CONSOLIDATED FINANCIAL STATEMENTS

In 2012, subsidiary Asurebi subscribed a derivative financial instrument for cash-flows hed-

ging with an interest rate Swap. In 2014 due to changes in the related loan swap conditions

were adjusted as follows:

- initial date: September, 5th 2015;

- expiration date: July, 15th 2019;

- fixed interest rate: 0,78%;

- variable interest rate: Euribor 1M;

- total amount: 10 million euros, reduces with debt repayment plan.

This derivative is classified as a level 2 category and its technical valuation based on a market

approach (MTM).

As the derivative financial instrument was not registered under hedge accounting, its changes

in fair value are reflected in the income of the year (66.666 euros, Note 27).

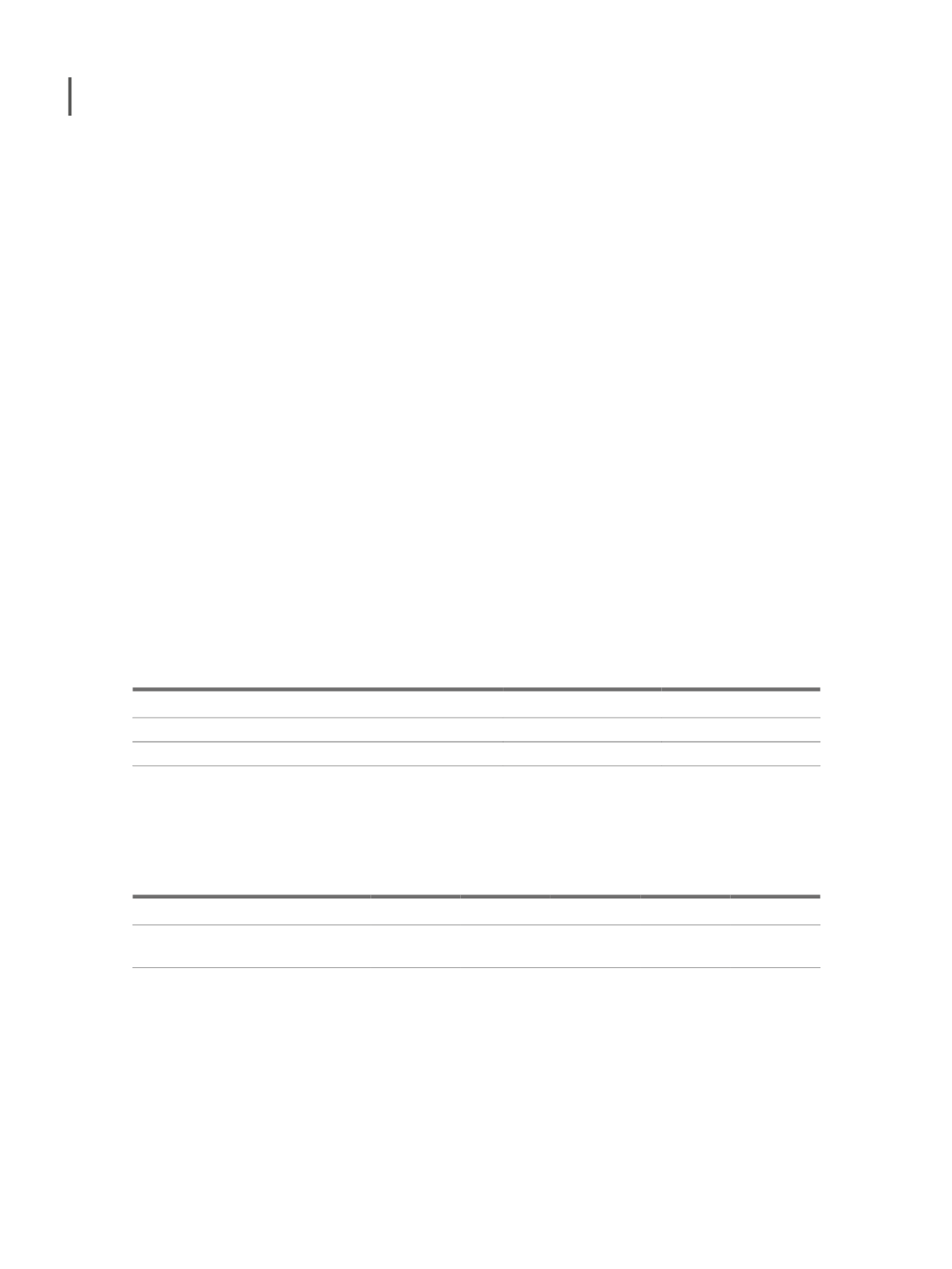

21. OTHER NON-CURRENT LIABILITIES

On December 31st 2016 and 2015, the item “Other non-current liabilities” may be broken

down as follows:

Dec. 2016

Dec. 2015

Other creditors (1)

208,040

239,713

Financial investments debt

-

-

Other non-current liabilities

208,040

239,713

(1) includes 197,128 euros referring to the debt for the purchase of subsidiary Vidisco, S.L..

