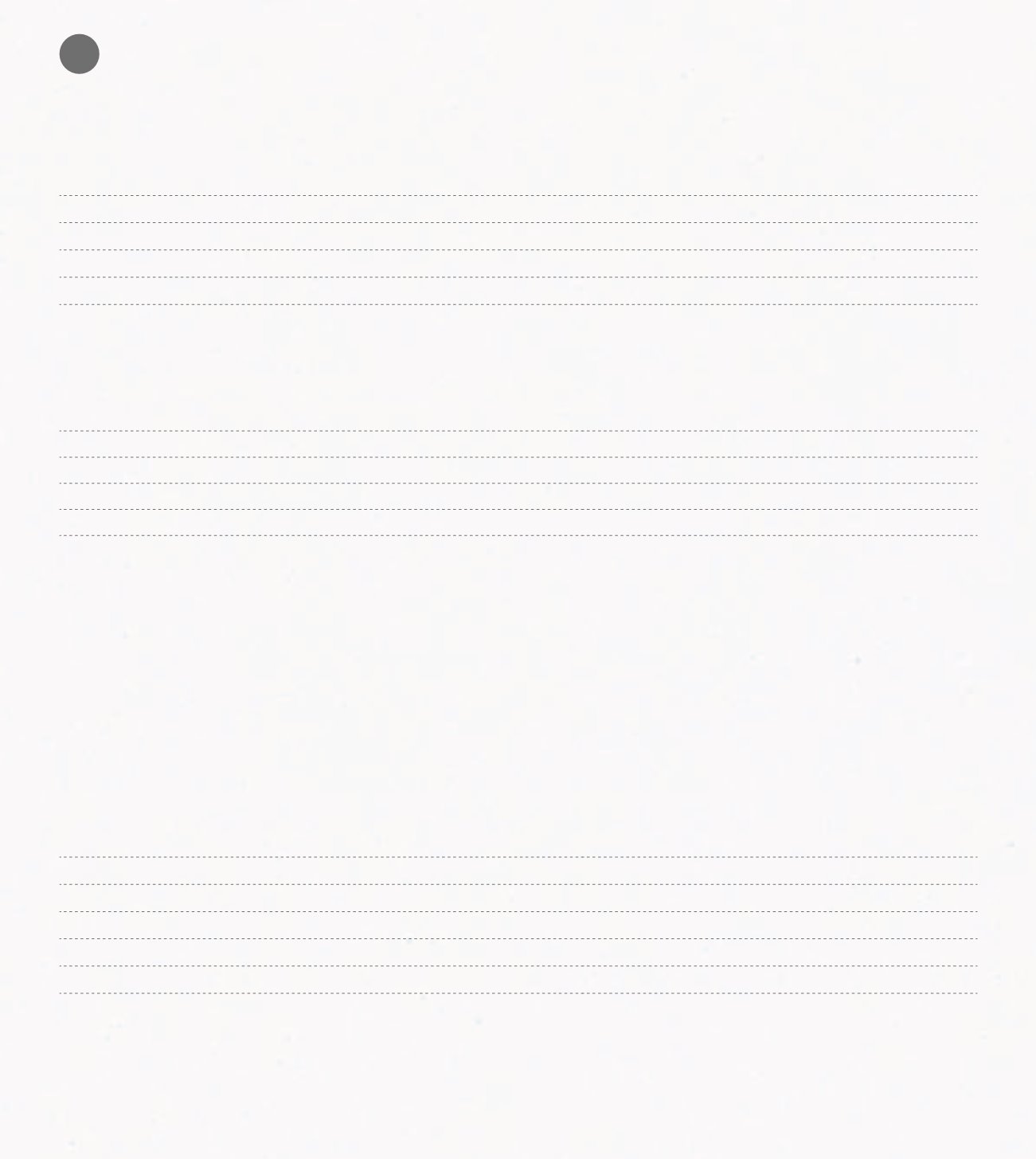

Interest

Dec-12

Dec-11

Accounts receivable

-

-

Assets available for sale

-

-

Liabilities at amortised cost

2,157,199

1,951,928

2,157,199

1,951,928

29. DIVIDENDS

At the General Meeting of 13

th

April 2012, the company decided to pay a gross dividend of 0,055 euros per share

(0,055 euros in 2011), which was paid on 11th May 2012 corresponding to a total value of 990.000 euros (990.000

euros in 2011).

30. CASH FLOWS FROM OPERATIONS

Cash flows from operations are broken down as follows:

2012

2011

Receipts from clients

169,654,587

195,056,707

Payments to supliers

-103,241,372

-112,133,112

Staff payments

-47,620,023

-49,047,909

Payments/receipt of income tax

-1,984,087

-3,355,057

Other paym./receipts related with operating activities (1)

-2,047,145

-11,349,301

Cash flow generated by the operations

14,761,960

19,171,328

(1) includes mainly social security payments, VAT and other debtors and creditors debt.