CONSOLIDATED FINANCIAL STATEMENTS

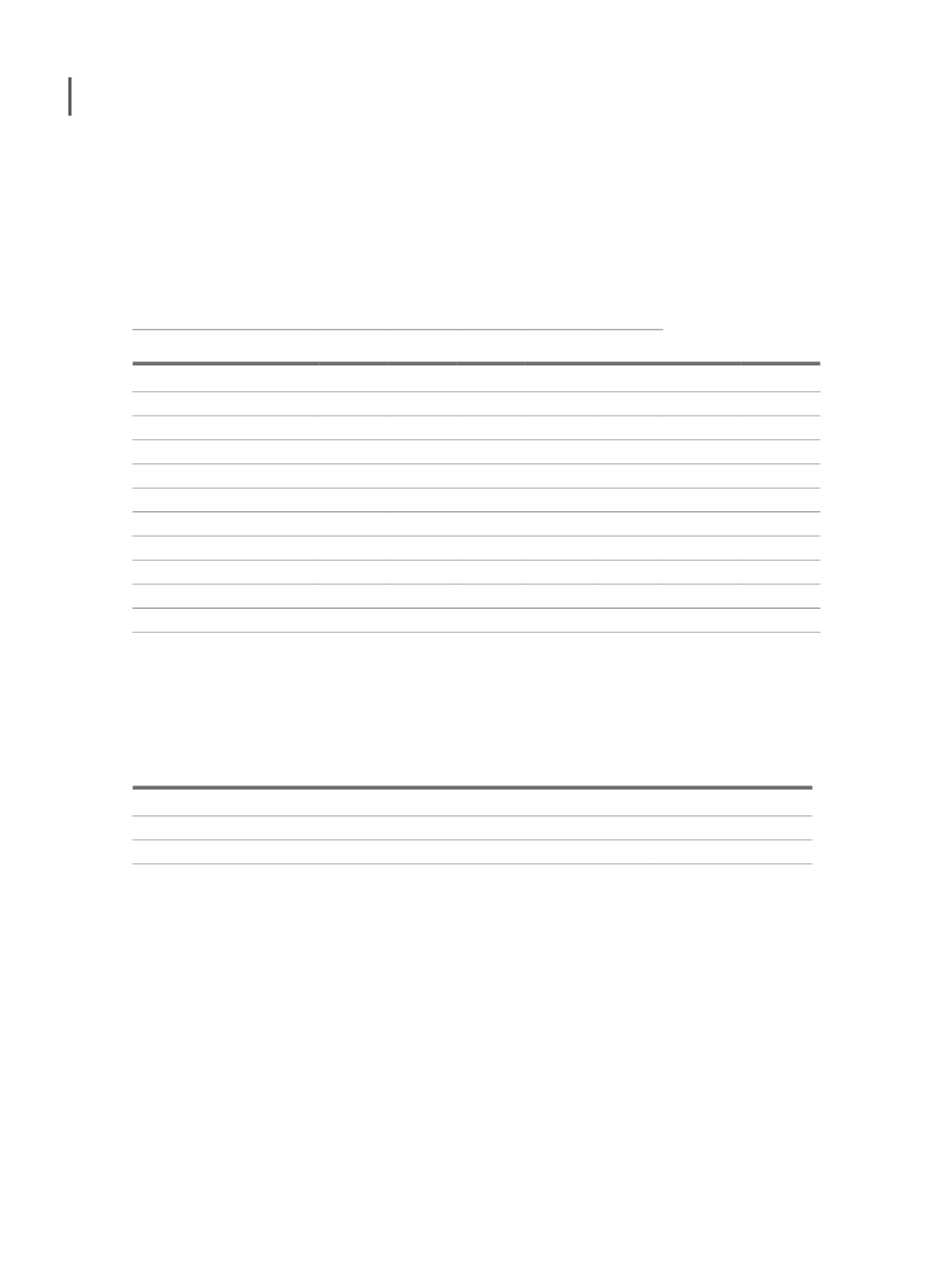

Prudently the Group did not recognise deferred tax assets in the amount of 56.856 euro re-

ferring to fiscal losses of 262.328 euros which may be deducted from future taxable income.

Fiscal reports and its deferred tax assets by jurisdiction are as follows:

Limit year of use

2017 2018 2021 2026 2027

unlimited Total

Start year

2012 2013 2016 2014 2015

Portugal

with deferred tax (21%)

-

without deferred tax

84,121 66,878 16.546 28,523 22,080

218,148

Spain

with deferred tax (28%)

5,438,217 5,438,217

without deferred tax

84,121 66,878 16.546 28,523 22,080 5,438,217 5,656,365

Deferred tax assets

Portugal

-

Spain

1,359,554 1,359,554

1,359,554 1,359,554

For use in subsequent years (by 2018) there are 7,483 euros of tax benefits (CFEI) on Decem-

ber 31st 2016.

Tax rates of the jurisdictions in which the Group is present are:

Portugal

21%

Spain

25%

Angola

30%

Why are not met or are not significant, they were not recognized deferred tax assets relating

to:

(a) use of future income deferred tax assets higher than the profits arising from the reversal

of existing taxable temporary differences.

(b) the entity has suffered a tax loss in either the current period or the preceding period in

the tax jurisdiction to which it relates the active deferred tax.

260