ANNUAL REPORT 2016

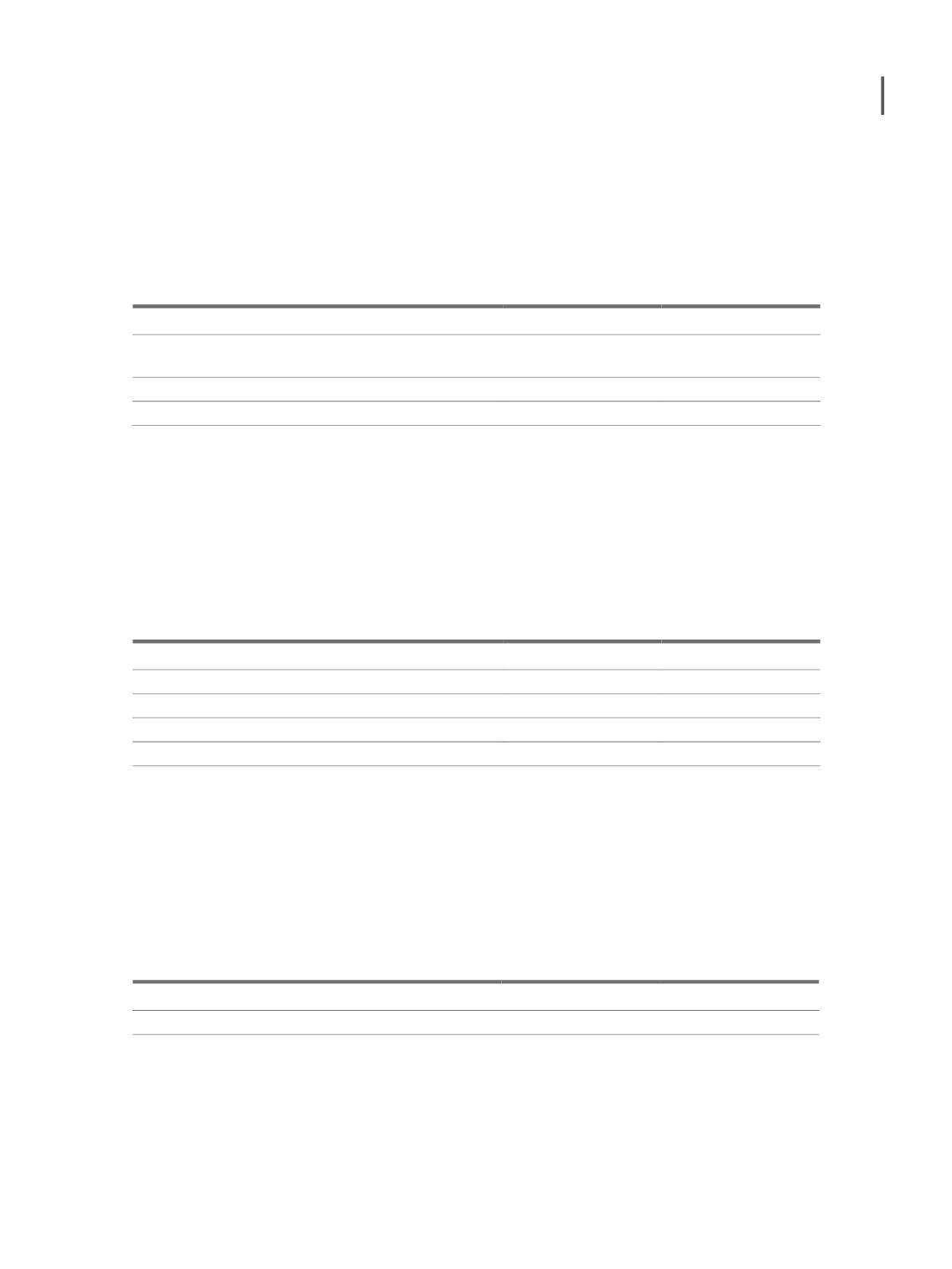

18.2.2 Deferred tax liabilities

Deferred tax liabilities on December 31st 2016 and 2015, according to the temporary diffe-

rences that generated them, are broken down as follows:

Deferred tax liabilities

Dec. 2016

Dec. 2015

Amortization and depreciation standardization (1)

8,204,190

9,159,985

Temporary differences in Spain (2)

1,653,385

718,378

Other temporary differences

330,357

167,762

10,187,932

10,046,125

(1) the deferred tax homogenization depreciation corresponds to the difference in depreciation between the individual and consolidated accounts which by

2010 were prepared on different criteria. This value will reduce over the years.

(2) relate mainly to UTE income of the year, with the incorporation in its subsidiaries carried out with the postponement of a year, in compliance with the

regulations in force in Spain.

