CONSOLIDATED FINANCIAL STATEMENTS

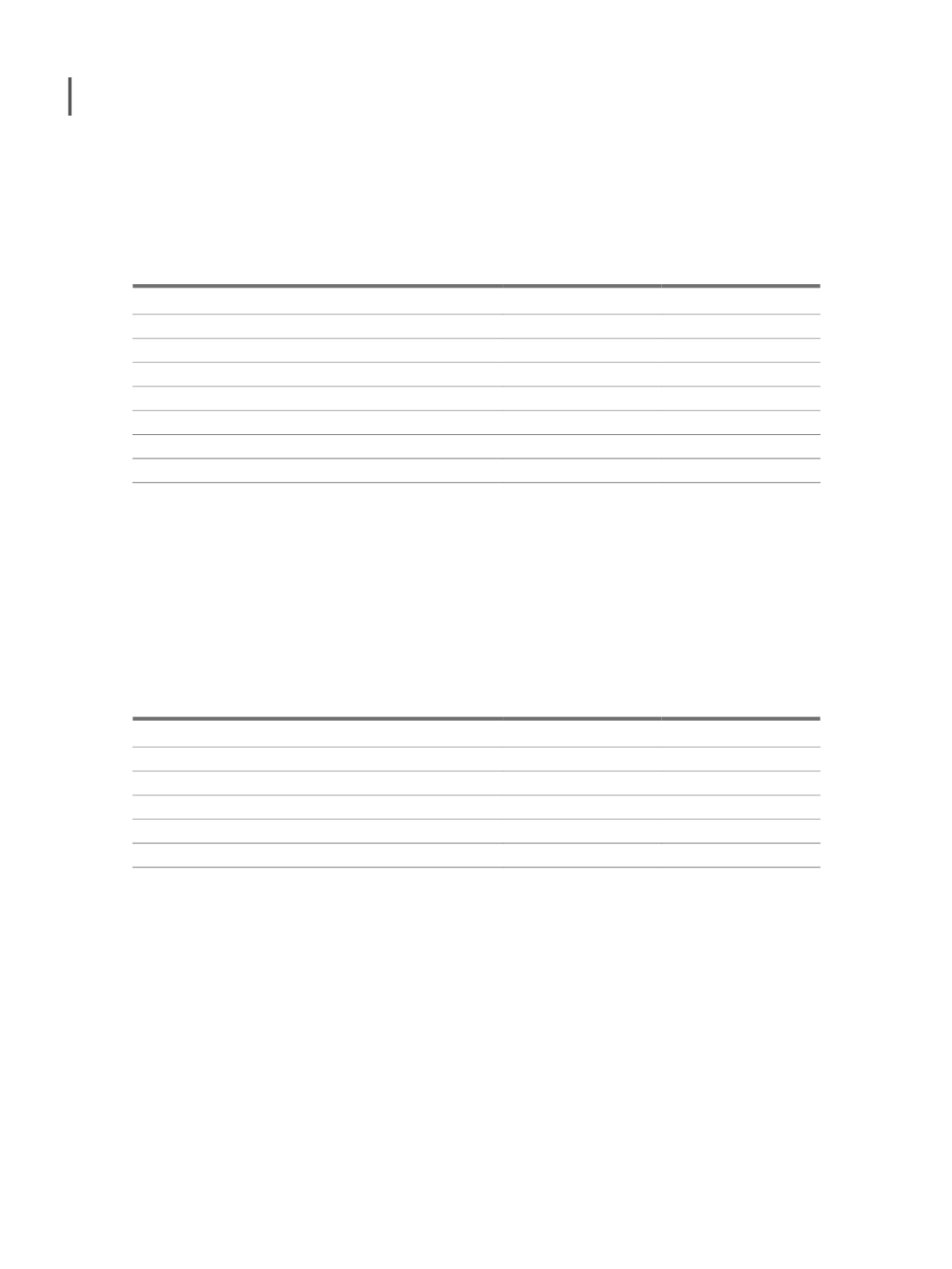

Other operating income in the years ending on December 31st 2016 and 2015 are broken down

as follows:

Other operating income

2016

2015

Supplementary income (1)

6,292,268

1,962,398

Compensations (2)

2,397,758

-

Operating grants

154,367

155,530

Impairment adjustments reversion

156,468

70,532

Investment grants

79,507

34,317

Gains in fixed assets

1,752

250

Other operating gains

7,850

8,747

9,089,970

2,231,774

(1) Mainly from revenues from contracts with suppliers and services rendered to third parties, from consulting firms, amounting to 951 thousand euros,

which are non-recurring in nature.

(2) As a result of the formalization of the agreement entered into with Ascendi, non-recurring income of 2,397,758 euros was recorded in operating

income corresponding to compensation for loss of traffic in former scuts (free highways).

