ANNUAL REPORT 2016

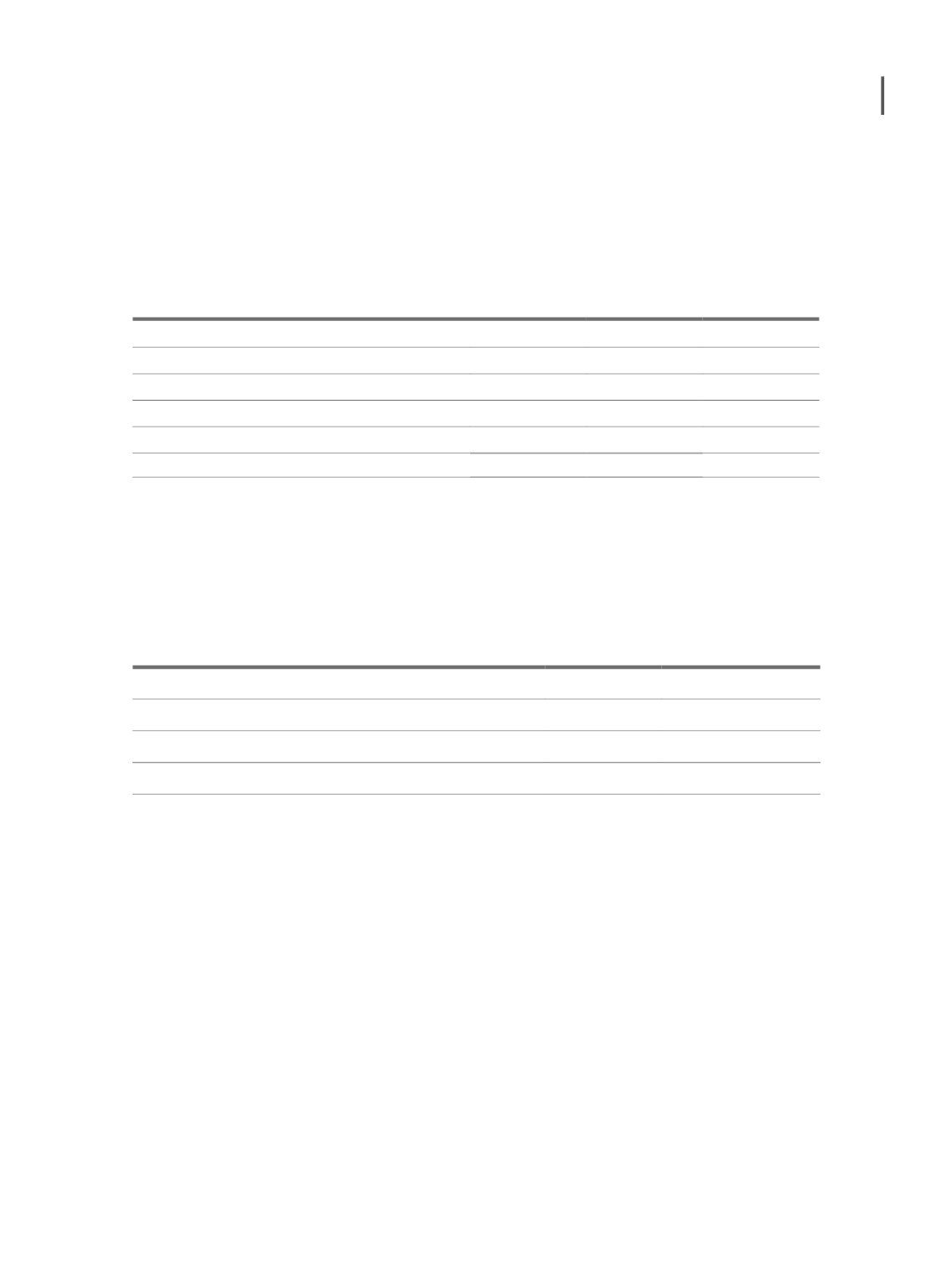

18.2. DEFERRED TAX

Changes in deferred taxes in the period are:

Assets

Liabilities

Income and

loss account

(Note 28)

Starting balance

3,294,546

10,046,125

Temporary differences in the year

-600,095

-473,053

Changes in the consolidation perimeter

5,941,376

614,860

Deferred taxes write-off

-67,474

-

Tax rate change in the year (Spain)