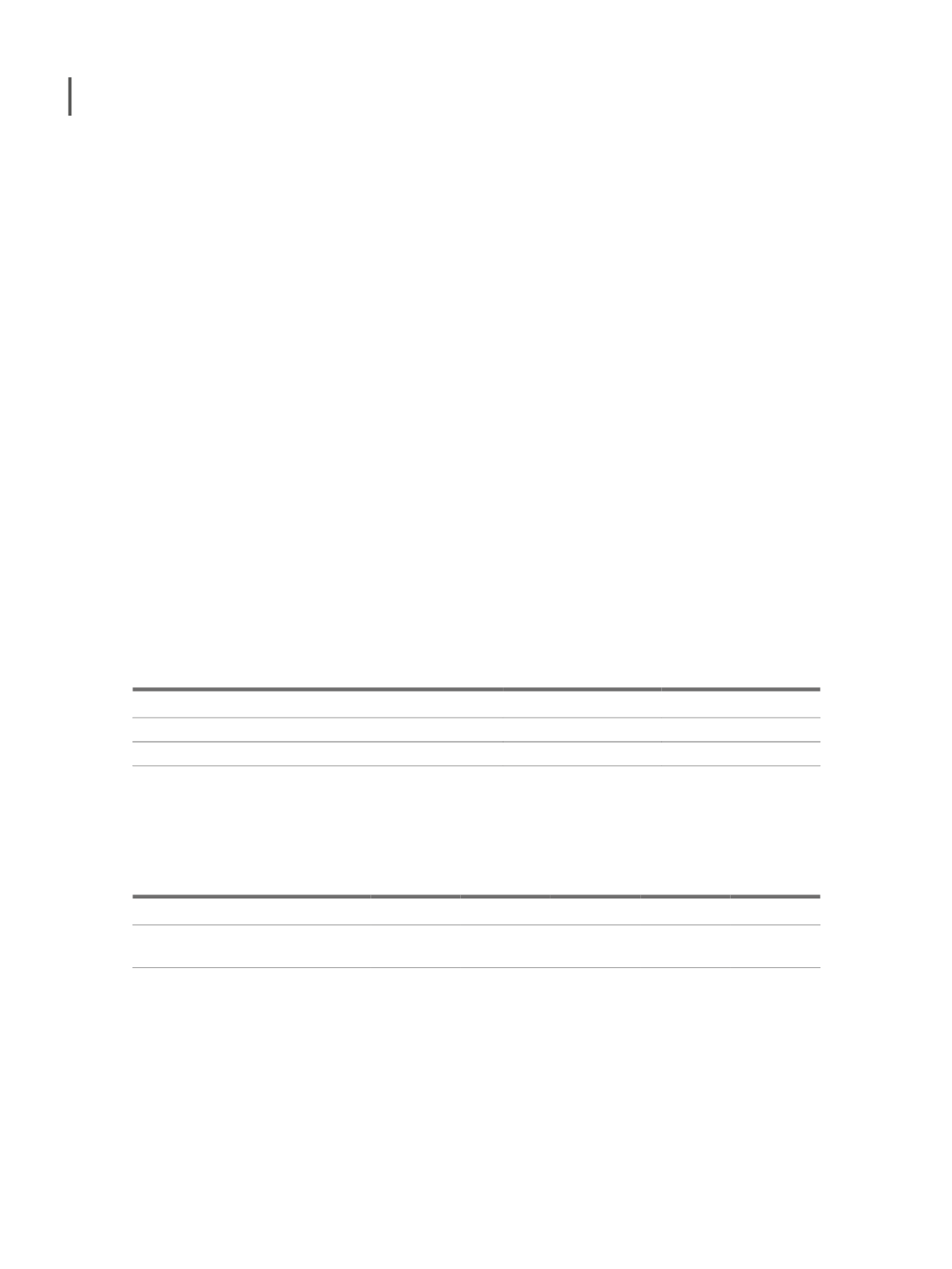

On December 31st 2016 the future (contractual) Cash Flows associated to these liabilities are

broken down as follows:

FC 2017

FC 2018

FC 2019

FC 2020

FC 2021 FC 2022/23

Other creditors

39,760

28,848

28,848

28,848

28,848

52,888

Financial

investments debt

-

-

-

-

-

-

262