CONSOLIDATED FINANCIAL STATEMENTS

18. INCOMES TAXES AND DEFERRED TAXES

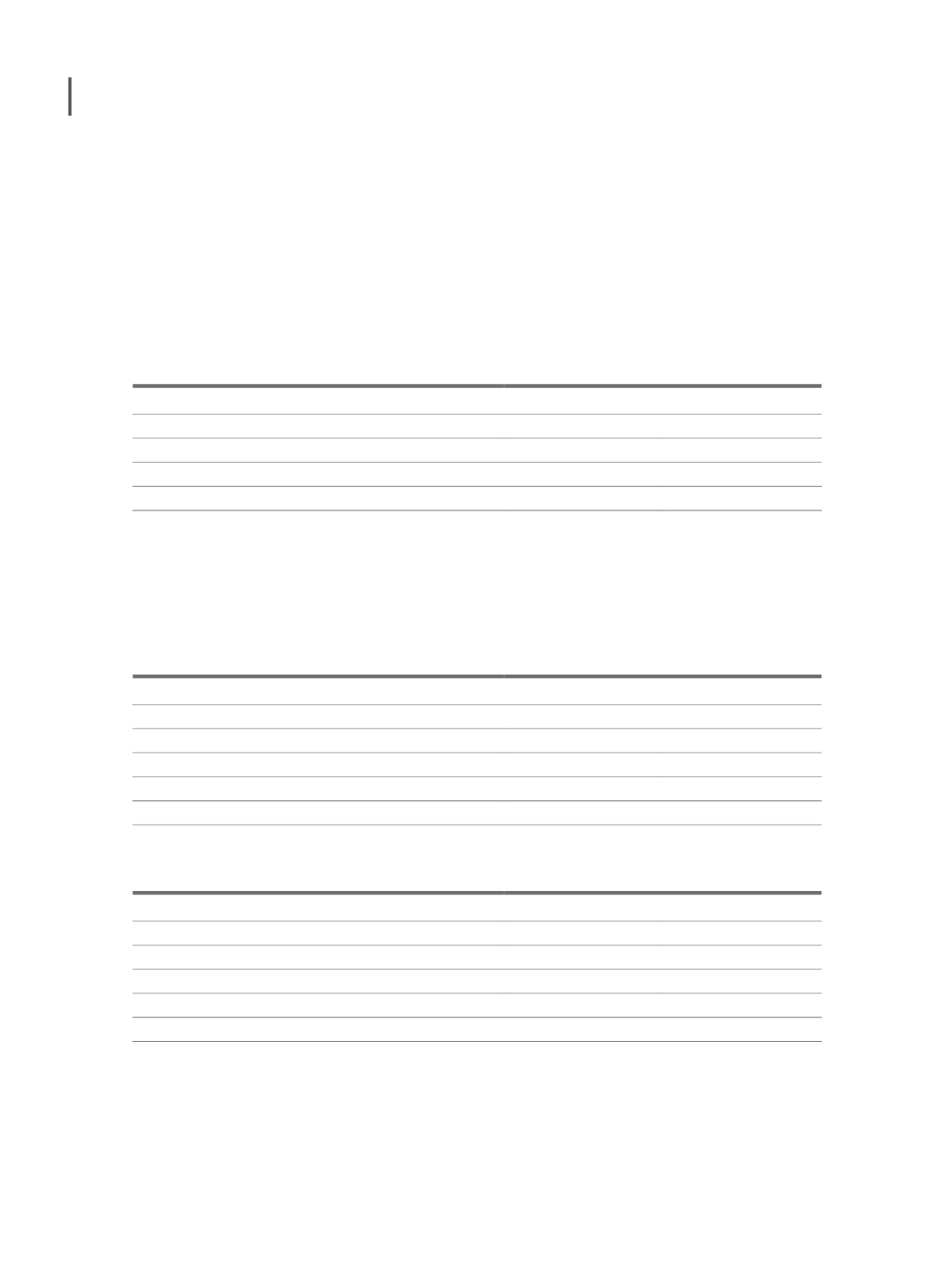

18.1. INCOME TAX

18.1.1 18.1.1. Income tax receivable

On December 31st 2016, income tax receivable amounts to 2.332.391 euros (144.108 euros

in 2015), presented as follows:

Dec. 2016

Dec. 2015

Eat Out Group

2,246,990

-

Inverpeninsular Group (1)

77,883

-

Other witholding taxes

-

141,588

Income tax (Restmon)

7,518

2,519

2,332,391

144,108

(1) Tax Group of subsidiaries based in Spain.