-13,167

-

Closing balance

8,555,186

10,187,932

-207,683

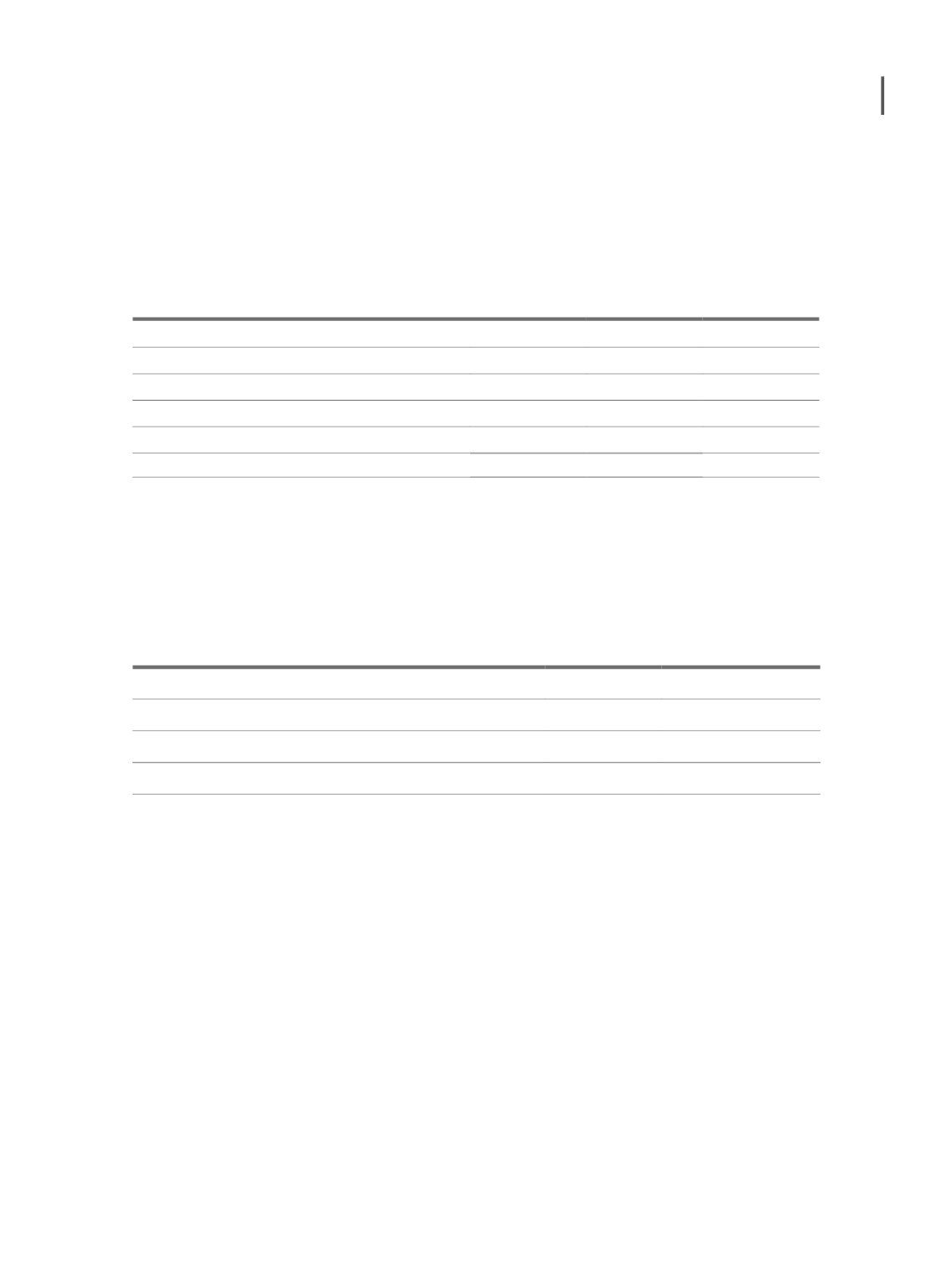

18.2.1 Deferred tax assets

Deferred tax assets on December 31st 2016 and 2015, according to the temporary differences

that generate them, are broken down as follows:

Deferred tax assets

Dec. 2016

Dec. 2015

Reportable fiscal losses

1.359.554

122.890

Tangible fixed assets and intangible asset impairment losses (1)

4.520.447

3.019.368

Other temporary differences

2.675.185

152.288

8.555.186

3.294.546

(1) Amount related essentially to the value of the goodwill generated on the sale of a subsidiary in 2015, and other temporary differences, by the Eat Out

Group.

259