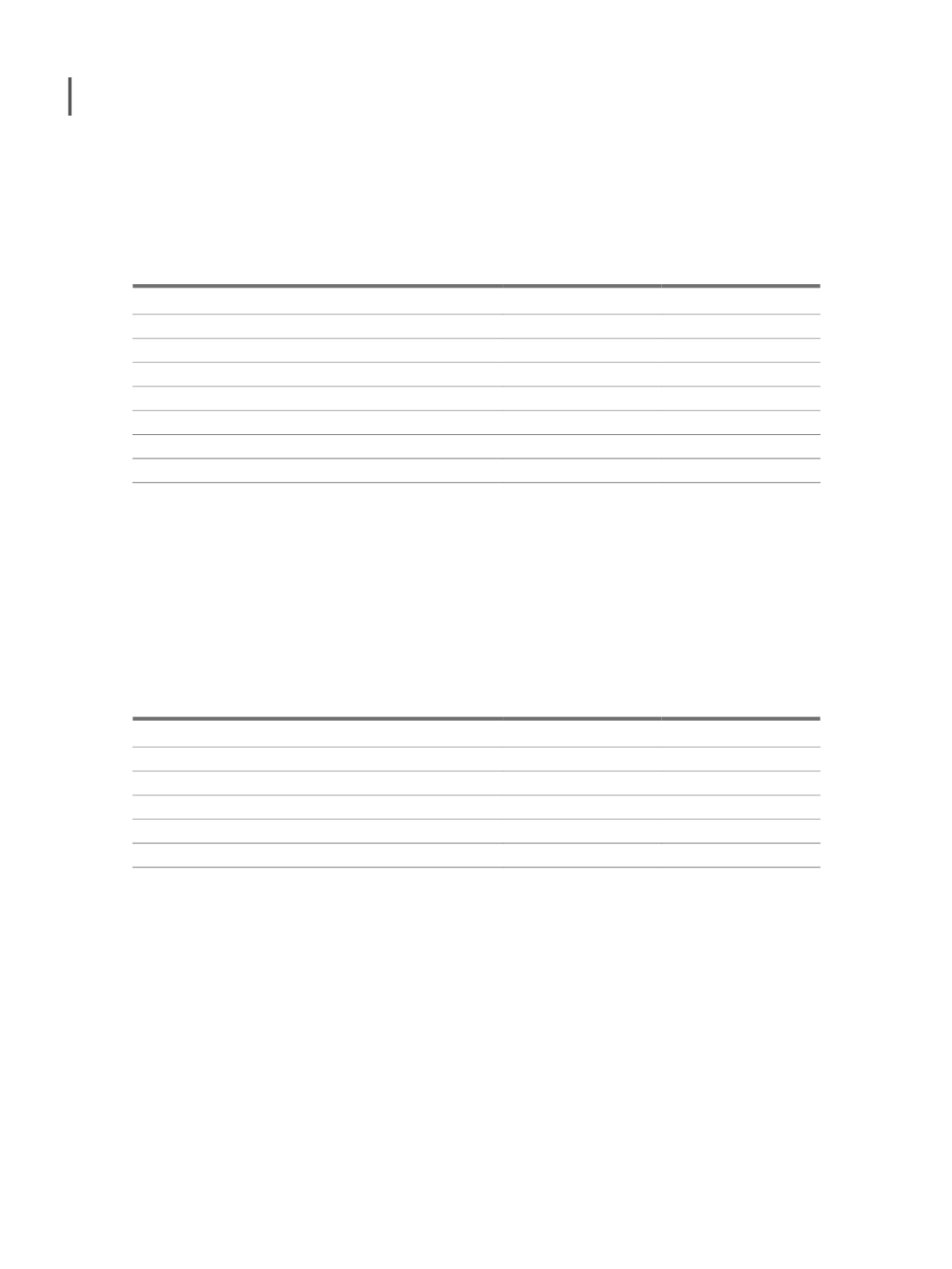

27. NET FINANCING COST

Net financing cost in the years ending on December 31st 2016 and 2015 are broken down as

follows:

2016

2015

Interest paid

2,786,616

1,261,542

Interest earned

-2,554,156

-72,663

Currency exchange differences (1)

-95,540

2,366,406

Payment discounts obtained

-10,625

-9,321

Other financial costs and income

1,069,130

733,787

1,195,425

4,279,751

(1) In 2016, essentially related to:

(a) Aenor’s compensation interest. It was agreed not to install the Service Areas of Guimarães, Fafe and Paredes and the respective conces-

sion rights that gave rise to the receipt of contractual interest in the amount of 1,570,323 euros;

(b) Interest on treasury bonds.

(2) In 2015 the devaluation of Kwanza (AOA) against major currencies, with particular emphasis on the USD led to potential unfavorable exchange rate

differences in Angola for updating assets and liabilities in foreign currency. In 2016, this exchange rate adjustment was accounted in other operating

costs (around 0.4 million euros).

266