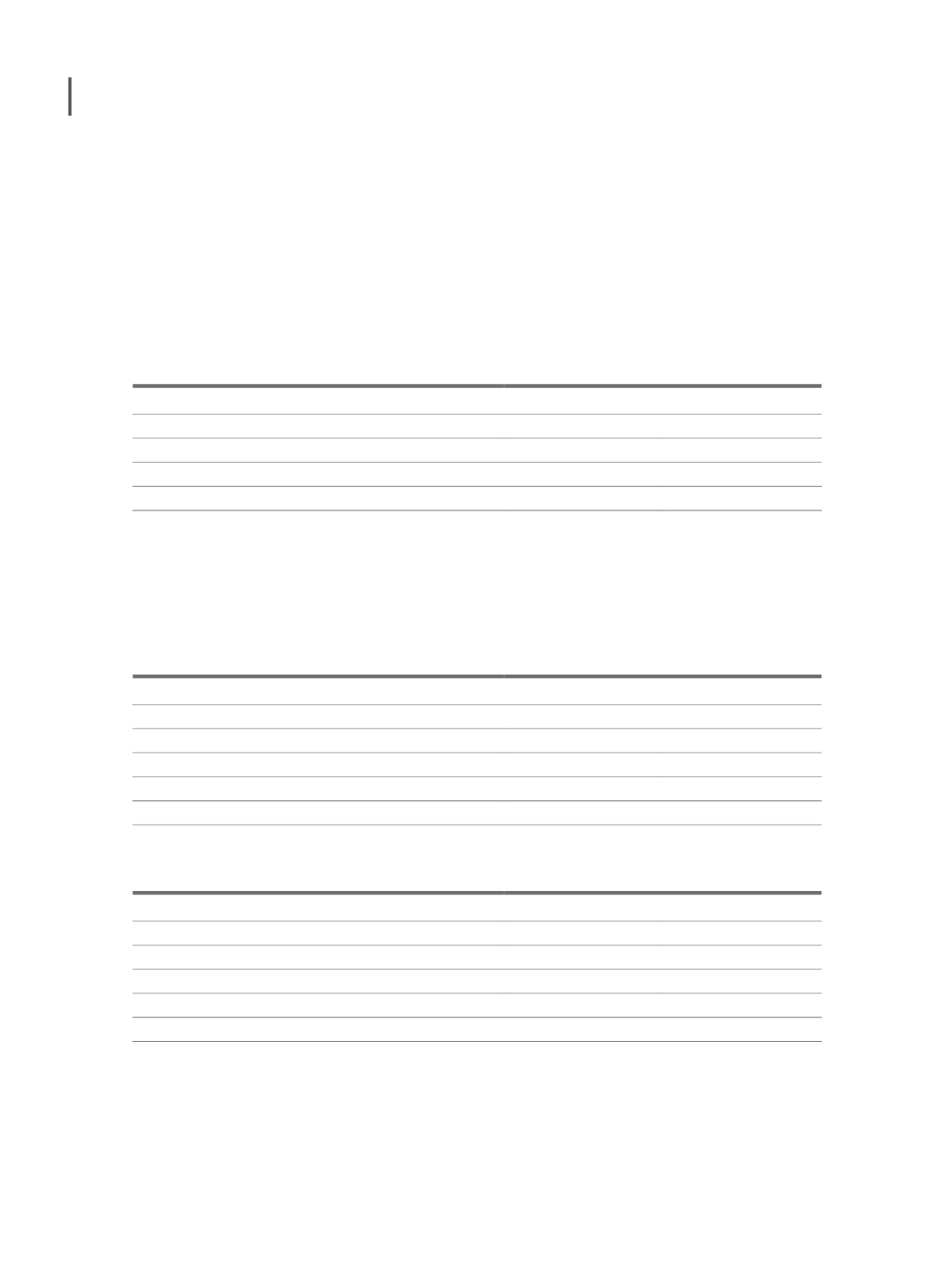

18.1.2 Income tax payable

Income tax payable in the years ending on December 31st 2016 and 2015 are broken down as

follows:

Dec. 2016

Dec. 2015

RETGS (1)

1,541,182

1,099,991

Grupo Inverpeninsular (2)

-

217,498

Ibersol Angola

618,265

72,141

Dehesa

189,328

-

Others (3)

878

913

2,349,654

1,390,543

(1) AMOUNTS ARE DETAILED AS FOLLOWS:

Dec. 2016

Dec. 2015

Special payments on account (PEC)

-31,896

-101,355

Payments on account

-2,498,358

-1,652,622

Withholding taxes

-653,430

-

Income tax - parent

198,720

24,154

Income tax - Tax Group (RETGS)

4,526,147

2,829,814

Total

1,541,182

1,099,991

((2) Subsidiaries fiscal and tax Group, headquarter in Spain;

(3) Excluded from the special taxation of corporate groups (RETGS), income tax to be paid by subsidiaries Iberusa ACE.

258