ANNUAL REPORT 2016

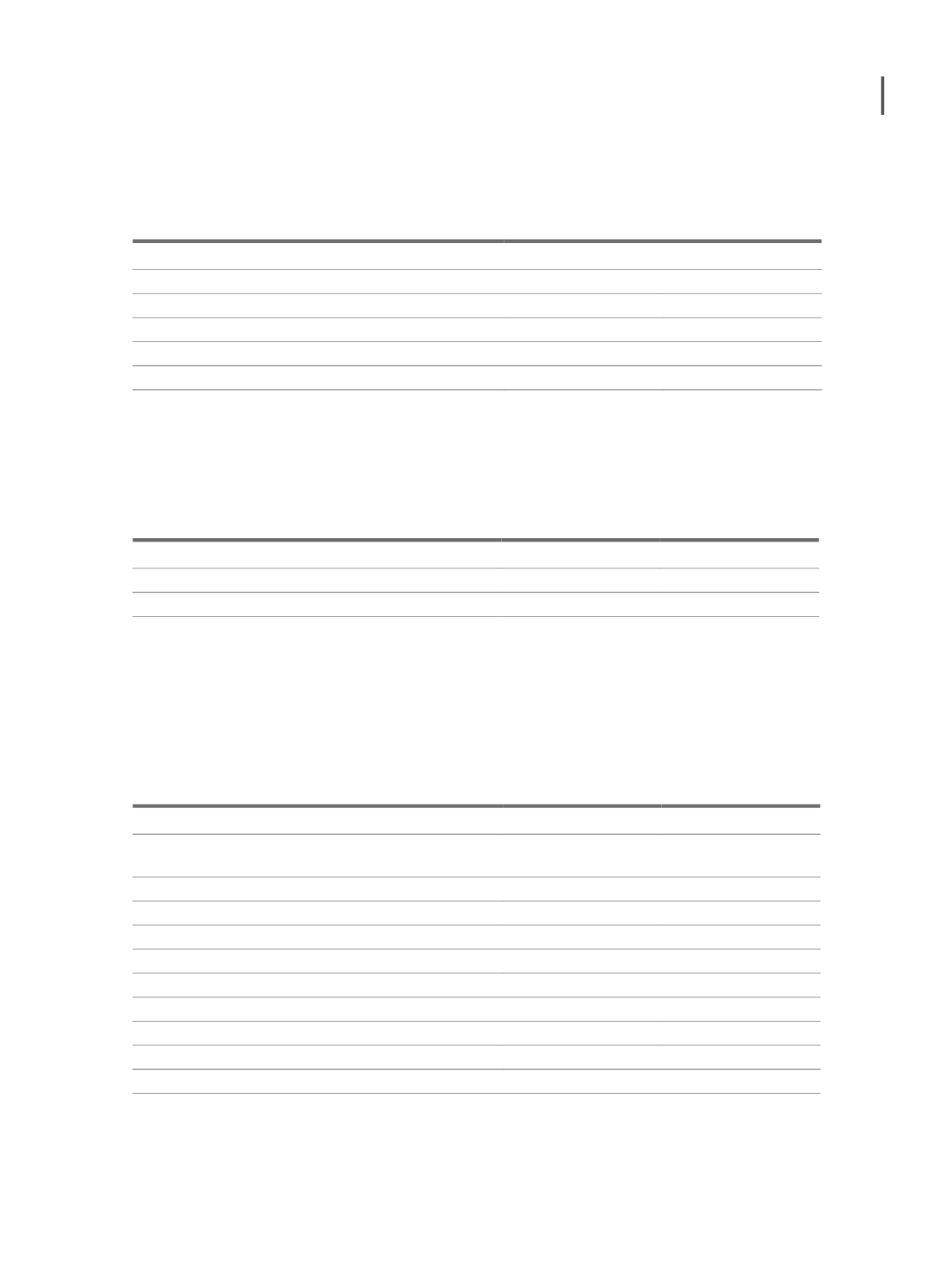

The detail of other financial costs and income, is presented as follows:

2016

2015

Bank services

790.990

313.533

Financial instruments - cash flow hedge (Note 20)

-66.666

-35.418

Commercial paper programmes charges

325.608

238.408

Other commissions (1)

96.830

218.320

Other financial cost and gains

-77.632

-1.056

1.069.130

733.787

(1) Amount related mainly to guarantees bank charges and financing charges of the subsidiary Ibersol Angola.