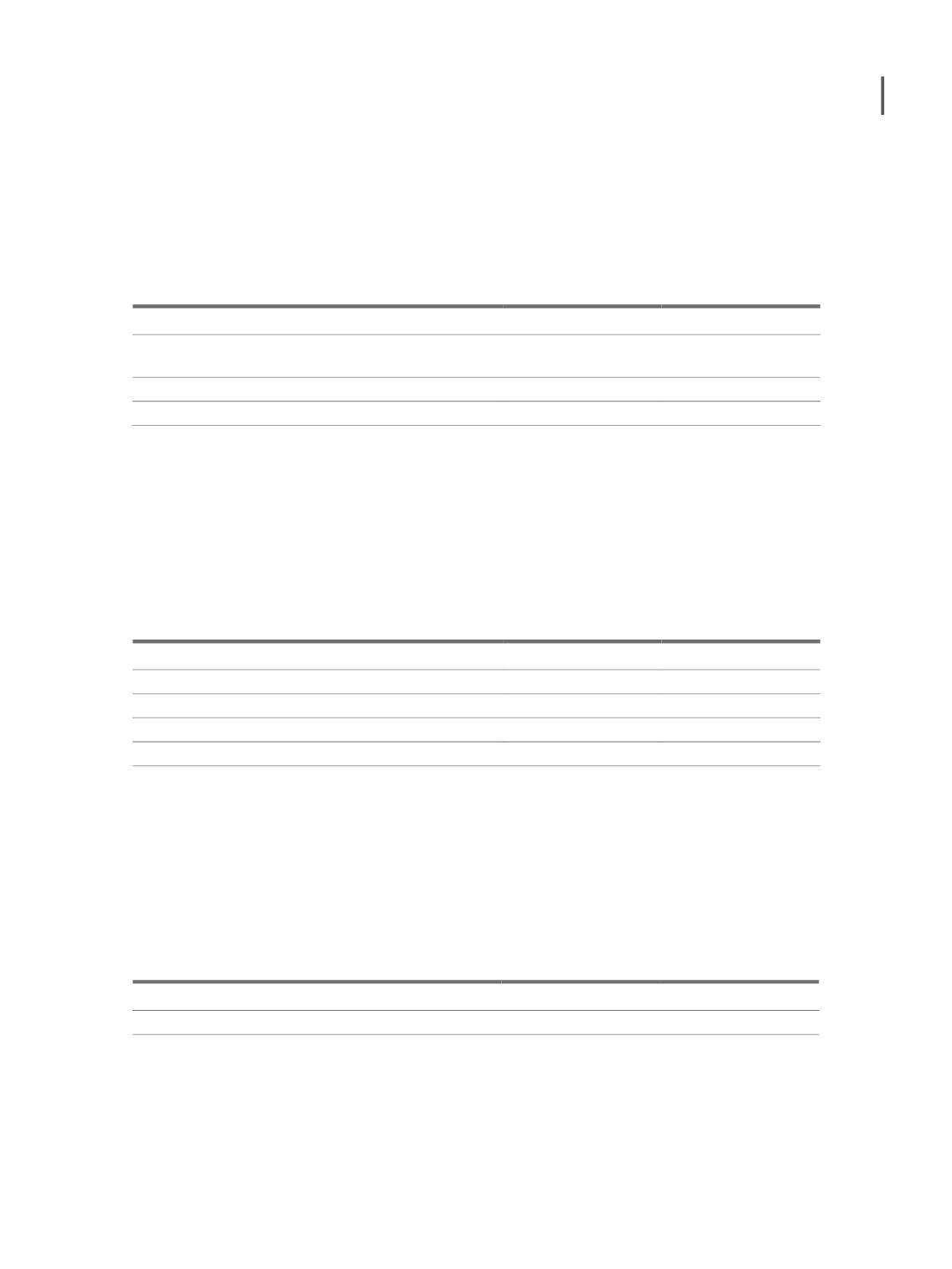

19. PROVISIONS

On December 31st 2016 and 2015, provisions were broken down as follows:

Dec. 2016

Dec. 2015

Legal processes

5,257

5,257

Income tax (1)

2,028,871

828,705

Compensation (2)

1,350,000

-

Other

28,000

28,000

Provisions

3,412,128

861,962

(1) provision concerning 2014 and 2015 income tax calculation for tax benefits in the process of confirmation of their implementation.

(2) provision of 350.000 related to the legal process concerning the former Madeira Airport concessionaire employees and 1.000.000 relating to contrac-

tual investments not made in the Airports operated by Eat Out Group and that may be claimed by the Concessionaire as compensation.

20. DERIVATIVE FINANCIAL INSTRUMENT

On December 31st, 2016 and 2015 the detail of Ibersol derivative financial instruments is

presented as follows:

Dec. 2016

Dec. 2015

Swap

114,935

181,602

Derivative financial instruments

114,935

181,602

261