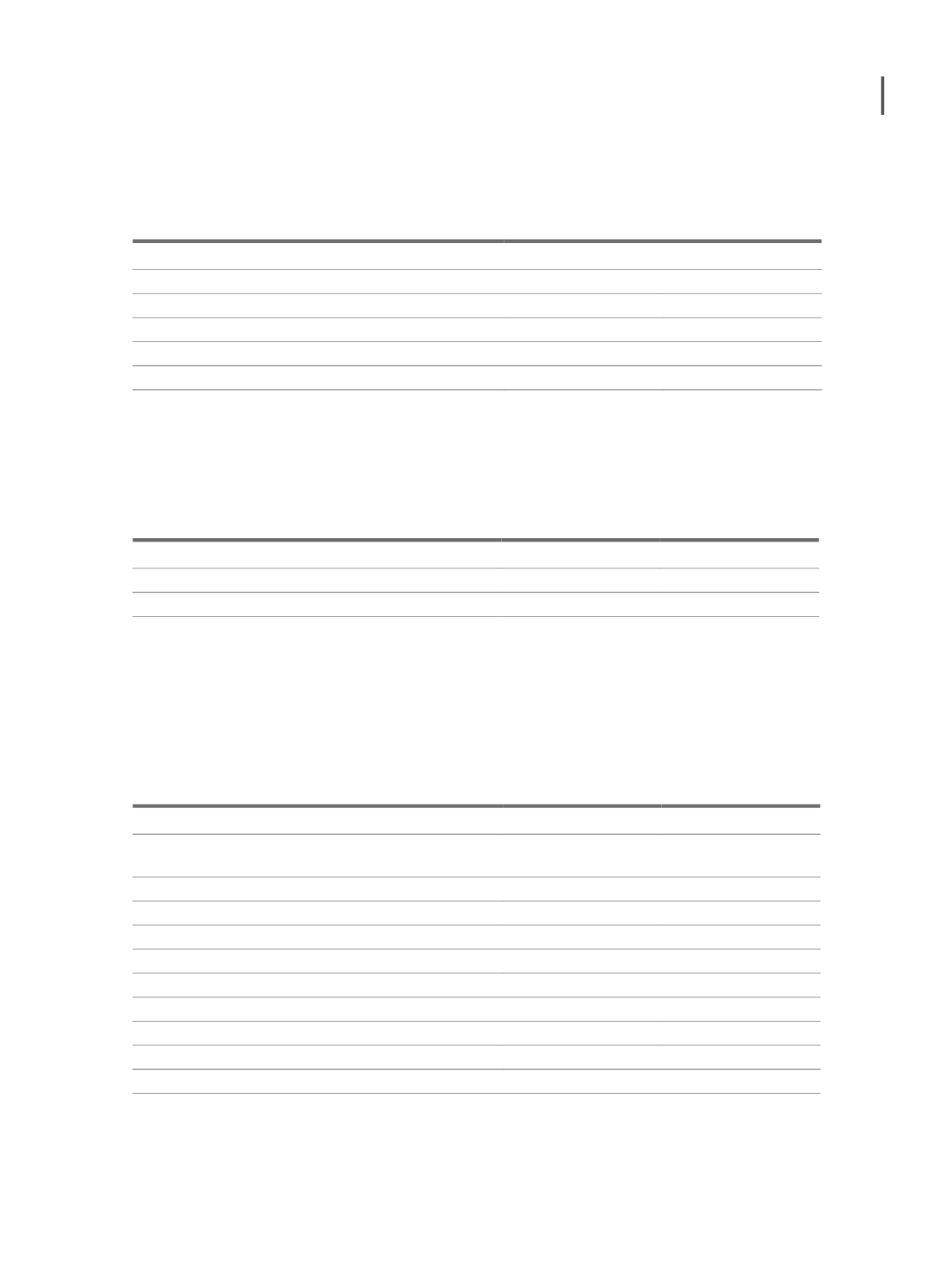

28. INCOME TAX

Income tax recognised in the years 2016 and 2015 are broken down as follows:

Dec. 2016

Dec. 2015

Current taxes

5,675,703

3,704,062

Deferred taxes (Note 18)

207,683

-419,846

5,883,386

3,284,216

(1) Includes a tax provision in the amount of 1,200,166 euros (Note 19) and estimate excess

income tax with the amount of 1,254,493 euros.

The Group’s income tax prior to taxes is not the same as the theoretical amount that would

result from applying the mean weighted income tax rate to the consolidated profit, as follows:

2016

2015

Pre-tax profit

29,318,426

14,011,282

Tax calculated at the applicable tax rate in Portugal

(22,5%)

6,596,646

3,152,538

Fiscal effect caused by:

Correction deferred tax

-

-81,492

Credit tax investment (CFEI) effects

-20,365

-249,182

Other income taxes benefits (Eat Out Group and RETGS)

-1,215,057

-

Special tax (independent)

136,934

123,870

Tax pours

275,580

130,622

Write-off deferred tax

8,237

116,534

Other effects

101,411

91,325

Income Tax Expenses

5,883,386

3,284,216

The income tax rate was of 20%, lower than the nominal rate, mainly due to income taxes

benefits obtained. In 2015 the income tax rate was of 23%.

267